For any entrepreneur, a business plan is more than a document; it’s the blueprint for your dream, the argument for your existence, and the primary tool you use to convince strangers to believe in your vision with their capital. In the competitive landscape of American business, a generic, half-hearted plan is destined for the recycling bin. To secure funding from angel investors, venture capital firms, or banks, your business plan must be a masterclass in clarity, strategy, and financial acumen.

This guide goes beyond the basic templates. It delves into the mindset of American investors and lenders, outlining how to structure a narrative that doesn’t just inform but compels. We will build a plan section by section, focusing on the critical elements that separate a funded plan from a forgotten one.

Understanding Your Audience: The American Investor’s Mindset

Before you write a single word, you must understand who you are writing for. American investors are not just evaluating an idea; they are investing in you, your team, and your potential for outsized returns. They are inundated with pitches, so your plan must quickly and effectively answer their core questions:

- What is the Massive, Urgent Problem? Is this a “nice-to-have” or a “must-have”?

- Is Your Solution Truly Differentiated and Defensible? Why you? Why now?

- Who is on the Team? Do you have the experience, expertise, and grit to execute?

- What is the Path to Massive Scalability and Profitability? Is the market big enough, and can you capture it profitably?

- What is the Exit Strategy? How do I, the investor, get a return on my investment (e.g., acquisition, IPO)?

Your business plan is the first, and sometimes only, chance to answer these questions convincingly.

The Anatomy of a Fund-Winning Business Plan

While structures can vary, a comprehensive plan for seeking funding in the USA typically includes the following sections. We will explore each in detail.

- The Executive Summary

- Company Description

- Market Analysis

- Organization & Management

- Products or Services

- Marketing & Sales Strategy

- Financial Projections

- Funding Request

- Appendix

1. The Executive Summary: Your 2-Minute Elevator Pitch in Writing

This is the most important section of your plan. Many investors will only read this first. If it doesn’t grab them, the rest of the plan is irrelevant. Despite its name, write it last, after you’ve fleshed out every other part of your business.

What to Include:

- The Hook: Start with a powerful one-sentence description of your business.

- Example: “Acme Analytics provides AI-powered supply chain visibility software for mid-sized manufacturing companies, reducing inventory costs by an average of 20%.”

- The Problem: Briefly describe the significant pain point or opportunity in the market.

- The Solution: Clearly state your product or service and its unique value proposition.

- The Target Market: Define your ideal customer and the total addressable market (TAM).

- The Business Model: Explain how you make money (e.g., SaaS subscriptions, transaction fees, product sales).

- The Team: Highlight the key team members and their relevant, “rockstar” qualifications.

- The Traction (if any): Mention any key milestones: beta customers, revenue, partnerships, or patents.

- The Financial Ask: State clearly how much funding you are seeking and what it will be used for (e.g., “We are seeking $1.5M in seed funding to expand our engineering team and launch our sales and marketing initiatives.”).

- Key Financial Projections: Summarize your projected revenue and profitability for the next 3-5 years.

Pro Tip for Funding: Keep it concise—one to two pages maximum. It should be a standalone document that is compelling enough to get an investor to read the full plan or schedule a meeting.

2. Company Description: The “Who” and “Why”

This section provides the foundational details of your venture.

What to Include:

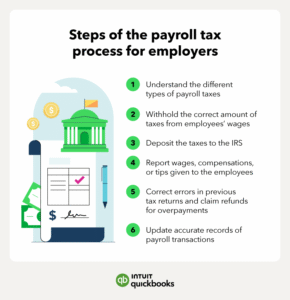

- Company Name & Legal Structure: Are you a C-Corp, S-Corp, LLC? (Note: Most VCs prefer to invest in C-Corporations).

- Mission Statement: Your company’s purpose beyond profit.

- Vision Statement: The long-term change you seek to create in the world.

- Core Values: The principles that guide your company’s culture and decisions.

