Introduction – U.S. Risk Control: Why It Matters Now

Are U.S. investors doing enough to mitigate market volatility through effective Risk Control? With uncertainty persisting through 2025, 60% of American investors are more concerned than ever—especially those nearing retirement Gallup.com. This article unpacks:

- Why Risk Control is vital in volatile markets

- Real strategies U.S. investors use (and miss)

- Voices of authority, stats, quotes

- FAQs, external links to top-tier content

- Key takeaways to make smarter moves

Let’s dive in—with clarity, cadence, and conviction.

1. U.S. Risk Control: Understanding the Stakes

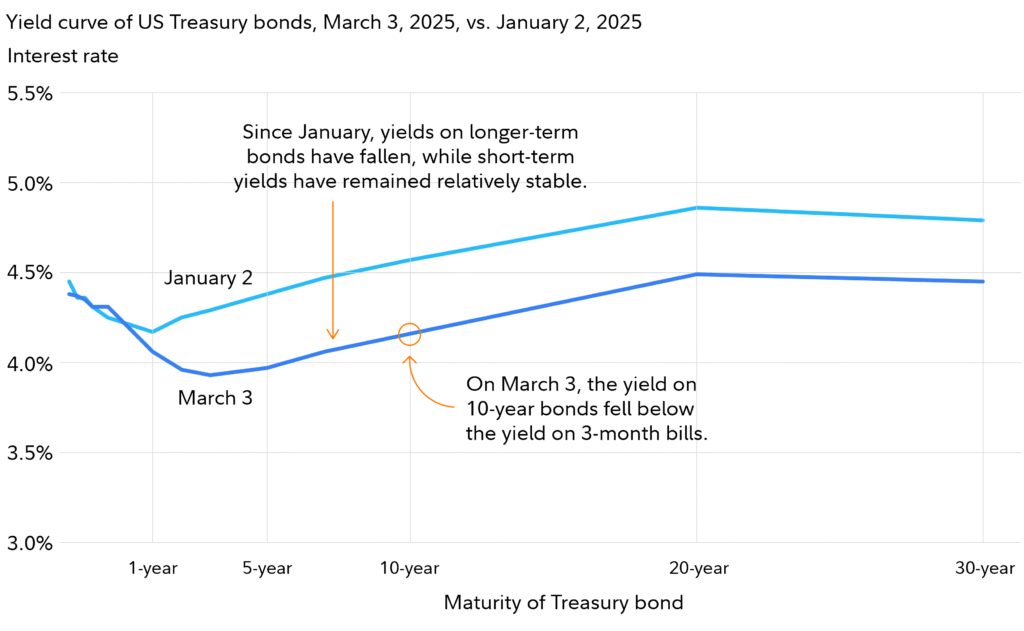

Market volatility isn’t new—but it’s tricky. BlackRock reminds us volatility has been a constant across crises: 1987, 2008, 2020—and often markets bounce hard afterward. Meanwhile, Vanguard says not all volatility is created equal—some arise from cyclical shifts rather than existential shock—and may last weeks or months Vanguard. In mid‑2025, the bond market’s volatility index (MOVE Index) jumped 5% in one day—its biggest surge in months Barron’s.

In short: volatility will recur. And U.S. investors need solid Risk Control to stay grounded.

2. U.S. Risk Control: Strategies Investors Are Using Now

Buffer ETFs: Defined‑Outcome Vehicles

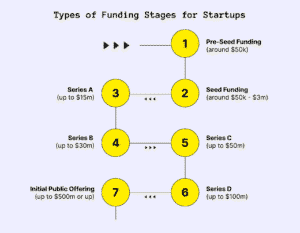

Americans are flocking to buffer ETFs—which cap downside (and upside) using options overlays. Inflows soared to $2.5B in a recent month; total assets nearly doubled from $38B in 2023 to $64B by February 2025 Reuters. There are now ~350 buffer ETFs with $70B in assets—Goldman Sachs and ARK are entering too .These tools offer Risk Control but come with complexity and limits.

