The gig economy. The side hustle. The passion project. These aren’t just trendy buzzwords; they are the modern incarnation of the American entrepreneurial spirit. What starts as a few extra dollars earned on Etsy, a handful of freelance clients, or a local service offered on weekends has the potential to blossom into a self-sustaining, thriving enterprise.

But the chasm between a profitable side project and a full-time, scalable business is vast. Crossing it requires more than just hard work; it demands a strategic shift in mindset, operations, and marketing. The American market, while incredibly lucrative, is also fiercely competitive and complex. Success here isn’t accidental—it’s engineered.

This guide is your blueprint. We will walk through the critical stages of scaling your side hustle into a dominant force in the American marketplace. Drawing on established business principles and real-world scalability tactics, this article is designed to provide you with the expertise, actionable steps, and strategic framework needed to make your entrepreneurial dream a sustainable reality.

Part 1: The Foundation – Proving Your Concept and Preparing for Scale

Before you can scale, you must have something worth scaling. The initial phase is all about validation, refinement, and laying a rock-solid foundation.

1.1 Validating Your Side Hustle: Is It Ready for Prime Time?

A side hustle that brings in $500 a month is a wonderful thing. But not every successful side project is meant to be a full-time business. Ask yourself these critical questions:

- Product-Market Fit: Are people actively seeking and paying for your product or service? Or are you convincing them to buy? True product-market fit is when demand feels organic and repeatable.

- Profitability, Not Just Revenue: Are you actually making a profit after accounting for all your costs—materials, time, software subscriptions, transaction fees, and taxes? A high revenue number is meaningless if your margins are razor-thin.

- Scalable Demand: Is the market large enough to support your growth ambitions? A business servicing a hyper-niche market in one city may not have the addressable market to scale nationally without significant pivots.

- Repeatability: Can your process be systemized and taught to others? If your business relies entirely on your unique, irreplicable skill for every single order, scaling will be nearly impossible.

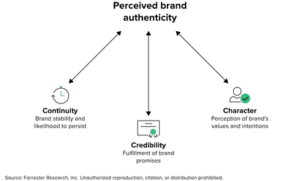

1.2 Defining Your Brand and Unique Value Proposition (UVP)

In a crowded market, being “good” isn’t good enough. You must be distinct. Your Unique Value Proposition (UVP) is a clear statement that describes the benefit of your offer, how you solve your customer’s needs, and what distinguishes you from the competition.

- Who is your target customer? Get specific. Instead of “women,” think “career-driven women aged 28-45 in urban areas who value sustainable, ethically-made accessories.”

- What problem do you solve? Are you saving them time? Making them feel more confident? Providing a unique, handcrafted solution they can’t find on Amazon?

- Why should they choose you? Is it your quality, your story, your customer service, your design aesthetic? Your UVP should be the cornerstone of all your messaging.

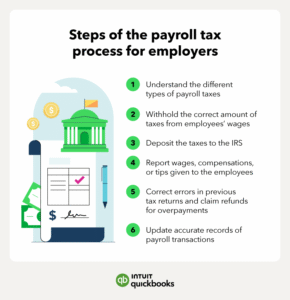

1.3 Getting Your Financial House in Order

Financial chaos is the number one killer of young businesses. Before you take the leap, you must have absolute clarity on your numbers.

- Open a Separate Business Bank Account: This is non-negotiable. Commingling personal and business finances is a recipe for disaster, both for tracking and legal protection.

- Understand Your Unit Economics: Know your Cost of Goods Sold (COGS) for every unit you sell. This includes materials, labor, and shipping. Your price must be significantly higher than your COGS.

- Create a Runway: Calculate your personal monthly living expenses. How much capital do you need to survive for 6-12 months without a stable salary? This is your financial runway. Do not quit your day job until you have this saved, or your business is already generating enough profit to cover it.

- Establish a Business Structure: As a side hustle, operating as a Sole Proprietorship is common. For a scaling business, forming a Limited Liability Company (LLC) or S-Corp is highly advisable. This protects your personal assets (like your home and savings) from business debts and lawsuits. Consult with a small business attorney or accountant to choose the right structure for you.

Part 2: The Strategic Shift – From Hustler to CEO

Quitting your day job is a psychological and operational milestone. You are no longer a hobbyist; you are the CEO of your own company. This requires a fundamental shift in how you work.

2.1 Crafting a Formal Business Plan

A business plan is not just for securing loans; it’s your strategic roadmap. It forces you to think through challenges and opportunities you haven’t yet faced.

- Executive Summary: A snapshot of your business and goals.

- Market Analysis: Deep dive into your industry, target market, and competitors.

- Marketing and Sales Strategy: How you will attract and retain customers.

- Operations Plan: How you will produce and deliver your product/service.

- Financial Projections: Detailed Profit & Loss, Cash Flow, and Balance Sheet forecasts for the next 3-5 years.

2.2 Building Your Digital Foundation: The Trifecta

In the American market, your online presence is your storefront. It must be professional, trustworthy, and functional.

