Starting a new business is an exhilarating journey filled with big ideas and crucial checklists. Among the myriad of tasks—from crafting a business plan to securing your first customer—one of the most fundamental and non-negotiable steps is obtaining an Employer Identification Number (EIN). Think of an EIN as a Social Security Number for your business. It’s a unique nine-digit code assigned by the Internal Revenue Service (IRS) that is used to identify your entity for tax, banking, and legal purposes.

While the process is administered by the IRS, it’s not just for businesses with employees. Whether you’re a sole proprietor opening a solo consulting firm or a group of founders incorporating the next tech startup, an EIN is a critical piece of your operational foundation. This guide is designed to be your definitive resource, walking you through not only the “how” but also the “why,” “when,” and “what’s next” of obtaining your EIN. We’ll demystify the process, highlight common pitfalls, and equip you with the knowledge to get your business off to a compliant and confident start.

Section 1: Understanding the EIN – More Than Just a Tax ID

Before we dive into the application process, it’s essential to understand what an EIN is and the pivotal role it plays in your business’s lifecycle.

1.1 What Exactly is an EIN?

An Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is a unique identifier assigned to business entities operating in the United States. The format is XX-XXXXXXX. It’s used by the IRS to track the tax reporting of all businesses, except for certain sole proprietorships who may use the owner’s Social Security Number (SSN).

1.2 Why is an EIN So Crucial for Your Business?

You will need an EIN to perform a wide range of essential business activities:

- To Open a Business Bank Account: Nearly all banks require an EIN to open a business checking or savings account. Separating your personal and business finances is a cornerstone of sound financial management and legal protection.

- To Hire Employees: As the name implies, you must have an EIN to legally hire employees. It’s used for reporting employment taxes to the IRS and state agencies.

- To File Federal and State Tax Returns: Your business’s tax returns, including income, excise, and employment tax returns, are filed under your EIN.

- To Apply for Business Licenses and Permits: Most state and local government agencies will ask for your EIN when you apply for necessary business licenses and permits.

- To Establish a Business Credit Profile: An EIN allows you to build a credit history for your business separate from your personal credit. This is vital for securing business loans, lines of credit, and trade credit with vendors.

- To Form an LLC or Corporation: When you form a legal entity like an LLC or Corporation, you are required to have an EIN for the entity itself, separate from the owners’ personal SSNs.

- To Work with Partners and Investors: If you have a partnership or multiple members in an LLC, an EIN is required for the partnership’s tax reporting (via Form 1065).

1.3 Who Needs an EIN? A Clear Checklist

You are legally required to obtain an EIN if your business falls into any of the following categories:

- You have employees.

- Your business is organized as a Corporation or Partnership.

- You file tax returns for Employment, Excise, or Alcohol, Tobacco, and Firearms.

- You have a Keogh Plan (a tax-deferred pension plan for self-employed individuals).

- You are involved with certain types of organizations, including:

- Non-profits (Trusts, Estates)

- Real estate mortgage investment conduits (REMICs)

- Farmers’ cooperatives

Even if you are not required to have one, it is highly recommended if you are:

- A Sole Proprietor: While you can use your SSN, getting an EIN allows you to avoid giving out your personal SSN to vendors and clients. It also helps prevent identity theft and is essential if you plan to hire anyone in the future.

- A Single-Member LLC: The IRS may allow a disregarded entity SMLLC to use the owner’s SSN, but every single bank and state agency will require an EIN to open an account or get a license. It is standard practice to get one.

Section 2: Pre-Application Checklist: Get Your Ducks in a Row

The EIN application process is straightforward, but it requires specific information. Preparing this information before you start the application will save you time and frustration. The “responsible party” is a key concept here.

2.1 The “Responsible Party” Explained

The IRS requires every EIN application to name a “responsible party.” This is the person who ultimately owns or controls the entity or who exercises effective control over it. This individual must provide their name and Taxpayer Identification Number (SSN, ITIN, or EIN).

