Navigating the U.S. tax system can feel like trying to decipher an ancient, complex code. The forms are intimidating, the terminology is confusing, and the fear of making a costly mistake is ever-present. But here’s a secret: understanding your taxes is one of the most powerful financial skills you can develop. It’s not just about fulfilling a legal obligation; it’s about keeping more of your hard-earned money and building a secure financial future.

This guide is designed to demystify the process. We will walk you through the entire journey, from gathering your documents to filing your return and planning for the year ahead. We’ll focus not just on compliance, but on strategy—highlighting legitimate ways to reduce your tax bill and maximize your refund. Whether you’re a first-time filer or someone who has been wrestling with taxes for years, this guide will provide clarity, confidence, and a actionable roadmap.

Part 1: The Foundation – Understanding Your Tax Situation

Before you can file, you need to understand a few core concepts. Your filing status, income sources, and the difference between deductions and credits form the bedrock of your tax return.

1. Your Filing Status: It’s More Than Just a Box

Your filing status determines your standard deduction, tax rates, and eligibility for certain credits. Choosing the correct one is crucial. The five statuses are:

- Single: For unmarried individuals who do not qualify for any other status.

- Married Filing Jointly (MFJ): For married couples who combine their income and deductions on one return. This status often provides the most beneficial tax outcome, with higher income thresholds for tax brackets and access to more credits.

- Married Filing Separately (MFS): For married couples who file two separate returns. This is less common and can result in a higher combined tax bill, but may be beneficial in specific situations, such as when one spouse has significant medical expenses or if the couple is separated.

- Head of Household (HOH): For unmarried individuals who pay more than half the cost of keeping up a home for themselves and a “qualifying person” (e.g., a child, relative). This status offers a higher standard deduction and lower tax rates than the “Single” status.

- Qualifying Widow(er) with Dependent Child: Available for two years following the death of a spouse, allowing you to use the MFJ tax rates and standard deduction.

Actionable Tip: If you are unsure, the IRS Interactive Tax Assistant on their website can help you determine your correct filing status.

2. Know Your Forms: The Alphabet Soup of Tax Documents

In January, you’ll start receiving tax documents in the mail or digitally. Here’s what they mean:

- Form W-2, Wage and Tax Statement: From your employer. Reports your annual wages, tips, and the taxes withheld (federal, state, Social Security, Medicare).

- Form 1099-NEC, Nonemployee Compensation: For freelance, contract, or gig work. Reports income paid to you that wasn’t as a formal employee.

- Form 1099-INT, Interest Income: From banks or financial institutions. Reports interest you earned from savings accounts, CDs, etc.

- Form 1099-DIV, Dividends and Distributions: Reports dividends and capital gains distributions from investments.

- Form 1099-B, Proceeds from Broker and Barter Exchange: Reports sales of stocks, bonds, and other securities. You’ll need your “cost basis” (what you paid for it) to calculate the taxable gain or loss.

- Form 1098, Mortgage Interest Statement: From your mortgage lender. Reports the interest you paid, which is often deductible.

- Form 1095-A, B, or C, Health Insurance Marketplace Statement: Proof of your health insurance coverage for the year, necessary for complying with the Affordable Care Act.

Gather all your forms before you start. Missing just one can lead to an inaccurate return.

3. The Core Concepts: Adjusted Gross Income (AGI), Deductions, and Credits

This is the heart of tax calculation. Understanding these terms is key to saving money.

- Gross Income: The total of all your income from all sources.

- Adjustments to Income (Above-the-Line Deductions): These are deductions you can take before calculating your AGI. They are valuable because they are available even if you don’t itemize. Examples include:

- Student loan interest paid

- Contributions to a traditional IRA

- Contributions to a Health Savings Account (HSA)

- Educator expenses

- Adjusted Gross Income (AGI): Your gross income minus your adjustments. Your AGI is a critical number—it’s used to determine your eligibility for many tax credits and deductions.

