Feeling overwhelmed by your finances? You’re not alone. In a world of rising costs, confusing financial advice, and the constant pressure to keep up, taking control of your money can feel like a monumental task. But what if there was a straightforward, time-tested framework that could transform your financial chaos into clarity and confidence?

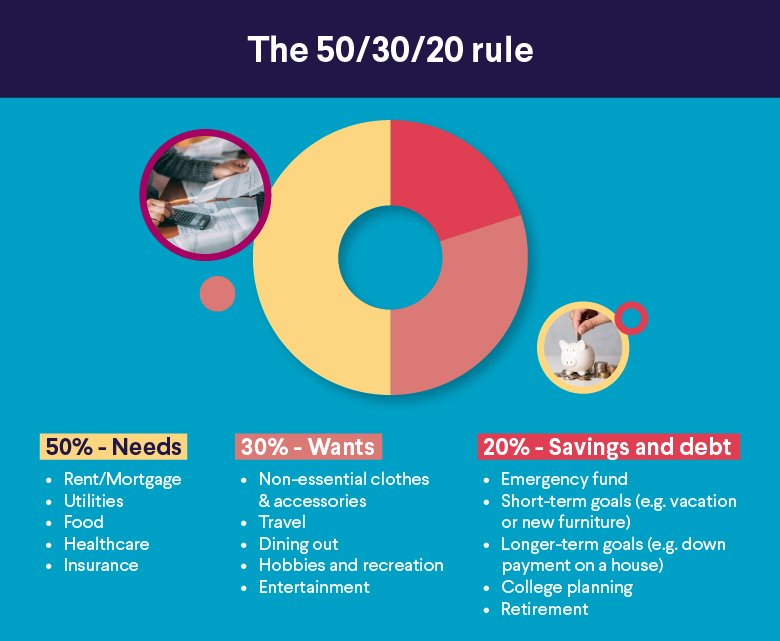

Enter the 50/30/20 rule.

More than just a budget, it’s a powerful guiding principle for your entire financial life. Coined by U.S. Senator Elizabeth Warren in her book All Your Worth: The Ultimate Lifetime Money Plan, this rule provides a simple, flexible structure for managing your income. It’s not about pinching pennies or tracking every single dime; it’s about making conscious, strategic decisions that align with your values and long-term goals.

This ultimate guide will walk you through every step of implementing the 50/30/20 rule in the American economic context. We’ll cover how to adapt it for high-cost-of-living areas, navigate U.S.-specific expenses like healthcare and 401(k)s, and build a financial future that is not only secure but also sustainable and fulfilling.

Why the 50/30/20 Rule is a Game-Changer for Americans

Before we dive into the numbers, let’s understand why this framework is so effective, especially in the dynamic U.S. economy.

- Simplicity: Unlike complex budgeting systems that require numerous categories and meticulous tracking, the 50/30/20 rule uses just three. This makes it easy to understand, implement, and stick with long-term.

- Flexibility: It’s a guideline, not a rigid law. It adapts to your life, whether you’re a recent grad in a studio apartment, a family of four in the suburbs, or someone nearing retirement.

- Holistic Focus: The rule recognizes that financial health isn’t just about paying bills and saving. It explicitly carves out space for your present quality of life (Wants) and your future security (Savings & Debt Repayment), preventing burnout and fostering a healthy relationship with money.

- Goal-Oriented: By prioritizing savings and debt repayment, it automatically pushes you toward critical financial milestones: building an emergency fund, saving for a home, and investing for retirement.

Deconstructing the 50/30/20 Rule: What Do the Numbers Really Mean?

The rule is simple: you divide your after-tax income into three distinct buckets.

- 50% for Needs: Essential expenses you must pay to live and function in society.

- 30% for Wants: Non-essential spending that enhances your lifestyle.

- 20% for Savings & Debt Repayment: Money allocated for your future financial security.

But what falls into each category? Let’s break it down with American-specific examples.

Category 1: Needs (50% of Your After-Tax Income)

Needs are the non-negotiable, essential expenses. If you lost your job tomorrow, these are the bills you would still need to cover, often using your emergency fund.

What Qualifies as a “Need”?