- For Sole Proprietorships: The responsible party is the owner.

- For Partnerships: The responsible party is a general partner.

- For Corporations: The responsible party is the principal officer (e.g., CEO, President, CFO).

- For LLCs: The responsible party is typically a managing member.

The responsible party must be a natural person (an individual), not another business entity.

2.2 Information You Need to Have On Hand

Gather the following information for a smooth application:

- Legal Name of Business Entity: This must be the exact legal name as it appears on your formation documents (e.g., Articles of Incorporation or Organization) filed with the state. If you are a sole proprietor using your name, it would be “John A. Smith.”

- Trade Name or DBA (Doing Business As): If your business operates under a name different from its legal name (e.g., Legal Name: “Smith Enterprises, LLC”; DBA: “Awesome Coffee Shop”), have that ready.

- Mailing and Physical Address: The street address, city, state, and ZIP code.

- Responsible Party’s Name and SSN/ITIN: As defined above.

- Type of Entity: Be prepared to select the correct legal structure.

- Sole Proprietorship

- Partnership

- Corporation (including S-Corp)

- LLC (and you’ll need to specify how it will be taxed—as a sole prop, partnership, or corporation)

- Estate

- Trust

- Non-Profit

- Reason for Applying: e.g., Started a new business, Hired employees, Banking purposes, Changed legal structure.

- Date Business Started or Acquired: The official start date of your business operations.

- Closing Month of Accounting Year: For most businesses, this is December (calendar year).

- Business Activity and Expected Number of Employees: A brief description of what your business does (e.g., “Restaurant,” “Software Development,” “Landscaping Services”) and an estimate of employees in the first year.

- Contact Information: A phone number and email address for the person completing the application.

Section 3: The Step-by-Step Guide to Applying for Your EIN

You have several options for applying for an EIN. The best method for most new businesses is the online application.

Method 1: Online Application (The Fastest and Easiest Way)

The IRS’s online EIN Assistant is the preferred method for most applicants. It is available Monday through Friday, 7 a.m. to 10 p.m. Eastern Time.

Eligibility: The online application is only available if the responsible party’s legal residence, principal place of business, or principal office is in the United States or U.S. Territories.

Step-by-Step Walkthrough:

- Access the IRS EIN Assistant: Go to the official IRS website at

www.irs.govand search for “EIN Online Application.” Ensure you are on the official.govsite to avoid scams. - Begin the Application: Click “Begin Application” and carefully read the instructions.

- Determine Eligibility: The system will ask a series of questions to confirm your eligibility to apply online.

- Select Your Entity Type: Choose the legal structure that best describes your business (e.g., Sole Proprietor, LLC, Corporation). Crucial Note for LLCs: You will be asked how the LLC will be taxed. If you are a single-member LLC and have not filed an election to be taxed as a corporation, you would select “Sole Proprietor.” A multi-member LLC would select “Partnership” unless it has elected corporate taxation.

- Explain the Reason for Applying: Select “Started a new business.”

- Input Responsible Party Information: Enter the full legal name, SSN/ITIN, and address of the responsible party.

- Input Business Information:

- Enter the legal name of your business entity.

- Provide your business mailing and physical address.

- Enter the name and SSN/ITIN of the responsible party (again, for verification).

- Select the type of application you are filing.

- Provide Business Details:

- Describe the principal business activity (e.g., “real estate,” “consulting”).

- Estimate the number of employees you expect to have in the next 12 months.

- Select the primary reason for applying for the EIN (e.g., “Banking”).

- Indicate the first date you paid or will pay wages to employees. If you have no employees, you can select “N/A.”

- Specify the closing month of your accounting year.

- Review Your Information: This is the most critical step. Carefully review every field for accuracy. Once you submit, you cannot go back and change it online. Errors can cause significant delays.

