You have a brilliant business idea, a plan, and the drive to succeed. But before you launch, you face one of the most fundamental and consequential decisions as a new entrepreneur: choosing your business structure. For most small to medium-sized businesses in the US, the debate often narrows down to two popular options: the Limited Liability Company (LLC) and the S-Corporation (S-Corp).

This isn’t just bureaucratic paperwork. Your choice of entity is the legal and tax foundation upon which your entire business will be built. It impacts everything:

- How much you pay in taxes.

- How you can raise money.

- The paperwork you’re required to file.

- Your personal liability for business debts.

- Your ability to offer equity to employees.

Getting this decision right from the start can save you thousands of dollars, prevent legal nightmares, and set you up for smooth growth. Getting it wrong can lead to administrative headaches, unexpected tax bills, and even put your personal assets—your home, car, and savings—at risk.

This guide is designed to demystify the LLC and S-Corp. We will break down the complexities into plain English, providing you with the knowledge and framework to confidently choose the right structure for your unique situation. Remember, while this guide provides expert information, it is not a substitute for personalized advice from a qualified CPA or business attorney.

Part 1: The Foundation – Understanding Business Entities

Before diving into the specifics of LLCs and S-Corps, it’s essential to understand the core concepts that define all business structures.

1. Liability Protection: Shielding Your Personal Assets

This is the single most important reason most entrepreneurs move beyond a sole proprietorship or general partnership.

- No Protection (Sole Proprietorship/Partnership): In these default structures, there is no legal separation between you and your business. If your business is sued for a faulty product, or can’t pay its loans, creditors can come after your personal assets—your house, personal bank accounts, and car—to satisfy those business debts.

- With Protection (LLC, S-Corp, C-Corp): These structures create a separate legal entity for your business. The company can sue, be sued, and enter into contracts in its own name. This creates a “corporate veil” between your business and your personal finances. If the business fails or faces a lawsuit, your personal assets are typically shielded. This protection is not absolute—you are always personally liable for your own direct misconduct or failure to maintain the corporate formalities.

2. Taxation: How the Government Gets Paid

How your business is taxed is the other major differentiator.

- Pass-Through Taxation: The business itself does not pay federal income taxes. Instead, the profits and losses “pass through” the business to the owners’ personal tax returns. The owners then pay tax at their individual income tax rates. This avoids the “double taxation” of a standard C-Corporation.

- Corporate Taxation (C-Corp): The business is taxed as a separate entity on its profits at the corporate tax rate (currently 21%). If those after-tax profits are then distributed to owners as dividends, the owners pay personal income tax on those dividends. This results in the same profit being taxed twice.

3. Management & Formalities: Running Your Business

Different structures have different requirements for how they must be run and managed.

- Informal: Some structures, like a sole proprietorship, have virtually no formal requirements.

- Formal: Corporations (S-Corps and C-Corps) require a rigid structure with directors, officers, and shareholders. They must hold annual meetings and keep detailed minutes.

- Flexible: LLCs offer a more relaxed structure, allowing owners to design their own management system.

With these core concepts in mind, let’s explore our two main contenders.

Part 2: Deep Dive into the Limited Liability Company (LLC)

The LLC is a relatively modern business structure that has become the default choice for millions of American small businesses due to its simplicity and flexibility.

What is an LLC?

A Limited Liability Company is a hybrid legal structure that provides the limited liability features of a corporation with the tax efficiencies and operational flexibility of a partnership. It was created to be a simpler, more accessible alternative to corporations.

Key Characteristics of an LLC

- Liability Protection: Members (the owners of an LLC) are generally not personally responsible for the business’s debts and liabilities. This is its primary advantage over a sole proprietorship.

- Pass-Through Taxation (by default): By default, an LLC is a “disregarded entity” for tax purposes if it has one member, or a partnership if it has multiple members. This means the LLC itself does not pay income tax. All profits and losses are reported on the members’ personal tax returns.

- Flexible Management: An LLC can be managed by its members (owner-managers) or by appointed managers (similar to a CEO), even if they are not members. This is outlined in the LLC’s Operating Agreement.

- Fewer Formalities: Unlike corporations, LLCs are not generally required to hold annual meetings, keep formal minutes, or maintain the same level of corporate recordkeeping. This reduces administrative burden.

Formation and Ongoing Requirements

- Formation: You form an LLC by filing Articles of Organization with the secretary of state (or equivalent agency) in your state. This document includes basic information like the LLC’s name, address, and registered agent. There is a filing fee, which varies by state.

- Operating Agreement: This is the most critical internal document. While not always required by state law, it is essential. It is a legal document that outlines the ownership percentages, profit/loss distribution, members’ roles and responsibilities, and procedures for adding or removing members. It’s the “rulebook” for your LLC.