- Standard Deduction vs. Itemized Deductions: After calculating your AGI, you get to subtract either the standard deduction or your itemized deductions.

- Standard Deduction (2023 Tax Year): A fixed amount based on your filing status.

- Single: $13,850

- Married Filing Jointly: $27,700

- Head of Household: $20,800

- Itemized Deductions: The total of specific expenses you paid during the year. You would only itemize if the total is greater than your standard deduction. Common itemized deductions include:

- State and local taxes (SALT) up to $10,000

- Mortgage interest on your primary home

- Charitable contributions

- Medical and dental expenses that exceed 7.5% of your AGI

- Standard Deduction (2023 Tax Year): A fixed amount based on your filing status.

- Taxable Income: Your AGI minus your deductions (standard or itemized). This is the amount the IRS actually taxes.

- Tax Credits vs. Tax Deductions: This is the most important distinction for saving money.

- Deductions reduce your taxable income. A $1,000 deduction saves you $1,000 multiplied by your tax bracket (e.g., $220 if you’re in the 22% bracket).

- Credits reduce your tax bill, dollar-for-dollar. A $1,000 credit saves you $1,000, regardless of your tax bracket. Credits are far more powerful.

Part 2: The Step-by-Step Filing Process

Step 1: Gather Your Documents and Information

Create a “tax folder” – physical or digital. Collect all your W-2s, 1099s, receipts for potential deductions, records of charitable donations, and your Social Security number (and those of your dependents). Having everything in one place streamlines the process.

Step 2: Choose Your Filing Method

You have three main options:

- Tax Software (e.g., TurboTax, H&R Block, Free File):

- Best for: Most people, especially those with straightforward or moderately complex situations (like gig work, investments, or homeownership).

- Pros: User-friendly, guides you with questions, performs calculations, helps identify credits and deductions, and allows for electronic filing (e-filing).

- Cons: Can have upsells and fees, especially for more complex returns.

- Hire a Professional (CPA or Enrolled Agent):

- Best for: Complex situations (self-employment, business ownership, rental properties, major life changes, high net worth), if you are uncomfortable doing it yourself, or if you have been audited in the past.

- Pros: Expertise, personalized advice, audit support, and time savings.

- Cons: The most expensive option.

- Paper Filing:

- Best for: Those with very simple tax situations who are comfortable with forms and math.

- Pros: It’s free (minus postage).

- Cons: Prone to human error, significantly slower processing (expect 6+ months for a refund), and no built-in guidance.

Recommendation: For the vast majority of people, using tax software and e-filing is the most efficient and accurate method.

Step 3: Prepare and Double-Check Your Return

Whether you’re using software or working with a pro, be an active participant. Review each section carefully.

- Ensure all personal information is correct (name, SSN, address).

- Input all your income documents accurately. The IRS receives copies of your W-2s and 1099s and will match them to your return.

- Don’t overlook deductions and credits. The software will prompt you, but think about your life—did you have major medical procedures? Did you donate to a food bank? Every bit counts.

- Choose the correct bank account for your refund or payment.

Step 4: File and Pay (If Necessary)

- E-filing: Once you submit your return electronically, you’ll receive a confirmation email. The IRS typically processes e-filed returns within 21 days.

- Payment: If you owe taxes, you have several payment options (direct debit, credit card, check). You must pay by the filing deadline (typically April 15) to avoid penalties and interest. If you can’t pay the full amount, still file your return on time and contact the IRS to set up a payment plan. The penalty for failure to pay is much smaller than the penalty for failure to file.

Part 3: Advanced Strategies for Saving Money

This is where you move from being a compliant taxpayer to a savvy one. These strategies are about proactive planning, not last-minute tricks.

For Employees (W-2)

- Maximize Your Retirement Contributions:

- Contributions to a traditional 401(k) or IRA are made with pre-tax dollars, lowering your current-year AGI.