- A Professional Website: Your website is your 24/7 salesperson. It must be clean, easy to navigate, and mobile-responsive. Use a platform like Shopify (for e-commerce), Squarespace, or WordPress. Include an “About Us” page that tells your story—this builds connection and trust.

- SEO (Search Engine Optimization): You need to be found when people search for what you offer. Conduct keyword research to understand what terms your potential customers are using, and optimize your website content, product descriptions, and blog posts around those terms. Local SEO is critical for service-based businesses.

- An Email List: Social media platforms come and go, but your email list is your owned digital real estate. Use a provider like ConvertKit, Mailchimp, or Klaviyo to offer a lead magnet (e.g., a discount code, a helpful guide) in exchange for an email address. This is your most direct and powerful marketing channel.

2.3 Systems and Processes: The Engine of Scale

If you have to “figure it out” every time you get an order, you will never scale. You must document and systemize everything.

- Customer Onboarding: What is the step-by-step process from the moment a lead says “yes”?

- Order Fulfillment: How is an order processed, packaged, and shipped? What are the quality control checkpoints?

- Customer Service: Create templates for common inquiries (shipping status, return requests). This saves time and ensures a consistent brand voice.

- Social Media Management: Use a scheduling tool like Buffer, Hootsuite, or Later to plan your content in batches.

Part 3: Mastering the American Market – Marketing and Sales Funnels

You have a great product and a solid foundation. Now, you need a predictable stream of customers.

3.1 Content Marketing: Becoming an Authority

Don’t just sell; provide value. Create content that educates, entertains, or inspires your target audience.

- Blog Posts: Write articles that answer common questions your customers have. A financial planner could write “5 Tax Tips for Freelancers.” A baker could write “How to Choose the Perfect Wedding Cake.”

- Video Content: Use YouTube, TikTok, and Instagram Reels to show behind-the-scenes processes, tutorials, or to simply humanize your brand.

- Podcasting or Webinars: Establish deep expertise by hosting a podcast or educational webinars on topics relevant to your industry.

3.2 Strategic Social Media Marketing

Be strategic, not just present. Don’t try to be on every platform. Focus on 1-2 where your ideal customers spend their time.

- Instagram/Facebook: Ideal for visually appealing products, personal brands, and B2C services. Use Stories and Reels for engagement and the main feed for aesthetics.

- LinkedIn: The premier platform for B2B services, consulting, and professional networking.

- TikTok: Excellent for reaching a younger demographic with authentic, viral-style content.

- Pinterest: A powerful visual search engine for niches like home decor, fashion, food, and wedding planning.

3.3 Paid Advertising: Accelerating Growth

Organic growth is essential, but paid ads can provide a powerful accelerator once you have a proven product and conversion funnel.

- Meta Ads (Facebook/Instagram): Unparalleled for its targeting capabilities. You can target users by demographics, interests, and even behaviors.

- Google Ads: Capture intent-driven traffic. When someone searches for “handmade leather wallet,” a Google Ad can place you at the top of the results.

- Start Small and Test: Begin with a small daily budget ($5-$10). Run A/B tests on your ad copy, images, and audience targeting to see what resonates. Double down on what works.

3.4 Networking and Partnerships

The American business landscape runs on relationships.

- Local Chambers of Commerce: Great for local service-based businesses.

- Industry Associations and Conferences: Connect with peers, suppliers, and potential partners.

- Strategic Collaborations: Partner with a non-competing business that shares your target audience. Co-host a webinar, run a joint giveaway, or create a bundled product offering.

Part 4: Scaling Operations – Meeting Demand Without Breaking

Growth strains systems. What worked for 10 customers a week will collapse under 100. It’s time to build an infrastructure that can handle volume.

4.1 Outsourcing and Delegation: The Key to Leverage

You cannot do it all. The transition from solopreneur to CEO involves letting go of tasks that others can do better or more cheaply.

- Start with the “Low-Hanging Fruit”: Delegate tasks that are time-consuming, repetitive, or outside your zone of genius. This could be:

- Virtual Assistant (VA): For email management, scheduling, and customer service.

- Bookkeeper/Accountant: To manage invoices, payables, and taxes.

- Social Media Manager: To create and schedule content.

- Fulfillment Center/3PL (Third-Party Logistics): To store, pack, and ship your products.

Read more: How to Protect Your Identity and Data Online: Essential Security Tips for 2024

4.2 Automating for Efficiency

Use technology to do the work for you.

- CRM (Customer Relationship Management): Tools like HoneyBook, Dubsado, or HubSpot automate client communication, invoicing, and proposal sending.

- Project Management: Asana, Trello, or ClickUp keep you and any team members on track with projects and deadlines.

- Accounting Software: QuickBooks or Xero automate expense tracking, invoicing, and financial reporting.

4.3 Financial Management at Scale

As revenue grows, so does financial complexity.

- Reinvest Profits Wisely: Don’t take all the profit out of the business. Strategically reinvest in new equipment, inventory, marketing, or key hires.