- Ongoing Compliance: Requirements are minimal but typically include filing an Annual Report (or Statement of Information) and paying an annual fee to the state. Failure to do so can result in the state dissolving your LLC, voiding your liability protection.

Taxation of an LLC: The Default Scenarios

- Single-Member LLC: The IRS treats it as a “disregarded entity.” You report business income and expenses on Schedule C and attach it to your personal Form 1040 tax return. You pay self-employment tax (Social Security and Medicare, ~15.3%) on the entire net profit.

- Multi-Member LLC: The IRS treats it as a partnership. The LLC must file an informational tax return (Form 1065), which reports the profit/loss allocation to each member. Each member then receives a Schedule K-1 and reports their share of the profit/loss on their personal Form 1040. Each member pays self-employment tax on their entire distributive share of the profit.

The LLC S-Corp Election: A Hybrid Option

This is a crucial point of confusion. An LLC can choose to be taxed as an S-Corporation by filing Form 2553 with the IRS. This allows the LLC to retain its legal structure and flexibility while adopting the unique tax treatment of an S-Corp, primarily to avoid self-employment tax on all profits. We will explore this in detail later.

Part 3: Deep Dive into the S-Corporation (S-Corp)

The S-Corporation is not a separate legal entity you form at the state level. Rather, it is a tax election made with the IRS by an existing corporation or an LLC.

What is an S-Corp?

An S-Corporation (Subchapter S Corporation) is a special tax status that allows a business to avoid the double taxation of a C-Corporation while still being a corporation under state law. It is a pass-through entity, but with specific rules and restrictions.

Key Characteristics of an S-Corp

- Liability Protection: Like an LLC and a C-Corp, an S-Corp provides strong personal liability protection for its owners (called shareholders).

- Pass-Through Taxation: The S-Corp does not pay federal income tax at the corporate level. Profits and losses are passed through to shareholders and reported on their personal tax returns via a Schedule K-1.

- Self-Employment Tax Savings: This is the S-Corp’s biggest draw. Owners who work in the business must pay themselves a “reasonable salary,” on which they pay payroll taxes (Social Security and Medicare). However, any remaining profit distributions are not subject to self-employment tax. This can result in significant tax savings.

- Strict Eligibility Requirements: The IRS places strict limits on who can be an S-Corp:

- Number of Shareholders: Limited to 100.

- Type of Shareholders: Only U.S. citizens or resident aliens can be shareholders. No corporations, partnerships, or non-resident aliens are allowed.

- One Class of Stock: The S-Corp can only have one class of stock, meaning all shares have identical rights to distributions and profits. (Voting rights can differ.)

Formation and Ongoing Requirements

- Formation: To become an S-Corp, you must first form a C-Corporation (or an LLC) at the state level by filing Articles of Incorporation. Then, you must elect S-Corp status with the IRS by filing Form 2553 within a strict timeframe (no more than two months and 15 days after the start of the tax year you want the election to take effect).

- Corporate Formalities: S-Corps are required to adhere to more corporate formalities than LLCs to maintain their liability protection and tax status. This includes:

- Adopting corporate Bylaws.

- Issuing stock certificates.

- Holding initial and annual meetings of shareholders and directors.

- Keeping detailed minutes of all major company decisions.

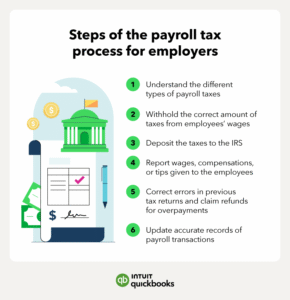

- Ongoing Compliance: S-Corps must file an Annual Report with the state and an annual tax return with the IRS (Form 1120-S). They must also run payroll for owner-employees, which involves setting up a payroll system and filing quarterly payroll tax returns.

Read more: How to Cut the Cord: A 2024 Guide to Streaming TV in the USA

Taxation of an S-Corp

The S-Corp files an informational tax return (Form 1120-S), which reports the company’s income, deductions, and profit/loss allocations. Each shareholder receives a Schedule K-1 showing their share of the income, which they report on their personal tax return.

The critical tax feature is the salary vs. distribution split:

- Reasonable Salary: Shareholders who are active in the business must be paid a “reasonable” wage as W-2 employees. This salary is subject to standard payroll taxes: the employee pays half (withheld from their check), and the company pays the other half.

- Distributions: Any remaining profits can be distributed to shareholders based on their ownership percentage. These distributions are not subject to self-employment tax (Social Security and Medicare). They are only subject to federal and state income tax.