- For 2023, you can contribute up to $22,500 to a 401(k) ($30,000 if you’re 50 or older). For a traditional IRA, the limit is $6,500 ($7,500 if 50+).

- Contribute to a Health Savings Account (HSA):

- If you have a High-Deductible Health Plan (HDHP), an HSA is a triple tax threat. Contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are tax-free. It’s one of the best savings vehicles available.

- Track Your Charitable Contributions:

- Even if you take the standard deduction, you can deduct up to $300 ($600 for MFJ) in cash contributions. Keep receipts for all donations, no matter how small.

- Bunch Deductions:

- If your itemizable deductions are close to your standard deduction, consider “bunching.” This means timing your payments to push two years’ worth of deductible expenses into one tax year. For example, you could prepay your next property tax installment and make two years of charitable donations in a single year to exceed the standard deduction threshold.

For Self-Employed and Gig Workers (1099)

You have a world of deductible business expenses available to you. Meticulous record-keeping is non-negotiable.

- The Home Office Deduction: If you use a part of your home exclusively and regularly for business, you can deduct associated costs. You can use the simplified method ($5 per square foot, up to 300 sq. ft.) or the regular method (calculating the actual percentage of your home expenses like mortgage interest, utilities, and insurance).

- Track Every Business Expense: This includes:

- Vehicle Expenses: Use the standard mileage rate (65.5 cents per mile for 2023) or track actual expenses (gas, insurance, repairs).

- Supplies and Equipment: Computers, software, office furniture.

- Marketing and Advertising: Website costs, business cards.

- Professional Services: Fees paid to lawyers, accountants, or contractors.

- Meals and Entertainment: 50% of the cost of business-related meals is deductible.

- Health Insurance Premiums: You can deduct 100% of your health insurance premiums for yourself, your spouse, and your dependents.

- Open a SEP-IRA or Solo 401(k): These retirement plans allow for much higher contribution limits than a standard IRA, dramatically reducing your taxable income.

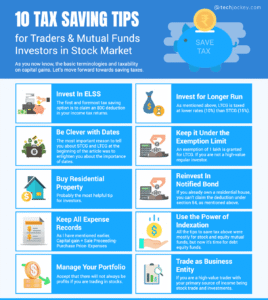

For Investors

- Utilize Tax-Advantaged Accounts: Maximize contributions to IRAs and 401(k)s. Earnings in these accounts grow tax-deferred or tax-free.

- Practice Tax-Loss Harvesting: This involves selling investments that are at a loss to offset capital gains you’ve realized from winning investments. You can use losses to offset up to $3,000 of ordinary income per year and carry forward any remaining losses to future years.

- Hold Investments for the Long Term: Assets held for more than one year qualify for preferential long-term capital gains tax rates (0%, 15%, or 20%), which are generally lower than ordinary income tax rates.

Part 4: Common Pitfalls and How to Avoid Them

- Filing Late: The penalty for filing late is 5% of the unpaid taxes for each month your return is late, up to 25%. Always file on time, even if you can’t pay.

- Mathematical Errors: Software virtually eliminates this risk. If you file by paper, check your math twice.

- Missing or Incorrect Social Security Numbers: Ensure the SSNs for yourself, your spouse, and your dependents are exactly as they appear on the Social Security cards.

- Forgetting to Sign and Date Your Return: An unsigned return is invalid. It’s like not filing at all.

- Overlooking Income: The IRS knows about your W-2 and 1099 income. Forgetting a side gig’s 1099-NEC is a surefire way to get a notice (and a bill) from the IRS.

Read more: How To Write a Business Plan That Actually Gets Funded in the USA

Part 5: What to Do If You Can’t Pay or Get Audited

If You Can’t Pay Your Tax Bill

- File Your Return On Time. This avoids the much larger “failure to file” penalty.

- Pay What You Can. This reduces penalties and interest.

- Apply for an IRS Installment Agreement. This allows you to pay your debt over time. You can often apply online for a long-term payment plan.

