Introduction

In today’s fast-changing economy, relying on a single income stream is increasingly risky. Inflation, housing costs, and economic uncertainty have pushed millions of Americans toward diversifying their earnings.

According to a MarketWatch–Times report, about 5.4% of the U.S. workforce—nearly 8.8 million people—now hold multiple jobs, up from 7.8 million in 2019. And 51% of adults have a side hustle, including 72% of Gen Z and 62% of millennials

This post explores how to build and balance multiple income streams—from active side hustles to passive investments—for stability, growth, and future freedom.

Table of Contents

- Why Multiple Income Streams Matter

- Types of Income Streams

- Active Side Hustles

- Passive Income Sources

- Strategies to Build Each Income Stream

- Real-Life Examples & Famous Insights

- Stats You Should Know (2025)

- Key Takeaways

- FAQs

- External Resources

1. Why Multiple Income Streams Matter

Relying solely on a paycheck comes with mounting risks:

- Economic shifts: A projected 60% chance of recession in 2025 has many Americans preparing now

- Wage stagnation: Nearly 39% hold side gigs just to meet basic needs—57% in NY alone

- Gig economy growth: Over 36% of U.S. adults now supplement income through side hustles—averaging roughly $530/month

Diversification helps:

- Reduce risk when traditional jobs falter

- Accelerate debt payoff and savings

- Provide flexibility to explore passions

2. Types of Income Streams

A. Active Side Hustles

These require ongoing effort but often stem from your skills:

- Freelance writing, design, tutoring

- Delivery driving (Uber, DoorDash)

- Reselling goods online (Etsy, eBay)

- Social media monetization

B. Passive Income Sources

Build once, benefit continuously:

- Investing (dividends, interest)

- Real estate rentals

- Digital products (e-books, courses)

- Royalties (music, artwork, licensing)

3. Strategies to Build Each Income Stream

A. Choose the Right Fit

- Align side hustles with your skills. A writer could easily freelance; a design-savvy person could sell printables for $9,500/month

B. Start Small, Scale Smart

- Begin part-time, reinvest profits to scale up.

C. Automate and Outsource

- Use apps for bookkeeping, marketing, and fulfillment.

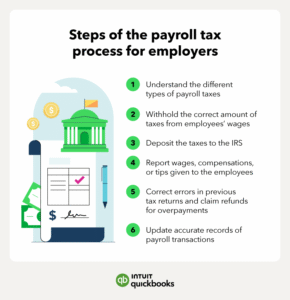

D. Protect Earnings

- Track income, pay estimated taxes, and consider forming an LLC for side businesses.

E. Reinvest Wisely

- Channel profits into passive income—stocks, real estate, platforms like Upwork or Airbnb.

4. Real-Life Examples & Famous Insights

- Graham Stephan, a real estate investor/YouTuber, diversified into rentals, YouTube, and AI consulting—earning millions by 2025

- Flau’jae Johnson, LSU basketball talent, leveraged NIL deals and real estate rentals to build passive income streams

Quotes to inspire you:

“Never depend on a single income.” — Warren Buffett

“The key to financial freedom … is to convert earned income into passive income.” — Robert Kiyosaki

“If you don’t find a way to make money while you sleep, you will work until you die.” — Warren Buffett

5. Stats You Should Know (2025)

- 39% of Americans now have a side hustle (≈80 M people), with 50% of millennials participating

- Global gig market valued at $556 B in 2024; projected to triple by 2033

- Side hustle earnings:

- Gen Z: $968/month

- Millennials: $1,029/month

- Gen X: $512/month

- Boomers: $918/month

6. Key Takeaways

- Diversify: Spread earnings across active and passive income streams.

- Protection first: Track taxes and shield assets legally.

- Start lean: Begin with one stream, then scale.

- Reinvest for growth: Profits should feed future ventures.

- Use data: Monitor income trends monthly to stay agile.

7. FAQs

Q1: How many income streams should I have?

Aim for 3–5: one main job, a skill-based side hustle, and one or two passive streams.

Q2: What’s better: active or passive income?

Both have roles. Active income fuels growth; passive income builds long-term freedom.

Q3: Do side hustles pay taxes?

Yes. Use tax apps or consult a CPA. Consider forming an LLC for protection.

Q4: Can I build passive income with less than $1k?

Absolutely: start with an e-book, digital course, or a micro-investment platform.

8. Trusted Further Reading

- Bankrate: “25 Passive Income Ideas To Make Extra Money in 2025”

- MarketWatch: “Gen Z thinks it needs $500k/year to succeed”

- Wikipedia – FIRE movement: Principles for early retirement

- Times/The Telegraph: “Even America’s elite professions… side hustles”

Final Thoughts

By 2025, multiple income streams are no longer optional—they’re essential. With strategic planning, disciplined investing, and smart diversification, you can build a resilient financial foundation and earn the freedom to shape your future.