Every great American business begins with a vision. But before you can launch your website, open your doors, or make your first sale, you face a foundational decision that will shape your company’s legal and financial future: choosing your business structure.

This isn’t just bureaucratic paperwork. Your choice of entity—be it a Sole Proprietorship, LLC, S-Corp, or another—impacts everything:

- Your personal liability: Is your house, car, and savings protected if your business is sued?

- Your tax bill: How much will you pay in self-employment tax, federal income tax, and state tax?

- Your ability to raise capital: Can you easily bring on investors or partners?

- Your administrative workload: How much ongoing paperwork and compliance is required?

Many new entrepreneurs default to the simplest option, often without understanding the long-term risks and implications. This guide is designed to change that. We will demystify the most common business structures in the USA, providing you with the expertise and clarity you need to make an informed, confident choice that protects you and propels your venture forward.

Part 1: The Core Concepts – Understanding Liability, Taxation, and Compliance

Before we dive into specific structures, let’s establish the three pillars upon which this decision rests.

1. Personal Liability Protection: Your Shield Against Risk

This is the single most important consideration for most small business owners.

- Unprotected (Sole Proprietorship/General Partnership): Your business is not a separate legal entity from you. If your business incurs debt or is sued, your personal assets—your home, personal bank accounts, vehicles, and other property—are at risk to settle those business obligations. This is known as “unlimited personal liability.”

- Protected (LLC, S-Corp, C-Corp): The business is a separate legal entity, distinct from its owners. This creates a “corporate veil” that shields your personal assets. If the business is sued or fails, only the business’s assets are typically at risk. This protection is not absolute (you can be held personally liable for your own fraudulent or negligent actions), but it is a powerful and essential safeguard.

2. Taxation: How Your Profits Are Taxed

The IRS treats different structures in fundamentally different ways.

- Pass-Through Taxation (Sole Proprietorship, Partnership, LLC, S-Corp): The business itself does not pay federal income tax. Instead, the profits and losses “pass through” to the owners’ personal tax returns. The owners then pay tax at their individual income tax rates. This avoids the “double taxation” of C-Corporations.

- Double Taxation (C-Corp): The corporation pays corporate income tax on its profits. Then, if those profits are distributed to owners as dividends, the shareholders pay personal income tax on that dividend income. The same money is taxed twice.

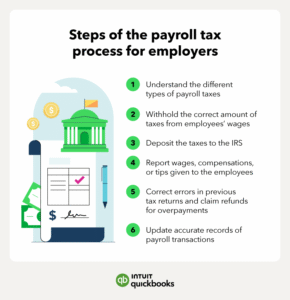

- Self-Employment Tax: This is a tax that funds Social Security and Medicare. For 2024, the self-employment tax rate is 15.3% (12.4% for Social Security and 2.9% for Medicare). In pass-through entities, all business profit is typically subject to self-employment tax. However, the S-Corp structure offers a potential method to reduce this burden, which we’ll explore later.

3. Compliance and Formalities: The Price of Protection

Simpler structures come with less paperwork. More complex structures offer more protection and tax benefits but require more rigorous formalities.

- Simple: Sole Proprietorships require minimal registration (often just a DBA) and have no ongoing corporate formalities.

- Moderate: LLCs require filing Articles of Organization with the state and may require an Operating Agreement and annual reports.

- Formal: S-Corps and C-Corps require filing Articles of Incorporation, adopting bylaws, holding initial and annual shareholder meetings, keeping detailed minutes, and issuing stock. Failure to maintain these formalities can jeopardize your liability protection.

Part 2: A Deep Dive into Each Business Structure

Now, let’s examine the specifics of the most common structures for small to medium-sized businesses in the USA.

Structure 1: Sole Proprietorship

A Sole Proprietorship is an unincorporated business owned and run by one individual, with no legal distinction between the owner and the business. It is the default status if you start a business on your own and take no action to form a different entity.

How it Works:

- Setup: Often as simple as registering a “Doing Business As” (DBA) or “Fictitious Business Name” with your city or county.

- Liability: Unlimited personal liability. You are personally responsible for all business debts and legal judgments.

- Taxation:

- Pass-Through: Business income and losses are reported on your personal tax return using Schedule C (Form 1040).

- Self-Employment Tax: You pay the full 15.3% self-employment tax on the entire net profit of the business.

- Management & Compliance: Complete control by the owner. Minimal to no ongoing formalities or separate business tax filings.

