📉 Understanding Value Investing

Value investing focuses on identifying stocks trading below their intrinsic worth—often measured by low P/E, P/B, P/FCF, or high dividend yields—and patiently waiting for the market to recognize their true value. It’s a strategy popularized by Warren Buffett and Benjamin Graham, predicated on disciplined valuation analysis rather than short-term growth narratives

1. Why Value Investing Is Returning

🔍 Valuation Disparity in U.S. Markets

The U.S. stock market, especially the S&P 500, is extremely concentrated—the top three tech stocks now constitute roughly 20% of the index, compared to 8% in the Russell 1000 Value Index The valuation gap is colossal: overall market P/E is in the low 20s while many value-oriented portfolios trade much lower. Bill Nygren (Oakmark) calls this disparity “unusual” and argues it benefits value investors

📈 Recent Focus on Valuation

In early 2025, markets have swung toward high volatility (VIX >18.5), a backdrop where valuation-based strategies historically perform best From Jan–Mar 2025, Deep‑Value and general Value quintiles in the S&P 500 outpaced Growth—returning +16.1% and +3.35% respectively—while Growth lagged, highlighting shifting investor priorities

🌍 Global Value Trends

While U.S. value stocks have underperformed domestically, international markets show strong value-led gains. Analysts suggest U.S. investors may benefit by incorporating foreign value equities into portfolios .

2. What’s Driving the Resurgence

🔁 Rotation from Growth to Value

The long-standing dominance of growth and tech, buoyed by AI breakthroughs, may be giving way to rotation. Tech outperformance has foreshadowed value rebounds historically

💸 Rising Rates & Inflation Sensitivity

With interest rates normalized, defensive sectors like financials, energy, and industrials often outpace high-growth stocks. Value tends to outperform when bond yields exceed ~3%

🌀 Macro Volatility

Uncertainty, from tariffs to geopolitical risks, increases volatility—a condition under which value tends to shine. High-VIX periods often favor valuation discipline over speculative growth .

3. Evidence Value Works: Data & Research

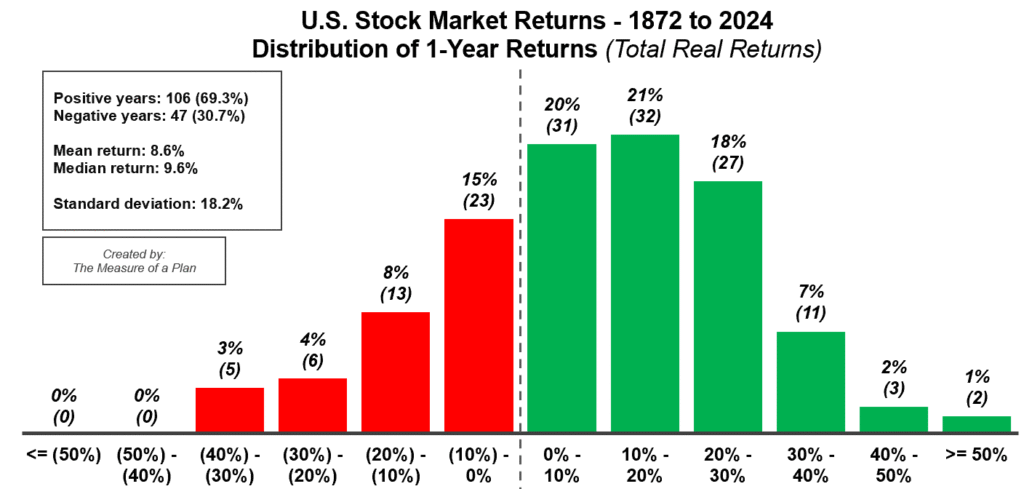

📊 CFA Historical Outperformance

Studies repeatedly show value investing generating long-term premiums. For instance, value stocks delivered annualized returns of ~15.1% (Conservative Formula strategy) versus ~9.3% for benchmarks, with lower volatility

🧠 Reddit Insights

Retail investors report strong results. One user commented:

“I began value investing in 2013…my performance has consistently beaten the market with a 24–26% average annual return.”

Quantitative correlation between valuation factors and returns also supports value investing: e.g., Book/Price correlates ~0.306 with annualized returns across 1980–2023

4. Where Value Opportunities Are Emerging

🏦 Financials

Bank stocks surged recently, with KBW Bank Index up ~25%, supported by deregulation and higher rates

⚙️ Energy & Industrials

Energy rebounded strongly (+35% YTD as of Dec 2024)—value investors see potential upside amid underweight positioning Industrials and utilities gain renewed interest as interest rates normalize .

💊 Healthcare & Materials

Deep Value outperformance includes healthcare and materials segments, which trade at low valuations with stable fundamentals

5. Risks and Counterpoints

⚠️ Growth’s Strength Continues

Growth and AI stocks remain powerful—Sanctuary Wealth forecasts a 12% S&P 500 rise driven by AI Barron’s notes growth still outperforming value over recent decades

⚠️ Elevated Market Valuations

The S&P is trading at ~22–23x earnings—levels historically associated with muted 5-year returns under 5% Dense valuations require careful stock selection, not blanket value allocations.

⚠️ Need for Active Selection

Value is not a passive index play. Managers must avoid value traps (low valuations for valid reasons) and target quality value with catalysts

6. How Investors Can Use Value Now

✅ Diversified Value Allocation

Consider overweighting value via ETFs (e.g., IVE, VTV) or active mutual funds. A balanced approach: 50% Growth / 50% Value may guard against one-sided exposure .

🏛️ Blend with Growth

Combine dividend-paying value stocks with high-quality growth and thematic exposures like AI/cloud for balance.

🕵️ Active Management

Engage with managers focused on fundamentals, valuation, catalysts, and macro risks rather than blind factor tilts

🌐 Go Global

Explore international value equities, which often trade at steeper discounts relative to the U.S.

7. Case Studies: Value Winning in 2025

🏦 Banks

Financials enjoy major earnings momentum. KBW Index +25%, while top U.S. banks continue strong earnings—analysts optimistic despite price pressure

🛢 Energy

Energy sector underrepresentation (3% in S&P vs. >10% in 2010) positions it for value-led rebound

📦 Industrials & Materials

Value archetypes like industrials and commodity-driven sectors, with low valuations and stable earnings, are beginning to outperform

8. Is It Too Late to Get In?

- Valuation spread remains wide—value stocks continue to look cheap relative to overall market

- Volatility may persist, but this offers entry points for patient investors.

- Factor timing matters—value tends to thrive in early expansion and normalization phases, which aligns with current macro trends

9. Bottom Line

- Value investing is resurgent in 2025, supported by valuation dislocations, macro and volatility dynamics, and sector rotation.

- International value offers further upside, complementing cyclically sensitive sectors like banks, energy, and industrials.

- Blend value with quality growth, emphasize active selection, and maintain a global perspective.

🟢 Final Verdict

For disciplined investors, 2025 appears to be a favorable environment to overweight value—anchored in fundamentals and supported by macro dynamics. But success depends on selecting the right stocks or managers, staying patient, and balancing with growth exposure.