- Business Model: A clear, concise explanation of how you make money. Be specific. Is it a subscription fee? A commission? A licensing model?

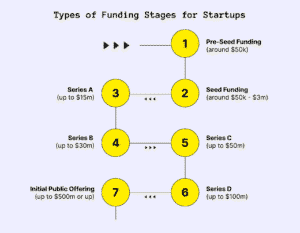

- Current Status & Location: Where are you headquartered? What is your current stage (e.g., seed, Series A)?

- Legal Structure: Briefly explain your setup (C-Corp, S-Corp, LLC) and why it’s advantageous for your business and investors.

Pro Tip for Funding: Your mission and vision matter. Investors want to back founders who are driven by a purpose, not just a paycheck. This passion is a key indicator of resilience.

3. Market Analysis: Proving There’s a Gold Mine

This is where you prove that you have a deep, data-driven understanding of the landscape you are entering. Vague statements will destroy your credibility.

What to Include:

- Industry Overview & Size: Discuss the broader industry you are in. Use reputable sources like IBISWorld, Statista, or Gartner.

- Total Addressable Market (TAM): The total revenue opportunity if you achieved 100% market share.

- Serviceable Addressable Market (SAM): The segment of the TAM you can actually serve.

- Serviceable Obtainable Market (SOM): The portion of the SAM you can realistically capture in the next 3-5 years. This shows you are grounded and realistic.

- Target Customer Profile: A detailed “avatar” of your ideal customer (demographics, psychographics, behaviors, pain points).

- Market Trends: What macro trends are working in your favor? (e.g., remote work, sustainability, AI adoption).

- Competitive Analysis: This is critical. Create a competitor matrix comparing key features, pricing, strengths, and weaknesses. Identify:

- Direct Competitors: Those offering a very similar product/service to the same customer.

- Indirect Competitors: Those solving the same problem with a different solution.

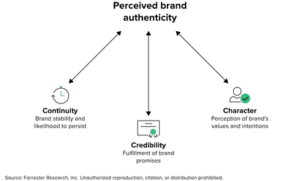

- Your Competitive Advantage (Moat): Why will you win? This could be:

- Technology: Proprietary patents or algorithms.

- Network Effects: The service becomes more valuable as more people use it.

- Brand: A strong, trusted brand identity.

- Cost Advantage: A more efficient operational model.

- Regulatory Moats: Licenses or regulations that protect your business.

Pro Tip for Funding: Use a “Competitive Positioning Map.” Plot your competitors on a 2×2 grid (e.g., Price vs. Quality, Features vs. Ease of Use) to visually demonstrate the gap in the market that you fill.

4. Organization & Management: The “A-Team” Slide

Investors often say they “bet on the jockey, not the horse.” This section is all about the jockeys.

What to Include:

- Organizational Chart: A visual of your company’s structure.

- Key Team Member Profiles: For each founder and key executive, provide:

- Name and Title

- Brief Bio highlighting relevant experience (not just a list of jobs).

- Key accomplishments and expertise. Quantify where possible (“Grew revenue from $0 to $2M in 18 months”).

- Advisory Board: If you have well-respected industry experts on your advisory board, list them here. It adds immense credibility.

- Gaps & Hiring Plan: Be honest about any skill gaps on your team and outline your plan to hire for those roles with the new funding. This shows foresight.

Pro Tip for Funding: If your team lacks direct experience, emphasize transferable skills—leadership, problem-solving, and a proven ability to learn and adapt. Show evidence of your team’s ability to execute under pressure.

5. Products or Services: The “What”

Move beyond features and focus on the value and experience you deliver.

What to Include:

- Detailed Product/Service Description: What is it? How does it work? Use clear, non-technical language.

- The Technology: If applicable, describe the underlying technology, any patents (filed or granted), and your development roadmap.

- The Value Proposition: What specific, measurable benefit does the customer get? (Save time, save money, increase revenue, reduce risk).