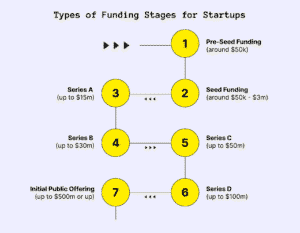

- Secure Funding (If Necessary): If you need capital to fund inventory or a major expansion, explore options like SBA loans, business lines of credit, or in some cases, venture capital or angel investors.

- Work with a CPA: A good Certified Public Accountant (CPA) is worth their weight in gold. They will help you with tax strategy, financial planning, and ensuring compliance.

Part 5: The Long Game – Sustaining Growth and Building a Legacy

Scaling isn’t a one-time event; it’s a continuous process. To build a lasting business, you must look beyond the initial growth spike.

5.1 Cultivating a Company Culture (Even as a Team of One)

Culture is the personality of your business. It’s defined by your values, how you treat customers, and how you operate. Even if you’re a solo entrepreneur, establishing a clear culture will guide your decisions and attract the right customers and future team members.

5.2 Prioritizing Customer Retention

Acquiring a new customer is 5-25x more expensive than retaining an existing one. A loyal customer base provides stable, predictable revenue.

- Loyalty Programs: Reward repeat purchases.

- Exceptional Customer Service: Go above and beyond. Surprise and delight your customers.

- Email Nurturing Sequences: Stay in touch with past customers, update them on new products, and offer exclusive content.

5.3 Continuous Innovation and Adaptation

Markets change. Customer preferences evolve. The businesses that last are those that adapt.

- Gather and Act on Feedback: Regularly survey your customers. What do they love? What could be improved?

- Monitor Industry Trends: Stay informed about new technologies, competitors, and shifting consumer behaviors.

- Pivot When Necessary: Be willing to change your product, service, or model if the data and feedback suggest a better path.

Conclusion: Your Journey Awaits

The path from side hustle to full-time enterprise is a challenging yet immensely rewarding journey. It’s a test of resilience, strategic thinking, and execution. There will be setbacks and moments of doubt, but by following a structured approach—validating your idea, building a strong foundation, mastering marketing, and scaling your operations—you dramatically increase your odds of success.

The American market is vast and full of opportunity for those who are prepared. Stop thinking like a hustler and start building like a CEO. Your business isn’t just a source of income; it’s an asset you are building and a legacy you are creating. Now is the time to take the lessons, strategies, and frameworks from this guide and put them into action. Your full-time future awaits.

Read more: How to Cut the Cable Cord: A Beginner’s Guide to Streaming TV in the USA

Frequently Asked Questions (FAQ)

Q1: How much money should I have saved before I quit my job to focus on my business full-time?

A: The general rule of thumb is to have a financial runway of 6 to 12 months of your personal living expenses saved. This does not include business expenses. This safety net allows you to focus on growing your business without the immediate pressure of drawing a large salary, reducing financial stress and enabling better decision-making.

Q2: What is the single most important legal step I need to take when scaling?

A: Forming a Limited Liability Company (LLC) is arguably the most critical early legal step. It creates a legal separation between you and your business, protecting your personal assets (like your home, car, and personal bank accounts) from business debts and lawsuits. Sole Proprietorships do not offer this protection.

Q3: I’m overwhelmed by all the marketing options. Where should I start?

A: Start with the channel where your ideal customers are most likely to be and where you can best showcase your value. For most visual or B2C businesses, this is Instagram or Facebook. For B2B or professional services, it’s LinkedIn. Master one platform before adding another. The most foundational and important marketing asset, however, is your email list.

Q4: When is the right time to hire my first employee or contractor?

A: The right time is when you have a repeatable, systemized task that is taking up too much of your time and preventing you from working on high-value, revenue-generating activities (like strategy, sales, and product development). If you can pay someone else to do a task for less than what your time is worth, it’s time to delegate.

Q5: How can I differentiate my business in a saturated market?

A: Compete on something other than price. Your differentiator could be:

- Superior Customer Service: Offer a white-glove, personalized experience.

- A Compelling Brand Story: Why did you start this business? What do you stand for?

- Niche Specialization: Become the absolute best in one very specific area.

- Unique Product Features or Quality: Use higher-quality materials or offer a unique design.

Q6: What are the most common financial mistakes new business owners make?

A: The top three are:

- Commingling Personal and Business Finances: This makes accounting a nightmare and pierces the corporate veil of an LLC.

- Not Understanding Profit vs. Revenue: Mistaking a high top-line revenue number for actual profitability.

- Underestimating Tax Obligations: Not setting aside money for quarterly estimated taxes can lead to a massive, unexpected tax bill.

Q7: Is it better to focus on getting new customers or retaining existing ones?

A: You must do both, but retention should be a major focus. A retained customer is cheaper to market to, often spends more over their lifetime, and can become a vocal advocate for your brand. A balanced strategy uses marketing to attract new customers while using email, loyalty programs, and exceptional service to keep existing ones coming back.

Q8: How important is a business plan if I’m not seeking a loan?

A: Extremely important. A business plan is primarily for you. It forces you to think through your strategy, anticipate challenges, set measurable goals, and understand your financials. It’s your strategic roadmap and a tool to hold yourself accountable, regardless of whether a bank ever sees it.