- Submit and Receive Your EIN Immediately: After submitting, you will be issued your official EIN immediately. You will see a confirmation notice on the screen with your new number. Download and save this PDF immediately! This is your official EIN confirmation document (CP 575 Notice), and the IRS does not mail a duplicate unless you specifically request it, which can take weeks.

Read more: The Ultimate Guide to Filing Your Taxes Online for Free (Legit IRS-Approved Methods)

Method 2: Application by Fax

If you cannot or prefer not to apply online, you can fax a completed Form SS-4.

- Download Form SS-4: Get the latest version from the IRS website.

- Complete the Form: Fill out the form legibly and completely using the information from your pre-application checklist.

- Find the Appropriate Fax Number: The IRS has different fax numbers depending on your state and the type of entity. Check the “Where to File” section in the Form SS-4 instructions.

- Fax the Application: Include your return fax number on the application. If all the information is correct, the IRS will generally fax your EIN back to you within four (4) business days.

Method 3: Application by Mail

This is the slowest method and should be used only if fax or online is not an option.

- Complete Form SS-4: Fill out the form as described above.

- Find the Appropriate Mailing Address: This also varies by state and entity type. Refer to the Form SS-4 instructions.

- Mail the Application: Send the completed form to the IRS address. It can take up to four to five weeks to receive your EIN confirmation letter in the mail.

Method 4: Application by Telephone (for International Applicants)

If the responsible party does not have an SSN or ITIN and is located outside the US, you may apply by telephone.

- Call the IRS at 267-941-1099 (this is not a toll-free number).

- Have your completed Form SS-4 and all supporting information ready.

- The IRS agent will walk you through the application and provide your EIN over the phone.

Section 4: After You Receive Your EIN – Next Steps

Congratulations! You now have the official ID for your business. Here’s what to do next.

4.1 Secure Your EIN Confirmation

Save the downloaded PDF (if you applied online) or the confirmation letter in a secure location. This document is vital and may be required by banks, landlords, and government agencies.

4.2 Use Your EIN to Open a Business Bank Account

This is one of the first and most important actions. Present your EIN confirmation and your business formation documents (e.g., Articles of Organization) to a bank to open your account.

4.3 Register with Your State Revenue Agency

Your state’s department of revenue will require your EIN for state withholding, sales tax, and other state-level business taxes. You will likely need to register with them separately.

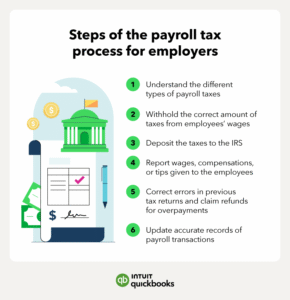

4.4 Stay Compliant: Understand Your Tax Obligations

Your EIN triggers certain filing responsibilities with the IRS.

- Annual Tax Returns: File the appropriate form each year (e.g., Form 1040 Schedule C for Sole Props, Form 1065 for Partnerships, Form 1120 for Corporations).

- Employment Taxes: If you have employees, you must file quarterly employment tax returns (Form 941) and annual returns (Form 940).

- Estimated Taxes: As a business owner, you may need to make quarterly estimated tax payments.

4.5 When You Might Need a New EIN

Generally, an EIN is for the life of the business. However, you will need to apply for a new EIN if:

- You incorporate or take on partners, changing your legal structure.

- You purchase or inherit an existing business and operate it as a sole proprietorship.

- Your sole proprietorship becomes a partnership or is incorporated.

- A new partnership is created due to the termination of a partnership under IRC §708(b)(1)(B).

You do not need a new EIN if you simply change your business name or location.

Section 5: Common Pitfalls and How to Avoid Them

Many applicants run into avoidable issues. Here’s how to steer clear of common mistakes.

- Pitfall #1: Incorrect Legal Name. Using a DBA name in the “Legal Name” field will cause a rejection. The legal name must match your state filing exactly.