Part 4: LLC vs. S-Corp – The Head-to-Head Comparison

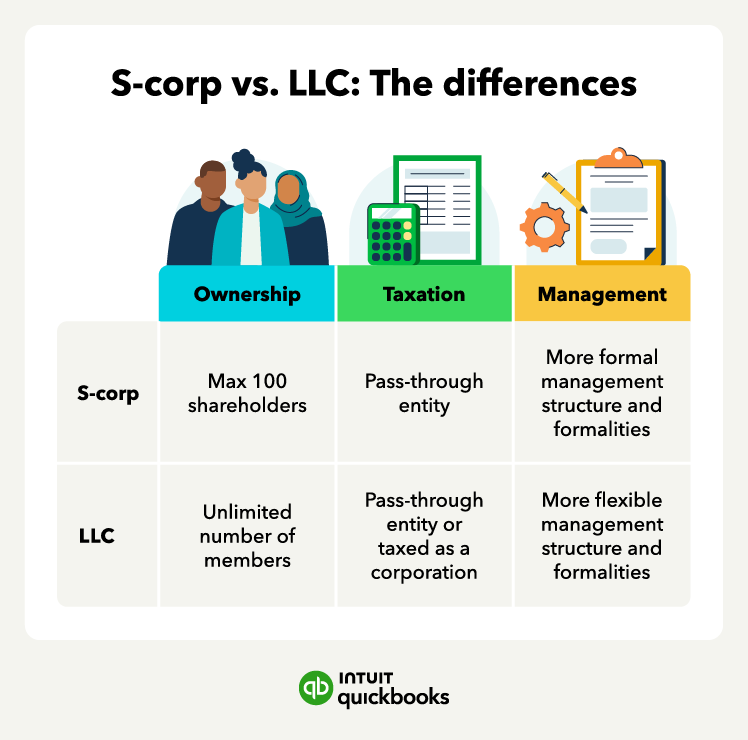

Now that we understand each structure individually, let’s put them side-by-side.

| Feature | Limited Liability Company (LLC) | S-Corporation (S-Corp) |

|---|---|---|

| Liability Protection | Yes | Yes |

| Default Taxation | Pass-Through (Sole Prop/Partnership) | Pass-Through (S-Corp) |

| Self-Employment Tax | Applied to all net profits. | Applied only to “reasonable salary.” Distributions are exempt. |

| Ownership Restrictions | Very flexible. Almost anyone/anything can be a member (individuals, corps, trusts, foreigners). | Very restrictive. Max 100 shareholders, must be US individuals/estates, only one class of stock. |

| Management & Formalities | Highly flexible. Managed by members or managers. Few formalities required. | Rigid structure. Directors and officers required. Must follow corporate formalities (meetings, minutes). |

| Setup & Compliance | Simpler. File Articles of Organization. Operating Agreement is critical but internal. | More complex. File Articles of Incorporation, then Form 2553 with IRS. Bylaws, stock, meetings required. |

| Profit Distribution | Very flexible. Can allocate profits/losses disproportionately if stated in Operating Agreement. | Rigid. Profits/losses must be distributed strictly according to stock ownership percentage. |

| Investor Appeal | May be less appealing to VCs and institutional investors who prefer the corporate structure. | More appealing than an LLC, but C-Corp status is often required by sophisticated investors. |

Part 5: How to Choose: A Practical Decision Framework

The “best” choice depends entirely on your specific business circumstances, goals, and financial picture. Use this framework to guide your decision.

Scenario 1: When an LLC is Likely the Better Choice

- You are a Solopreneur or Very Small Partnership: If you’re just starting out and your business is simple (e.g., freelancer, consultant, small online store), the simplicity and low administrative burden of an LLC are perfect.

- Your Net Profit is Relatively Low: If your business’s net profit is not significantly higher than what would be considered a “reasonable salary,” the S-Corp tax savings are minimal or non-existent. The cost and complexity of running an S-Corp (payroll services, tax preparation) may outweigh the benefits.

- You Have Unique Ownership Needs: If you plan to have foreign investors, corporate partners, or want to create different classes of ownership with different rights, an LLC is your only option between the two.

- You Value Flexibility and Simplicity: If you want to avoid the rigid corporate formalities and want the freedom to distribute profits in a non-proportional way, the LLC is the clear winner.

Scenario 2: When an S-Corp is Likely the Better Choice

- Your Business is Consistently Profitable: The S-Corp tax advantage only kicks in when there is profit left over after you pay yourself a reasonable salary.

- Your Net Profit is Significantly Higher Than a “Reasonable Salary”: This is the sweet spot. For example, if your business nets $120,000 and a reasonable salary for your role is $70,000, the remaining $50,000 can be taken as distributions, saving you approximately $7,650 in self-employment taxes ($50,000 x 15.3%). As profits grow, so do the potential savings.

- You Are Willing to Handle the Administrative Work: You are comfortable with the formalities of running a corporation and the cost of setting up and managing a payroll system.