Pros:

- Easiest and least expensive to set up.

- Complete control and simplicity in decision-making.

- Minimal regulatory and compliance paperwork.

- Business losses can directly offset other personal income.

Cons:

- Unlimited personal liability is a massive risk.

- Can be difficult to raise capital (you can’t sell shares).

- May be perceived as less professional or established.

- Limited to the owner’s credit and resources.

Best For:

- Low-risk, part-time businesses or “side hustles” with minimal chance of lawsuit or debt.

- Consultants, freelancers, and artists testing a business idea.

- Anyone who prioritizes simplicity over protection.

Structure 2: Limited Liability Company (LLC)

The Limited Liability Company (LLC) is the most popular and versatile structure for small businesses in the USA. It blends the liability protection of a corporation with the tax simplicity and operational flexibility of a partnership.

How it Works:

- Setup: File Articles of Organization with your state’s Secretary of State office and pay a filing fee. It is highly recommended to create an Operating Agreement, even for single-member LLCs, which outlines the ownership and operating procedures.

- Liability: Limited personal liability. Members (owners) are typically not personally responsible for business debts and liabilities.

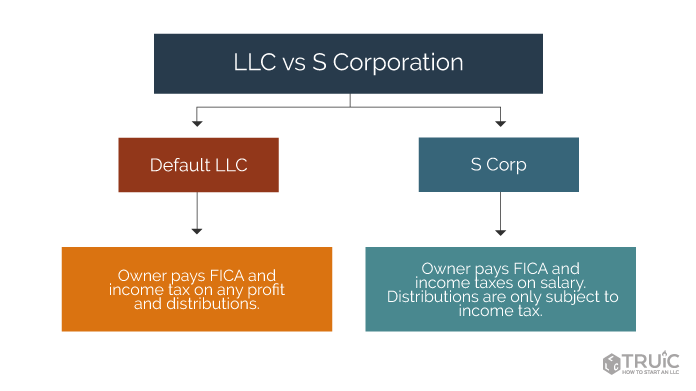

- Taxation (Flexible):

- Default (Single-Member): Treated as a “Disregarded Entity.” Profits/losses are reported on Schedule C, similar to a sole proprietorship, but liability protection remains.

- Default (Multi-Member): Treated as a Partnership. Files Form 1065, and members receive a Schedule K-1 to report their share of income on their personal returns.

- Election to be Taxed as S-Corp: An LLC can file Form 2553 with the IRS to elect to be taxed as an S-Corporation, which can offer self-employment tax savings (see S-Corp section below).

- Management & Compliance: Can be member-managed (all owners participate) or manager-managed (appointed managers run the LLC). Requires more setup than a sole prop but generally less than a corporation. Some states require annual or biennial reports and fees.

Pros:

- Strong personal asset protection.

- Flexible tax treatment (can choose to be taxed as Sole Prop, Partnership, or S-Corp).

- Less administrative complexity and paperwork than corporations.

- Flexible profit-sharing (not necessarily tied to ownership percentage).

Cons:

- More expensive and complex to set up than a sole proprietorship.

- Some states have high franchise or annual fees.

- The “corporate veil” can be pierced if formalities are ignored (co-mingling funds, etc.).

- Self-employment tax on all profits in default tax mode.

Best For:

- Virtually any small business owner seeking liability protection.

- Real estate investors.

- Business owners with significant personal assets to protect.

- Companies that want the option to be taxed as an S-Corp in the future.

Structure 3: S-Corporation (S-Corp)

An S-Corporation is not a separate business entity but rather a tax election. It is a special IRS designation that allows a corporation or an LLC to be taxed as a pass-through entity while avoiding the double taxation of a C-Corp.

How it Works:

- Setup: First, you must form a corporation (by filing Articles of Incorporation) or an LLC. Then, you file Form 2553 with the IRS (signed by all shareholders) to elect S-Corp status. Strict eligibility requirements include:

- Must be a domestic corporation/LLC.

- No more than 100 shareholders.

- Shareholders must be U.S. citizens/residents.

- Only one class of stock.

- Liability: Same as the underlying entity. If it’s an LLC electing S-Corp status, you have the liability protection of an LLC. If it’s a corporation, you have the liability protection of a corporation.

- Taxation (The Key Benefit):

- Pass-Through: Files Form 1120-S. Profits/losses pass through to shareholders via Schedule K-1.