Diversification & Asset Allocation

Diversifying across stocks, bonds, alternatives remains a core tactic. Russell Investments emphasizes dynamic asset allocation and diversification to manage downside. Hartford Funds highlights diversifying via fixed income, international equities, and dividend stocks. UBS also advises staying invested with a diversified mix, while remaining disciplined .

Liquid Alternatives (Liquid Alts)

When correlations rise across traditional markets, liquid alternative strategies provide quick diversification, hedging, and volatility buffering—especially in fixed income

Dollar‑Cost Averaging (DCA) & SIPs

Systematic investment helps smooth volatility. In the U.S., dollar-cost averaging is popular via ETFs, and SIPs (common in India) operate similarly. Staying the course avoids costly timing errors. Even financial advisors abroad recommend continuing SIPs through 2025 volatility .

Emotional Resilience (“50% Rule”)

Charlie Munger famously reminded: a serious U.S. investor must endure a 50% drop to earn outsized gains. Many panic-sell and miss the bounce Investopedia.

Stable Value Funds for Retirement Savers

Available in 401(k)s, these funds preserve capital and deliver steady returns via “wrap” contracts—offering low volatility and returns around 3–5% in crisis years.

Risk Parity & Modern Portfolio Theory (MPT)

Risk parity allocates by volatility, not capital, aiming at equal risk contributions; it’s more resilient in downturns. MPT supports diversification by mixing uncorrelated assets to reduce portfolio risk.

3. U.S. Risk Control: Famous Names & Quotes

- Charlie Munger (“50% Drop Rule”): “must be prepared to endure a 50% decline… to achieve exceptional long‑term gains”.

- Mark Twain (via BlackRock): “History doesn’t repeat itself, but it often rhymes” — reminding U.S. investors volatility is rhythmic, not random BlackRock.

- Jim Caron, Morgan Stanley CIO: “Volatility will be an ongoing market feature, such that controlling for risk becomes critical” Morgan Stanley.

4. U.S. Risk Control: FAQs

Q1: What’s a buffer ETF?

A defined‑outcome ETF that uses options to limit losses (and gains). Widely used for volatility hedging in 2025 Reuters.

Q2: Do U.S. investors panic or stay invested?

60% express concern; 73% expect volatility to continue through 2025—yet many still see stocks as key retirement tools.

Q3: Is diversification enough?

Yes—but must be dynamic. Combine stocks, bonds, buffer strategies, liquid alts. Oversimplified models may underperform.

Q4: Will volatility go away soon?

Unlikely. Bond-market volatility rebounded June 2025 after a lull Barron’s. Experts warn seasonal trends may spike turbulence in fall.

Q5: What’s the best risk-control mix?

There’s no one-size-fits-all. Younger investors may lean moderate equity, buffer ETFs, DCA; nearing retirees may favor stable value funds, bonds, and emotional discipline.

5. U.S. Risk Control: External High-End Links

- BlackRock – Navigating Volatility: historical insights and investor behavior lessons BlackRock

- Russell Investments – Managing Market Volatility: dynamic allocation and long-term perspective

- J.P. Morgan – Diversifying During Volatility: liquid alts and tactical hedging J.P. Morgan

(These are authoritative, well‑made, investor‑focused examples.)

6. U.S. Risk Control: Stats & Trends at a Glance

| Statistic | Description |

|---|---|

| 60% | U.S. investors concerned about volatility |

| 73% | Expect volatility to persist through 2025 |

| $2.5B/month, $64B total | Buffer ETF inflows/assets in early 2025 |

| ~350 funds, $70B | Buffer ETF growth total |

| 5% daily jump | MOVE bond‑volatility index biggest one‑day gain |

7. Key Takeaways

- Volatility is inevitable—U.S. investors need proactive Risk Control, not reactive panic.

- Buffer ETFs are trending—but understand caps, costs, complexity.

- Diversification + tactics win—dynamic rebalancing, fixed income, liquid alts, DCA.

- Emotional discipline matters—the “50% Rule” is as much mental as financial.

- Know your horizon—strategies should align with your retirement timeline and temperament.