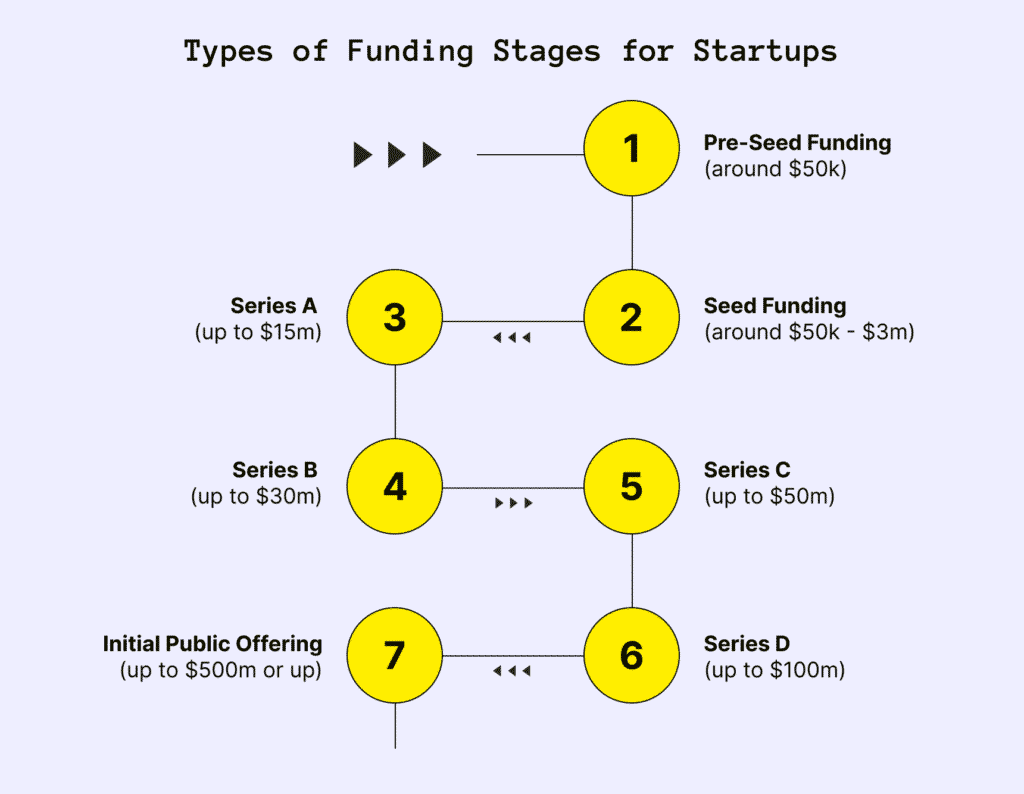

The journey of a startup from a nascent idea to a publicly-traded company is one of the most thrilling and complex narratives in modern business. It’s a path paved with innovation, relentless execution, and, crucially, capital. For entrepreneurs and aspiring founders, understanding the mechanics, terminology, and strategic implications of startup funding rounds is not just beneficial—it’s essential for survival and success.

This guide provides a detailed, authoritative roadmap through the labyrinth of startup financing in the United States. We will demystify each stage of funding, from the initial pre-seed check to the monumental Initial Public Offering (IPO), explaining the players involved, the key documents exchanged, and the strategic shifts a company must undergo at each phase. Our goal is to equip you with the knowledge to navigate this journey with confidence and clarity.

The Foundation: Pre-Seed Funding

Before the official “rounds” begin, there is the genesis of it all: the pre-seed stage.

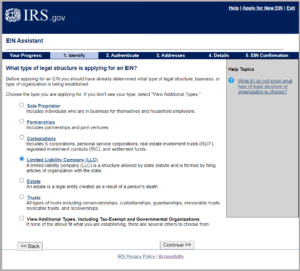

What it is: Pre-seed funding is the earliest capital raised by a startup. This stage is primarily about transforming an idea into a tangible entity. The funds are typically used for market research, building a prototype or Minimum Viable Product (MVP), incorporating the company, and covering the initial operational costs of the founding team.