- Product Lifecycle: Where are you in development? (Idea, prototype, MVP, launched with version 2.0 on the horizon).

- Future Products/Services: Briefly describe your product roadmap for the next few years. This shows you are thinking long-term.

Pro Tip for Funding: Use visuals! A screenshot of your software dashboard, a diagram of your process, or a professional photo of your physical product can make your description far more impactful.

6. Marketing & Sales Strategy: Your Path to Customers

How will you find customers and turn them into paying clients? “If we build it, they will come” is not a strategy.

What to Include:

- Market Positioning: How will you position your brand in the minds of consumers relative to competitors?

- Pricing Strategy: Justify your pricing model. Is it cost-plus, value-based, or competitive? Explain why it’s the right model.

- Promotion & Customer Acquisition:

- Channels: Detail the specific channels you will use (e.g., Content Marketing/SEO, Paid Social Media Ads, Partnerships, Cold Outreach, Trade Shows).

- Cost of Customer Acquisition (CAC): Estimate how much it will cost to acquire a customer through each channel.

- Sales Process: Map out the customer’s journey from awareness to purchase. Is it a self-service, transactional sale, or a complex, enterprise sales cycle requiring a dedicated team?

- Customer Retention Strategy: How will you keep customers and increase their lifetime value (LTV)? (e.g., excellent customer support, loyalty programs, upselling).

Pro Tip for Funding: The LTV to CAC ratio is a magic number for investors. A healthy ratio is typically considered 3:1 or higher. If you can, estimate this and highlight it.

Read more: A Step-by-Step Guide To Legally Registering Your Business in Any US State

7. Financial Projections: The Numerical Proof

This is where many entrepreneurs stumble. Your projections must be both ambitious and defensible. Wild, unsupported optimism will be immediately spotted and dismissed.

What to Include (for 3-5 years):

- Assumptions: This is the most critical part! Start by listing the assumptions behind your numbers (e.g., “We assume a 2% monthly conversion rate from web traffic,” “We assume a 10% monthly churn rate”). This shows your logic and makes the projections credible.

- Profit and Loss (P&L) Statement: Also known as an Income Statement. This shows your projected revenue, cost of goods sold (COGS), operating expenses, and ultimately, your net profit or loss.

- Cash Flow Statement: This shows the movement of cash in and out of your business. Many profitable businesses fail because they run out of cash. This statement proves you understand cash flow management.

- Balance Sheet: A snapshot of your company’s financial position at a specific point in time (assets, liabilities, and equity).

Pro Tip for Funding: Create three scenarios:

- Base Case (Realistic): Your most likely outcome.

- Best Case (Optimistic): What happens if everything goes right.

- Worst Case (Conservative): Your survival plan if things go poorly.

This demonstrates that you have thought through various outcomes and are prepared for volatility.

8. Funding Request: The “Ask”

Be explicit and specific about what you need.

What to Include:

- Amount Needed: State the exact amount of funding you are seeking (e.g., “$750,000”).

- Use of Funds: Provide a clear breakdown of how you will spend every dollar. Use a simple table:

- Category | Amount | Percentage

- Product Development | $300,000 | 40%

- Sales & Marketing | $300,000 | 40%

- G&A (Salaries, Rent) | $150,000 | 20%

- Proposed Terms (for Equity Investment): Are you offering common stock, preferred stock? At what valuation? ($750,000 for a 15% stake implies a $5M post-money valuation).

- Timeline: What key milestones will this funding allow you to achieve, and by when? (e.g., “Launch Version 2.0 by Q3 2024,” “Achieve $50,000 in Monthly Recurring Revenue by Q1 2025”).

Pro Tip for Funding: Ask for enough money to reach the next significant milestone that will allow you to raise your next round of funding at a much higher valuation. This shows you understand the staged nature of venture capital.