- Pitfall #2: Misidentifying the Responsible Party. Do not list another company or a fictional name. It must be a real person with an SSN or ITIN.

- Pitfall #3: Rushing the Online Application. The session will time out after 15 minutes of inactivity. Have all your information ready before you start to avoid losing your progress.

- Pitfall #4: Not Saving the Confirmation. The IRS will not email you a copy. Download and save the PDF the moment you receive it.

- Pitfall #5: Applying When You Don’t Need To. If you are a sole proprietor with no employees and no retirement plan, you can use your SSN. However, for the reasons stated earlier, getting an EIN is still a best practice.

- Pitfall #6: Using a Third-Party Scam Site. Only use the official IRS.gov website. Many companies charge high fees for a service you can do for free in 15 minutes. They often have official-sounding names but are not affiliated with the government.

Read more: How to Build Credit from Scratch: A Beginner’s Guide for Young Americans

Frequently Asked Questions (FAQ)

Q1: Is there a fee to get an EIN from the IRS?

A: No, the IRS does not charge any fee for obtaining an EIN. The service is free. Be wary of third-party websites that charge a “processing” or “application” fee; they are simply completing the free IRS form on your behalf.

Q2: How long does it take to get an EIN?

A: Through the online application, you receive it immediately upon completion. Via fax, it takes about 4 business days. By mail, it can take 4-5 weeks.

Q3: I lost my EIN confirmation letter (CP 575). How can I get it back?

A: If you lost your EIN, you can try to recover it by:

- Looking at any prior tax returns, bank account applications, or credit applications you filed.

- Calling the Business & Specialty Tax Line at 800-829-4933. The IRS can look it up if you can verify your identity.

- If you need a copy of the CP 575 notice, you can request a copy by calling the IRS. It may take several weeks to arrive by mail.

Q4: Can I use my SSN instead of an EIN for my sole proprietorship?

A: Yes, the IRS allows it. However, it is not recommended for privacy, security, and professionalism. Most banks will require an EIN to open a business account, even for a sole prop.

Q5: What’s the difference between an EIN and a State Tax ID Number?

A: An EIN is your federal tax ID, used for federal taxes. A State Tax ID number is issued by your state’s revenue department and is used for state-level obligations like sales tax, state income tax, and unemployment insurance. You will likely need both.

Q6: I am a single-member LLC. How should my LLC be taxed on the EIN application?

A: By default, a single-member LLC is a “disregarded entity” for tax purposes. On the EIN application, when asked for the type of entity, you would select “Sole Proprietorship.” You are indicating that the LLC will be taxed like a sole proprietorship (on Schedule C of your personal tax return).

Q7: Can I change the information on my EIN after it’s been assigned?

A: You cannot edit the original application. To change certain details, like the business address or responsible party name (due to marriage, for example), you must write a letter to the IRS. Include your EIN, the correct information, the reason for the change, and the signature of a responsible party. Mail it to the same address you would use for filing your tax return. For a change in business structure (e.g., from sole prop to corporation), you will likely need a new EIN.

Q8: I made a mistake on my online application. What should I do?

A: The online system does not allow for corrections. If the mistake is minor (e.g., a typo in the street address), you can note the correction when you file your first tax return. For more significant errors (e.g., wrong responsible party or legal name), the IRS recommends you call the Business & Specialty Tax Line at 800-829-4933 for guidance. In some cases, you may need to send a correction letter or, in extreme cases, cancel the EIN and reapply.

Conclusion: Your Foundation for Business Success

Obtaining your Employer Identification Number is more than a bureaucratic hurdle; it is the foundational act that officially brings your business to life in the eyes of the government, financial institutions, and the commercial world. By following this comprehensive guide, you have taken a critical step toward establishing a legitimate, compliant, and professional enterprise. The process, when approached with the right preparation, is simple and free. With your EIN in hand, you are now ready to build the financial, legal, and operational structures that will support your business’s growth and success for years to come.