- The Salary vs. Distribution Distinction: This is the primary tax advantage. Shareholders who work for the company must be paid a “reasonable salary” subject to payroll taxes (Social Security and Medicare, which split between employee and employer, effectively the same 15.3% as self-employment tax). Any remaining profit can be taken as a distribution, which is not subject to self-employment tax. This can result in significant tax savings.

- Management & Compliance: Requires formal corporate structure (directors, officers, bylaws) if it’s a corporation. Strict adherence to meetings, minutes, and corporate formalities is required to maintain liability protection and S-Corp status.

Pros:

- Potential for self-employment tax savings on distributions.

- Pass-through taxation avoids double taxation.

- Strong liability protection.

- Perceived credibility with investors and partners.

Cons:

- Strict eligibility requirements (shareholder number and type).

- More complex and expensive administration and accounting.

- “Reasonable salary” requirement is subjective and closely scrutinized by the IRS.

- Must manage payroll for owners, adding cost and complexity.

- Can have less flexible profit-sharing rules than an LLC.

Best For:

- Established, profitable businesses where the net income is consistently high enough to pay a reasonable salary and still have left-over profit for distributions.

- Businesses that expect to generate at least $60,000 – $80,000 in annual profit before owner pay to make the added compliance costs worthwhile.

Structure 4: (Briefly) The C-Corporation & Partnership

While our focus is on the Sole Prop, LLC, and S-Corp, it’s important to understand these other entities.

- C-Corporation (C-Corp):

- What it is: A separate legal and tax entity from its owners (shareholders).

- Best For: Businesses that plan to “go public” or seek significant venture capital funding, as they can issue multiple classes of stock. Also for large companies reinvesting profits (corporate tax rates may be lower than top individual rates).

- Key Drawback: Double taxation.

- Partnership:

- General Partnership (GP): Similar to a sole prop but with two or more people. All partners have unlimited personal liability.

- Limited Partnership (LP): Has general partners (with liability) and limited partners (passive investors with limited liability).

- Limited Liability Partnership (LLP): Similar to an LLC, often used by licensed professionals (doctors, lawyers, accountants). Protects partners from the malpractice of other partners.

Read more: How to Create a Standout LinkedIn Profile That Recruiters Will Find

Part 3: The Decision Matrix – A Side-by-Side Comparison

| Feature | Sole Proprietorship | LLC (Default Tax) | S-Corp (Tax Election) |

|---|---|---|---|

| Liability Protection | No – Unlimited Personal Liability | Yes – Limited Liability | Yes – Limited Liability |

| Taxation | Pass-Through (Schedule C) | Pass-Through (Schedule C or 1065) | Pass-Through (1120-S) |

| Self-Employment Tax | On 100% of net profit | On 100% of net profit | On Salary Only, not distributions |

| Setup Complexity | Very Low | Moderate | High (for a corporation) / Mod. (for LLC) |

| Ongoing Compliance | Very Low | Moderate | High |

| Cost to Form | Low ($10 – $100 for DBA) | Moderate ($50 – $500 + state fees) | High ($100 – $500 + state fees + payroll) |

| Credibility | Lower | Higher | Higher |

| Investment/Funding | Difficult | Easier (can admit members) | Easier (can sell shares, with restrictions) |

| Operational Flexibility | Total, but informal | High (Operating Agreement) | Rigid (Bylaws, formal meetings) |

Part 4: A Step-by-Step Guide to Making Your Choice

Follow this process to arrive at the best structure for your unique situation.

Step 1: Assess Your Personal Liability Risk

- Ask Yourself: What is the likelihood my business could be sued or incur significant debt? (e.g., A consultant has lower risk than a construction contractor or a restaurant owner).

- Guideline: If the risk is anything above “very low,” you need an entity with liability protection (LLC or Corp). Eliminate the Sole Proprietorship if you have any significant assets to protect.

Step 2: Project Your Business Income and Profitability

- Ask Yourself: What are my realistic revenue and profit projections for the next 1-3 years?

- Guideline:

- If you’re just starting or have low profits (<$50k), an LLC with default taxation is likely your best bet. It provides protection without the complexity of S-Corp payroll.

- If your business is established and consistently profitable (>$80k profit before owner pay), it’s time to run the numbers on an S-Corp election.

Step 3: Consider Your Growth and Funding Plans

- Ask Yourself: Will I need to bring on investors or partners? Do I plan to reinvest most profits back into the business for rapid growth?