Typical Funding Amount: $10,000 – $250,000.

Key Investors:

- Founders, Friends, and Family (FFF): The most common source, often driven by belief in the founder rather than a rigorous analysis of the business.

- Angel Investors: High-net-worth individuals who provide capital in exchange for equity. At this stage, they are often investing in the team and the vision.

- Startup Accelerators & Incubators: Programs like Y Combinator, Techstars, and 500 Startups provide small amounts of capital (usually in exchange for 5-10% equity) alongside mentorship, workspace, and a demo day to pitch to later-stage investors.

The “Why”: The pre-seed round is about proving feasibility. It answers the question: “Can we build a basic version of our product, and is there any initial user interest?”

Key Considerations: Valuations at this stage are often informal and can be based on the “post-money” or “safe note” method (explained later). The cap table is simple, but it’s crucial to set it up correctly from the start.

Round 1: Seed Funding – Planting the Future

The seed round is the first official equity funding stage. The metaphor is apt: you are planting the seed that, with the right resources, will grow into a thriving business.

What it is: This round is all about product-market fit and initial user growth. The capital from a seed round is used to finalize product development, launch the product to a broader market, hire the first key employees (e.g., first engineers, a Head of Marketing), and generate early traction metrics.

Typical Funding Amount: $500,000 – $2 million.

Key Investors:

- Angel Investors (Syndicates): Individual angels or groups banding together via platforms like AngelList.

- Venture Capital Firms (Micro-VCs & Seed Funds): Firms that specialize in early-stage investments, such as First Round Capital, Sequoia Capital’s Scout program, or numerous sector-specific micro-VCs.

- Equity Crowdfunding: Platforms like StartEngine and Wefunder allow a large number of small investors to contribute capital in exchange for equity.

The “Why”: The core objective of the seed round is to achieve a demonstrable product-market fit. This means showing evidence that a significant number of customers are not just trying your product but are actively using it, paying for it, and referring others.

Key Instruments:

- SAFE (Simple Agreement for Future Equity): Popularized by Y Combinator, a SAFE is not a debt instrument; it’s a warrant to purchase stock in a future priced round. It’s designed to be simpler and faster than a convertible note. Key terms include the Valuation Cap (the maximum valuation at which the SAFE converts) and the Discount (a percentage discount investors get compared to the next round’s price).

- Convertible Note: A short-term debt instrument that converts into equity upon a specific trigger event, usually the next funding round. It includes an interest rate and the same valuation cap and discount features as a SAFE.

- Priced Round (Less Common): The company and investors directly agree on a valuation and the investors purchase preferred stock. This is more complex and expensive but sets a clear valuation.

Post-Seed Reality: A successful seed round should set the company up for 12-18 months of runway. The goal is to use this time to generate data and traction compelling enough to attract a Series A investor.

Round 2: Series A Funding – Scaling the Engine

If the seed round is about finding product-market fit, the Series A is about building a repeatable and scalable business model. It’s the transition from a promising project to a bona fide company.

What it is: Series A funding is for startups that have moved beyond initial traction and have a clear plan for growth. The capital is used to optimize the user acquisition funnel, scale the team significantly (especially in sales, marketing, and engineering leadership), and aggressively expand market reach.

Typical Funding Amount: $2 million – $15 million.

Key Investors:

- Venture Capital Firms (Traditional VCs): This is the primary domain of established VC firms like Andreessen Horowitz, Benchmark, and Greylock Partners. They lead the round (“lead investor”) and set the terms. Other VCs often co-invest.

- Angel Investors (Super Angels): Only the most prominent and well-connected angels participate at this stage.

The “Why”: Investors in a Series A are betting on the team’s ability to execute a scalable growth strategy. They are looking for strong, quantifiable metrics: Month-over-Month (MoM) revenue growth, low customer churn, high Lifetime Value (LTV) to Customer Acquisition Cost (CAC) ratios, and a clear path to market leadership.

Key Instruments:

- Priced Round with Preferred Stock: Series A is almost always a priced round. Investors purchase Series A Preferred Stock, which comes with specific rights and protections, such as:

- Liquidation Preference: Ensures investors get their money back (often 1x, sometimes more) before common stockholders (founders and employees) in the event of a sale or liquidation.