- Your Business Fits the Ownership Rules: All owners are U.S. citizens or residents, and you don’t anticipate needing more than 100 shareholders or different classes of stock.

The LLC Electing S-Corp Status: The “Best of Both Worlds” Strategy

This is an extremely popular and often optimal strategy for growing small businesses.

How it works: You form an LLC at the state level for its flexibility and simplicity. Then, you file Form 2553 with the IRS to have your LLC taxed as an S-Corporation.

Why do this?

- Legal Side (LLC): You enjoy the flexible management, fewer formalities, and customizable Operating Agreement of an LLC.

- Tax Side (S-Corp): You get the self-employment tax savings of the S-Corp structure.

This hybrid approach gives you the operational ease of an LLC with the tax advantages of an S-Corp, making it a powerful combination for many business owners.

Part 6: Action Plan and Final Checklist

- Analyze Your Business Model and Projections: Be realistic about your expected revenue, expenses, and net profit in the first few years.

- Consult with Professionals: This is not optional. Schedule meetings with both a qualified CPA (to run tax scenarios) and a business attorney (to discuss liability and formation details). The cost of this advice is insignificant compared to the cost of a mistake.

- Make Your Decision: Based on your research and professional advice, choose the structure that best aligns with your current needs and future vision.

- Form Your Entity:

- For an LLC: File Articles of Organization with your state and draft a robust Operating Agreement.

- For an S-Corp: File Articles of Incorporation with your state and then file Form 2553 with the IRS.

- For an LLC electing S-Corp: File Articles of Organization and then file Form 2553.

- Fulfill Ongoing Requirements: Obtain an EIN from the IRS, open a business bank account, get necessary licenses/permits, and set reminders for your annual state and federal filing requirements.

Final Word of Caution

Your business is not static. The right structure today may not be the right structure in five years. As your business grows, becomes more profitable, or seeks outside investment, it’s crucial to re-evaluate your entity choice with your professional advisors. What starts as a simple LLC may later benefit from converting to an LLC with an S-Corp election, or even to a C-Corporation.

Read more: How to Create a Standout LinkedIn Profile and Get Recruited in the USA

Frequently Asked Questions (FAQ)

Q1: Can I change my business structure later if I make the wrong choice?

Yes, but it can be a complex and potentially taxable process. Converting from a sole proprietorship to an LLC or from an LLC to a corporation is generally straightforward. Converting an S-Corp back to an LLC or changing tax elections can be more complicated. It’s always best to get it right from the start.

Q2: What exactly is a “reasonable salary” for an S-Corp?

This is the million-dollar question and a common audit trigger. The IRS does not provide a fixed formula. A reasonable salary is what a similar business would pay for the same services in a similar geographic area. You must consider your experience, responsibilities, hours worked, and the company’s financial performance. Using salary data from sites like Salary.com or Glassdoor and consulting with your CPA is essential. Paying yourself an artificially low salary to avoid payroll taxes is a surefire way to attract IRS scrutiny.

Q3: Is an LLC or S-Corp better for real estate investing?

For holding rental properties, an LLC is almost always the preferred choice. The primary goal is liability protection, and the pass-through taxation is simple. The S-Corp’s main advantage (self-employment tax savings) is irrelevant for rental income, which is generally not subject to self-employment tax. Furthermore, the strict ownership rules of an S-Corp can complicate estate planning for property holdings.

Q4: I’m a single-member LLC. Do I need an EIN and a separate business bank account?

You need an Employer Identification Number (EIN) from the IRS if you have employees or if your LLC has more than one member. Even as a single-member LLC without employees, getting an EIN is highly recommended to avoid using your Social Security Number for business purposes. A separate business bank account is non-negotiable. It is critical for maintaining that “corporate veil” of liability protection. Commingling personal and business funds can pierce the veil, making you personally liable.

Q5: Can my business have investors if it’s an LLC?

Yes, but there can be limitations. You can bring on new members by amending your Operating Agreement and issuing membership units. However, venture capital firms and institutional investors almost universally prefer to invest in C-Corporations due to their familiar structure, ability to issue preferred stock, and clearer legal precedents. If you plan to seek significant venture capital, starting as or converting to a C-Corp is often necessary.

Q6: What happens if I don’t choose a formal business structure?

If you start doing business without filing any paperwork, the default is a Sole Proprietorship (one owner) or a General Partnership (multiple owners). This offers no personal liability protection and uses your Social Security Number for tax purposes. It is the riskiest way to operate a business.

Q7: Are there state-level tax differences between an LLC and an S-Corp?

Yes, and this is a critical point to discuss with your CPA. Some states (like California) impose a minimum franchise tax on both LLCs and S-Corps, but the amount can differ. A few states (like New York) have a state-level income tax that applies to S-Corps. Texas has a franchise tax that applies to both but with different calculations. Always check your specific state’s tax laws.