- Guideline:

- For most small businesses taking on a few partners, an LLC is perfectly suited.

- If you plan to seek venture capital, a C-Corp is often required by investors.

Step 4: Be Honest About Your Administrative Tolerance

- Ask Yourself: How much paperwork and formal record-keeping am I willing to handle? Can I afford a payroll service and a more sophisticated accountant?

- Guideline: If you want to “set it and forget it,” an LLC is your ceiling. If you are disciplined and have professional support, an S-Corp is manageable.

Step 5: Consult the Professionals

This guide provides expert information, but it is not a substitute for personalized legal and tax advice. Before you file anything, schedule consultations with:

- A Business Attorney: They can advise on liability, draft your Operating Agreement, and ensure you are set up correctly for your state.

- A Certified Public Accountant (CPA) or Enrolled Agent (EA): They can run detailed tax projections comparing an LLC to an S-Corp based on your specific numbers and advise on the “reasonable salary” requirement.

Conclusion: Your Path Forward

Choosing your business structure is a rite of passage for every American entrepreneur. It’s a decision that balances risk, tax efficiency, and administrative burden.

To summarize the journey:

- Start by dismissing the Sole Proprietorship if you have any liability concerns or assets to protect.

- For the vast majority of new and growing small businesses, the LLC provides the perfect balance of robust liability protection, operational flexibility, and manageable compliance. It is the gold standard for a reason.

- Once your business is stable and highly profitable, explore the S-Corp election with your CPA as a powerful tool for tax savings, weighing the benefits against the increased complexity.

This decision is a cornerstone of your business’s foundation. By investing the time to understand these options now, you are not just filling out forms—you are building a secure platform from which your American business dream can safely grow and thrive.

Read more: How to File Your US Taxes Online for Free (And Get Your Maximum Refund)

Frequently Asked Questions (FAQ)

Q1: Can I change my business structure later if I start with the wrong one?

A: Yes, it is possible, but it can be complex and may have tax consequences. Converting from a Sole Proprietorship to an LLC is generally straightforward. Converting an LLC to an S-Corp or C-Corp is also common. However, dissolving one entity and forming another can trigger taxes. It’s best to choose correctly from the start, but know that your structure can evolve with your business.

Q2: I’m a single-member LLC. How do I pay myself?

A: This is a common point of confusion. Unlike an S-Corp, you do not need to run payroll for yourself (unless you have elected S-Corp status). As a single-member LLC taxed as a disregarded entity, you simply take money from the business bank account as needed. This is called an “owner’s draw.” There are no tax withholdings; you are responsible for paying estimated quarterly taxes on your entire share of the business’s profit.

Q3: What exactly is a “reasonable salary” for an S-Corp owner?

A: The IRS does not provide a fixed formula, but it is defined as what a similar business would pay for the same services in the open market. Factors include your experience, duties, industry standards, and the company’s profitability. Setting it too low is a major red flag for an audit. Your CPA can help you determine a defensible figure, often in the range of $60,000 to $100,000+ for many small business owners.

Q4: Do I need to form my LLC in Delaware or Wyoming? I’ve heard they are the best.

A: While Delaware and Wyoming have business-friendly laws, for most small businesses that operate primarily in one state, it is simplest and most cost-effective to form your LLC in the state where you are physically located. If you form in Delaware but operate in Texas, you will have to register as a “foreign LLC” in Texas and pay fees and taxes in both states, doubling your compliance costs and complexity.

Q5: What is an Operating Agreement, and do I really need one for a single-member LLC?

A: Yes, you absolutely should have one. An Operating Agreement is an internal document that outlines the ownership and operating procedures of your LLC. Even for a one-owner LLC, it is critical because it:

- Formally separates you from the business, helping to protect your corporate veil.

- Provides a clear framework for what happens if you want to bring on a member, become incapacitated, or sell the business.

- Demonstrates to banks, landlords, and the IRS that you are treating your LLC as a legitimate business entity.

Q6: How much does it cost to set up an LLC or S-Corp?

A: Costs vary significantly by state. Setting up an LLC typically involves a one-time state filing fee (anywhere from $40 to $500). Some states also have an annual/biennial report fee or a “franchise tax.” An S-Corp that is a corporation (not an LLC election) has similar filing fees. You must also factor in the cost of professional advice ($200-$500 for a consultation) and potentially a registered agent service ($50-$300/year).