- Pro-rata Rights: The right to maintain their percentage ownership in future rounds.

- Board of Directors Seat(s): The lead investor will typically take a seat on the company’s board, bringing strategic oversight.

Post-Series A Reality: The company must now operate with a new level of rigor. It’s no longer just about building a great product; it’s about building a great business. This often involves implementing formal processes, KPIs, and a more structured management hierarchy.

Round 3: Series B Funding – Scaling the Business

With a proven model for growth, Series B is about taking the successful engine built in Series A and fueling it for hyper-growth and market expansion.

What it is: Companies at this stage have found their groove and are looking to dominate their market. Funding is used to scale marketing and sales efforts exponentially, expand into new geographies, acquire complementary businesses, and invest heavily in technology and infrastructure to support the growing user base.

Typical Funding Amount: $10 million – $50 million.

Key Investors:

- Venture Capital Firms (Later-Stage VCs): Many of the same firms from Series A may participate, but they are often joined by larger, later-stage VC firms and growth equity funds that specialize in scaling companies.

- Corporate Venture Arms (CVCs): Investment divisions of large corporations (e.g., Google Ventures, Salesforce Ventures) often come in at this stage for strategic alignment.

- Hedge Funds & Private Equity: Some crossover investors may begin to appear.

The “Why”: The narrative shifts from “can we grow?” to “how fast can we capture the entire market?” Investors are looking for a strong, defensible market position, a formidable management team, and a clear line of sight to becoming a category leader.

Key Instruments: The structure is similar to Series A (Preferred Stock) but often with more complex terms as the stakes are higher. The valuation is a critical point of negotiation, reflecting the company’s proven performance and future potential.

Round 4: Series C and Beyond – Scaling to Dominance

Not every company progresses to Series C, D, E, etc. These later stages are for the elite group of startups poised for market dominance, a major acquisition, or an IPO.

What it is: Capital at this stage is used for aggressive market penetration, including international expansion, major acquisitions of competitors or adjacent technologies, and developing new product lines. It’s about solidifying the company’s position as a global leader.

Typical Funding Amount: $30 million – $100+ million.

Key Investors:

- Private Equity Firms

- Hedge Funds

- Investment Banks

- Large Secondary Market Funds

- Existing VCs continuing to support the company.

The “Why”: The goal is to prepare the company for a major liquidity event—either an IPO or a significant acquisition. This funding provides the “war chest” needed to fend off competitors and make bold strategic moves before entering the public markets.

Key Considerations: At this stage, the company is often “de-risked” compared to its earlier days. The focus for investors is on financial engineering, global strategy, and the precise path to a public offering.

Read more: LLC vs. S-Corp: A Beginner’s Guide to Choosing Your US Business Structure

The Grand Finale: Initial Public Offering (IPO)

An Initial Public Offering (IPO) is the process by which a private company offers its shares to the public for the first time on a stock exchange like the NASDAQ or NYSE. It is the ultimate liquidity event for early investors and a significant milestone for employees.

What it is: The IPO is a rigorous, highly regulated process managed by investment banks (underwriters). It involves intense financial scrutiny, legal compliance (per the SEC), and a multi-week “roadshow” where company management pitches the investment story to institutional investors.

The “Why”:

- Liquidity: Provides an exit for early investors, founders, and employees (whose stock options can now be sold).

- Capital Raise: Accesses a vast pool of public market capital to fund further growth, acquisitions, or pay down debt.

- Brand Prestige & Credibility: Being a public company enhances brand recognition and can help in business development and talent acquisition.

- Currency for Acquisitions: Public stock can be used as a valuable currency to acquire other companies.

Key Steps in the IPO Process:

- Selection of Underwriters: Hiring investment banks to manage the offering.

- Due Diligence & Financial Auditing: A deep, independent audit of all company financials and operations.

- Drafting the S-1 Registration Statement: This comprehensive document, filed with the SEC, discloses everything about the company’s business model, financials, risks, and management. It becomes publicly available.