- Housing: Rent or mortgage payment (principal and interest only—we’ll address other elements later). Homeowners Association (HOA) fees are also a need.

- Utilities: Electricity, gas, water, sewage, and trash collection. Basic, non-negotiable utilities only.

- Groceries: Money spent on food for home consumption. Note: This does NOT include dining out, takeout, or premium specialty foods you don’t need.

- Healthcare: Health insurance premiums (including those deducted from your paycheck), out-of-pocket medical expenses (deductibles, co-pays), and necessary prescriptions.

- Transportation: Car payment (if necessary for work), car insurance, fuel for commuting, and basic maintenance. Public transit costs for commuting also qualify.

- Minimum Debt Payments: The minimum required payment on all credit cards, student loans, personal loans, etc. Note: Paying more than the minimum falls into the 20% category.

- Basic Clothing & Child Support: Clothing essential for work or weather, and legally mandated child support or alimony payments.

- Basic Insurance: Necessary insurances like auto and renters/homeowners insurance.

The Gray Area: American Edition

In the U.S., some “needs” can be tricky. Is your high-speed internet bill a “need” if you work from home? Yes. Is the premium movie package a “need”? No. Be honest with yourself. A need is the most basic, functional version of an expense.

Category 2: Wants (30% of Your After-Tax Income)

Wants are the fun, lifestyle-enhancing expenses that are not essential for survival. This is your quality-of-life bucket, and it’s crucial for maintaining a budget you can stick to.

What Qualifies as a “Want”?

- Dining & Entertainment: Restaurants, bars, coffee shops, movies, concerts, streaming services (Netflix, Spotify), hobbies, and vacations.

- Luxury Goods & Services: Premium clothing, jewelry, salon services, spa treatments, and designer accessories.

- Upgrades: Any upgrade from a basic “need.” This includes a larger apartment than you need, a luxury car payment, organic specialty groceries, and premium cable TV packages.

- Miscellaneous Fun Money: Impulse purchases, gifts for others, and recreational shopping.

The Mindset Shift: There is no guilt in spending your 30%! This category is designed to be used. It allows you to enjoy your life today, preventing the feeling of deprivation that causes so many budgets to fail.

Category 3: Savings & Debt Repayment (20% of Your After-Tax Income)

This is your future-building category. It’s the engine for financial freedom and security. This category is often the most challenging for Americans to fund, but it’s also the most transformative.

What Qualifies as “Savings & Debt Repayment”?

- Emergency Fund: Building and maintaining a savings buffer of 3-6 months’ worth of essential expenses (your “Needs”).

- Retirement Savings: Contributions to a 401(k) (especially up to the employer match), IRA (Traditional or Roth), and other retirement accounts beyond any automatic payroll deductions. Note: We’ll clarify how to count payroll deductions later.

- Additional Debt Payments: Any payment above the minimum on credit cards, student loans, or car loans. This is how you accelerate your path to being debt-free.

- Other Investments: Contributions to taxable brokerage accounts.

- Saving for Goals: Down payment for a house, a new car (if paying cash), a wedding, or your children’s 529 college savings plan.

Step-by-Step: How to Implement the 50/30/20 Rule Today

Ready to build your bulletproof budget? Follow these steps.

Step 1: Calculate Your After-Tax Income

This is the most critical step and requires precision for Americans, given our complex tax system.

If you are a W-2 employee:

Your after-tax income is your net pay—the amount that hits your bank account each pay period. This is your gross pay minus:

- Federal, State, and Local Income Taxes

- Social Security and Medicare (FICA) Taxes

- Health, Dental, and Vision Insurance Premiums

- But here’s the key EEAT insight: Do NOT subtract 401(k) contributions. Since 401(k) contributions are part of your 20% Savings category, we add them back to your net pay to get your true “take-home” base. This gives you a larger, more accurate pie to split.