9. Appendix: The Supporting Evidence

This is for all the supporting documents that would clutter the main body of your plan.

What to Include:

- Founder and key team member resumes

- Detailed financial tables

- Product brochures or spec sheets

- Market research data

- Letters of intent from potential customers

- Media mentions

- Patent documents

- Professional references

The Final Polish: Presentation and Professionalism

- Design & Formatting: Use a clean, professional layout. No Comic Sans. Use headings, subheadings, bullet points, and charts to improve readability.

- Proofread: Typos and grammatical errors signal a lack of attention to detail. Have multiple people proofread it.

- Be Concise: Aim for 20-30 pages maximum, with the Executive Summary being the shortest section. Respect the reader’s time.

- Tell a Story: Weave a narrative throughout. You are the hero solving a critical problem for your customers. The data and facts are the evidence that your story is true.

Conclusion: Your Plan is a Living Document

A business plan is not a one-time exercise you complete and forget. It’s a strategic tool that should be revisited and revised quarterly as you learn more about your customers, your market, and your own business. The process of writing it will force you to confront hard questions and solidify your strategy.

By following this structured, investor-centric approach, you are not just writing a document; you are building a compelling case for investment. You are demonstrating that you have the vision, the team, the strategy, and the financial discipline to build a successful, fundable American business. Now, go get that funding.

Read more: How To Choose the Right Business Structure in the USA: LLC, S-Corp, or Sole Proprietorship?

Frequently Asked Questions (FAQ)

Q1: Is a business plan still necessary in the age of the lean startup and one-page pitches?

Yes, absolutely. A one-page pitch deck is a fantastic tool for generating initial interest and securing a first meeting. However, once an investor is seriously considering writing a check, they will perform due diligence. A comprehensive business plan is the document that provides the deep, substantiated detail they need to make that multi-million dollar decision. It shows you have done your homework.

Q2: What is the biggest mistake you see in business plans seeking funding?

Unrealistic financial projections. Founders often project a hockey-stick growth curve with no clear, defensible explanation of how they will achieve it. This immediately erodes trust. The second biggest mistake is failing to clearly articulate a sustainable competitive advantage (a “moat”). Without one, investors assume you will be crushed by competitors as soon as you prove the market.

Q3: How detailed should my financial models be?

They should be built from the ground up, not the top down. For example, don’t just plug in “$1M in revenue Year 1.” Build a model based on drivers: Number of Website Visitors x Conversion Rate x Average Order Value. This allows you to test your assumptions and show investors the “levers” of your business.

Q4: Should I hire a professional to write my business plan?

You can hire a consultant to help, especially with financial modeling or design. However, the core content—the vision, the strategy, the knowledge of the market—must come from you, the founder. An investor will immediately sense if you are not the true author and will question your command of the business.

Q5: What’s the difference between a plan for a bank loan vs. a venture capital firm?

- Bank Loan: Focuses on stability, collateral, and your ability to repay the debt with interest. They are more risk-averse. Emphasize strong cash flow projections, assets, and a proven business model.

- Venture Capital: Focuses on hyper-growth, market disruption, and the potential for a 10x return. They are risk-tolerant but seek outsized rewards. Emphasize your massive TAM, scalable solution, and a clear path to an exit (IPO or acquisition).

Q6: How long does it typically take to get funding after submitting a plan?

There is no standard timeline. It can take anywhere from a few weeks to over a year. The process typically involves: initial pitch > submission of plan > first meeting > several follow-up meetings and due diligence > term sheet negotiation > legal closing. Building relationships with investors before you need the money is the best way to speed up the process.

Q7: My business is a “lifestyle business” with no plans for a massive exit. Can this plan get funded?

Traditional venture capital is not the right fit for a lifestyle business. Your focus for funding should be on personal savings, friends and family, small business loans (SBA loans are excellent in the USA), or grants. Your business plan should then emphasize steady profitability and low risk, rather than explosive growth.