If You Get an IRS Notice or Are Audited

Don’t Panic. An audit is a review, not an accusation.

- Read the notice carefully. It will explain what the IRS is questioning and what they need from you.

- Respond by the deadline. Ignoring the IRS only makes things worse.

- Gather your documentation. You will need records to support your position.

- Consider professional help. If the issue is complex, a CPA or Enrolled Agent can represent you and handle communications with the IRS.

Conclusion: Empowerment Through Understanding

Taxes are a constant in our financial lives, but they don’t have to be a source of anxiety and confusion. By understanding the basic framework, using the right tools, and implementing proactive strategies, you can transform this annual chore from a dreaded obligation into an opportunity for financial optimization.

The goal is not to evade your responsibilities, but to fulfill them intelligently, ensuring you pay no more than your fair share. Take control of your taxes, and you take a major step toward taking control of your financial future.

Read more: A Step-by-Step Guide To Legally Registering Your Business in Any US State

Frequently Asked Questions (FAQ)

Q1: When is the tax filing deadline?

The federal tax filing deadline is typically April 15. If April 15 falls on a weekend or holiday, it is moved to the next business day. You can also file for a six-month extension (until October 15), but this is an extension to file, not to pay. Any taxes you owe are still due by the original April deadline to avoid penalties and interest.

Q2: What is the difference between a tax credit and a tax deduction?

A tax deduction reduces your taxable income. The amount of tax you save is equal to the deduction multiplied by your marginal tax rate. A tax credit is a dollar-for-dollar reduction of your actual tax bill. Credits are generally more valuable than deductions. For example, a $1,000 deduction might save you $220 (if you’re in the 22% tax bracket), while a $1,000 credit saves you $1,000.

Q3: Should I itemize or take the standard deduction?

You should choose the method that gives you the larger deduction. With the significant increase in the standard deduction from the 2017 tax law, the majority of taxpayers now find it more beneficial to take the standard deduction. However, if you have significant mortgage interest, state and local taxes (up to the $10,000 cap), large charitable contributions, or major medical expenses, you should add them up to see if the total exceeds your standard deduction.

Q4: I’m a freelancer/contractor. What are my main tax obligations?

As a self-employed individual, you are responsible for paying both the employee and employer portions of Social Security and Medicare taxes (collectively known as self-employment tax, currently 15.3%). You must make quarterly estimated tax payments throughout the year (in April, June, September, and January) to cover your income and self-employment tax liability. You must also report your income and expenses on Schedule C (Profit or Loss from Business) and file it with your Form 1040.

Q5: What happens if I make a mistake on my tax return?

If you discover an error after filing, don’t panic. You can file an amended return using Form 1040-X. You generally have three years from the date you filed your original return to file an amendment. Tax software can guide you through this process, or you can consult a tax professional.

Q6: How long should I keep my tax records?

The IRS generally recommends keeping records that support an item of income, deduction, or credit shown on your tax return for three years from the date you filed the original return. However, if you underreported your income by more than 25%, keep records for six years. For assets like a home or stocks, keep records related to the purchase and improvements until the period of limitations expires for the year you dispose of the asset. It’s always better to err on the side of caution.

Q7: What is the “Kiddie Tax”?

The “Kiddie Tax” rules are designed to prevent parents from shifting large amounts of investment income to their children in lower tax brackets. A child’s unearned income (e.g., from investments) over a certain threshold ($2,500 for 2023) is taxed at the parents’ marginal tax rate, which is often higher. These rules generally apply to children under 19 and full-time students under 24.

Q8: Are there any truly “free” ways to file my taxes?

Yes. The IRS Free File Program is a partnership between the IRS and leading tax software companies that provides free guided tax preparation to taxpayers who earned $79,000 or less in 2023. Some software providers also offer a free version for taxpayers with very simple returns (just a W-2 and the standard deduction), regardless of income. Always start at the IRS Free File page to see if you qualify.