Formula for W-2 Employees:

After-Tax Income = Net Pay + 401(k) Contributions + HSA Contributions (if applicable)

Example:

- Gross Monthly Pay: $5,000

- Net Pay (after all taxes/insurance): $3,500

- 401(k) Contribution (from paycheck): $400

- Your After-Tax Income for Budgeting = $3,500 + $400 = $3,900

If you are self-employed or a freelancer:

This is trickier. You must estimate your quarterly tax payments. A good rule of thumb is to set aside 25-30% of your gross income for taxes. Your after-tax income is:

After-Tax Income = Gross Income – (Estimated Tax Rate + Business Expenses)

Step 2: Categorize Your Current Spending

For one month, track every single dollar you spend. Use a budgeting app (Mint, YNAB), your bank’s online tools, or a simple spreadsheet. At the end of the month, assign every expense to Needs, Wants, or Savings/Debt.

Be brutally honest. That $8 latte is a Want. The minimum payment on your student loan is a Need. The extra $100 you paid toward the principal is Savings/Debt.

Step 3: Crunch the Numbers and Adjust

Now, apply the 50/30/20 percentages to your after-tax income from Step 1.

*Using our example of $3,900 After-Tax Income:*

- Needs Target: $3,900 x 0.50 = $1,950

- Wants Target: $3,900 x 0.30 = $1,170

- Savings/Debt Target: $3,900 x 0.20 = $780

Compare these targets to your actual spending from Step 2. Where are you over? Where are you under? Most Americans find their “Needs” category is bloated.

Step 4: Create Your Plan and Monitor

Based on your analysis, create a spending plan for the next month. The goal is to shift your actual spending to align with the 50/30/20 targets. This doesn’t happen overnight. It’s a process of adjustment.

Tackling Common American Challenges with the 50/30/20 Rule

The rule is a perfect model, but American life is messy. Here’s how to adapt.

Challenge 1: “My Needs Are More Than 50%”

This is the most common issue, especially in high-cost-of-living (HCOL) areas like New York, San Francisco, or Boston.

Solutions:

- Audit Your “Needs”: Is your apartment truly a “need” or a “want”? Could you move to a more affordable area or get a roommate? Is your car a luxury model?

- Increase Your Income: Sometimes, the problem isn’t spending, but earning. Ask for a raise, pursue a promotion, or start a side hustle.

- Temporarily Adjust the Ratios: If you’re in a truly unavoidable HCOL situation, you might need a 60/25/15 split temporarily. The key is to have a plan to get back to 50/30/20 by focusing on increasing your income.

- The “Half” Rule for Bonuses/Tax Refunds: Use any windfall to pay down debt or boost savings, which can lower your future Needs (e.g., paying off a car loan).

Challenge 2: “I Have High-Interest Debt”

Credit card debt can feel like a financial emergency, and it should be treated as one.

Solutions:

- The Avalanche or Snowball Method: Within your 20% category, prioritize aggressively paying down high-interest debt. The “avalanche” method (paying highest interest rate first) saves the most money.

- Temporarily Rob Your “Wants”: It is perfectly acceptable to temporarily reduce your “Wants” to 20% and boost your “Savings/Debt” to 30% until high-interest debt is under control.

- Balance Transfer Cards: Consider a 0% APR balance transfer card to stop interest from accruing while you pay down the principal.

Challenge 3: “How Do I Handle My 401(k) and HSA?”

This is a crucial point of confusion.

Expert Clarification:

- 401(k) Contributions: As shown in Step 1, add your contribution back to your net pay. The contribution itself counts toward your 20% Savings goal. If your employer offers a match, that’s free money and should be your absolute first priority in the 20% bucket.

- HSA (Health Savings Account): If you have a High-Deductible Health Plan, HSA contributions are the ultimate triple tax threat. Contributions are tax-free, growth is tax-free, and withdrawals for qualified medical expenses are tax-free. Treat HSA contributions like 401(k) contributions: add them back to your net pay, and they count toward your 20% Savings.

Advanced Strategies: Making the 50/30/20 Rule Work for You Long-Term

Once you’ve mastered the basics, use these strategies to supercharge your financial progress.

- Automate Your 20%: Set up automatic transfers from your checking account to your savings, brokerage, and debt accounts right after you get paid. This makes saving effortless.

- Conduct a Quarterly “Budget Audit”: Every three months, review your spending. Are you on track? Have your goals changed? This keeps you engaged and proactive.

- Use Sinking Funds for Irregular Expenses: Annual car insurance, holiday gifts, and property taxes aren’t monthly, but they are predictable. Create a “sinking fund” within your savings—a separate sub-savings account where you contribute a little each month to cover these future costs. This prevents them from wrecking your monthly budget.