- The Roadshow: Management presents to potential investors across the country to generate demand and set the initial share price.

- Pricing & Going Public: The company and underwriters set a final offer price based on investor demand, and shares begin trading on the open market.

Post-IPO Life: The company enters a new world of quarterly earnings reports, shareholder meetings, increased regulatory oversight (SOX compliance), and constant pressure from public market investors to meet growth and profitability targets.

Alternative Paths: SPACs and Acquisitions

While an IPO is the traditional path, it’s not the only one.

- SPAC (Special Purpose Acquisition Company): Also known as a “blank check company,” a SPAC is a shell company that raises money through an IPO with the sole purpose of acquiring a private company. The private company then merges with the SPAC and becomes publicly listed. This can be a faster, less volatile path to going public than a traditional IPO, though it has faced increased regulatory scrutiny.

- Acquisition: Many successful startups are acquired by larger companies before they ever reach an IPO. This provides immediate liquidity and can be a strategic move to integrate the startup’s technology or team into a larger platform (e.g., Facebook’s acquisition of Instagram, Google’s acquisition of YouTube).

Conclusion: The Funding Journey as a Metamorphosis

The progression from pre-seed to IPO is not merely a series of financial transactions; it is the story of a company’s metamorphosis. With each round, the startup sheds its old skin, taking on new structures, responsibilities, and ambitions. The founder’s role evolves from a hands-on visionary to a CEO steering a complex organization under the watchful eyes of investors and, eventually, the public.

Understanding this roadmap is the first step. Successfully navigating it requires not just a brilliant idea, but relentless execution, strategic clarity, and the ability to build a team and a story that inspires others to invest—not just their capital, but their trust.

Read more: How to Write a Business Plan That Actually Gets Funded in the USA

Frequently Asked Questions (FAQ)

Q1: What is a valuation cap on a SAFE or Convertible Note?

A: A valuation cap is the maximum effective valuation at which your investment will convert into equity in a future priced round. It’s a protection for early investors. For example, if you invest via a SAFE with a $5M cap and the company later raises a Series A at a $10M valuation, your investment will convert as if the company was valued at $5M, giving you more shares for your money.

Q2: What’s the difference between a “pre-money” and “post-money” valuation?

A: Pre-money valuation is the company’s value immediately before the new investment. Post-money valuation is the value immediately after the investment, calculated as: Pre-money Valuation + Amount Raised. If a company has a $9M pre-money valuation and raises $1M, the post-money valuation is $10M. The new investors would own 10% ($1M / $10M). It’s critical to know which valuation is being discussed in term sheets.

Q3: How much equity do founders typically give up in each round?

A: There’s no fixed rule, but a common pattern is:

- Seed Round: 10-20%

- Series A: 15-25%

- Subsequent Rounds: 10-15% each

By the IPO, founders who began with 100% may collectively own 10-25% of the company, having diluted their ownership to bring in capital and talent that multiplied the company’s overall value.

Q4: What is a “down round”?

A: A down round occurs when a company raises a new funding round at a lower valuation than its previous round. It’s highly undesirable as it significantly dilutes the ownership of existing shareholders (including founders and employees) and can be a signal of company struggles. It can also trigger “anti-dilution” protections for earlier investors.

Q5: What are the key things investors look for beyond the idea?

A: Investors often prioritize:

- The Team: Do the founders have the expertise, resilience, and execution capability to build this?

- Traction: What does the data say? (User growth, revenue, engagement).

- Total Addressable Market (TAM): Is the market opportunity large enough to generate a venture-scale return (typically 10x+)?

- Product-Market Fit: Is there evidence that customers love and need the product?

- A Defensible Moat: What prevents competitors from easily copying you? (e.g., technology, network effects, brand).

Q6: When is a startup ready for an IPO?

A: While there’s no single metric, a company is generally considered IPO-ready when it has:

- Consistent, strong revenue growth (often $100M+ ARR for SaaS companies).

- A predictable and scalable financial model.

- A large and growing market.

- A seasoned management team with public company experience.

- Robust financial controls and governance in place.

- A compelling “public company narrative” that will resonate with investors for the long term.