Conclusion: Your Path to Financial Confidence Starts Now

The 50/30/20 rule is more than a budget; it’s a philosophy of financial balance. It acknowledges that a healthy financial life requires covering your essentials, enjoying the present, and diligently building for the future.

It won’t be perfect from day one. You’ll have months where an unexpected car repair blows your “Needs” category or a vacation maxes out your “Wants.” That’s okay. The power of this system is that it gives you a clear framework to return to, a map to guide you back on course.

By taking this structured, mindful approach, you are not just managing money. You are building a bulletproof financial foundation that can withstand life’s surprises and empower you to achieve your most ambitious American dreams. Start today. Calculate your after-tax income, track your spending, and take that first, powerful step toward the financial confidence you deserve.

Read more: From Idea to IPO: Understanding Startup Funding Rounds in the United States

Frequently Asked Questions (FAQ)

Q1: Is the 50/30/20 rule realistic for someone living in a very expensive city like New York or San Francisco?

It can be challenging. In these HCOL areas, housing alone can consume 40-50% of income. If your true “Needs” are consistently over 50%, first ensure you’ve cut all possible fat (e.g., a smaller apartment, no car if public transit is robust). If it’s still impossible, use a modified ratio like 55/25/20 or 60/20/20 as a starting point, with a clear goal of increasing your income to eventually reach the standard 50/30/20 split.

Q2: Should I use the 50/30/20 rule if I have a lot of high-interest credit card debt?

Yes, but with a temporary adjustment. High-interest debt is a financial emergency. It is perfectly reasonable and advisable to temporarily shift to a 50/20/30 model—diverting 10% from your “Wants” to your “Savings/Debt” category to aggressively pay down the debt. Once the high-interest debt is eliminated, you can return to the 30% for Wants.

Q3: How does this rule work with my 401(k) if contributions are taken directly from my paycheck?

This is a common point of confusion. The key is to add your 401(k) contribution back to your net pay when calculating your after-tax income. The contribution itself then counts toward your 20% Savings goal. For example, if your gross pay is $5,000 and $400 goes to your 401(k), your net pay might be $3,500. Your after-tax income for budgeting is $3,900 ($3,500 + $400). Your 20% Savings target is $780, and your $401(k) contribution is a big part of that.

Q4: Where should I keep my emergency fund?

Your emergency fund should be liquid and safe, meaning easily accessible and not subject to market risk. A high-yield savings account (HYSA) at a reputable online bank is ideal. These accounts offer significantly higher interest rates than traditional brick-and-mortar bank savings accounts, allowing your money to grow while remaining FDIC-insured and available for a true emergency.

Q5: What if I’m a freelancer with a variable income?

The 50/30/20 rule still works, but it requires a different approach.

- Calculate Your Baseline: Determine your average monthly after-tax income based on the last 6-12 months.

- Use a “Feast or Famine” Buffer: In high-income months, set aside extra money in a “Income Buffer” savings account. In low-income months, use this buffer to cover your essential 50% (Needs) and 20% (Savings) targets. Your “Wants” category will naturally fluctuate with your income, which is acceptable.

- Prioritize: Always fund your Needs and Savings categories first from whatever income you receive.

Q6: Does the 20% for savings include saving for a down payment on a house?

Absolutely. The 20% “Savings & Debt Repayment” category is for all your future-focused financial goals. This includes building an emergency fund, investing for retirement, and saving for short-to-medium-term goals like a down payment, a new car, or a vacation. You get to decide how to allocate that 20% based on your personal priorities.

Q7: I’m debt-free except for my mortgage. Where does my extra money go?

Congratulations! This is an excellent position to be in. First, ensure you are fully maximizing your retirement accounts (401(k), IRA). Once you are, you can reallocate the extra funds within your 20% category to other goals, such as:

- Accelerating your mortgage payments (this now falls into your 20% category).

- Investing more in a taxable brokerage account.

- Saving for other large goals like children’s education, a rental property, or early retirement.

You could also choose to slightly increase your “Wants” category to 35% and reduce “Savings” to 15% if your retirement is fully on track, giving you more lifestyle freedom.