For decades, the dream of starting a business has been shackled to a daunting prerequisite: access to substantial capital. The narrative often involves maxing out credit cards, taking a second mortgage, or securing an intimidating small business loan. This financial barrier has stopped countless brilliant ideas in their tracks. But what if I told you that the most successful business story of our time might be written not by a venture-backed unicorn, but by a solo entrepreneur who started with less than the cost of a new laptop? The landscape has fundamentally shifted. The digital revolution, the rise of the gig economy, and a new suite of powerful, free online tools have democratized entrepreneurship. Today, the most valuable asset isn’t a hefty bank balance; it’s your knowledge, skills, and execution. This guide is your definitive roadmap to leveraging that asset. We will walk you through, step-by-step, how to identify, launch, and scale a genuinely profitable small business with a low investment, focusing on real-world examples and actionable strategies that work in 2024. Let’s dismantle the financial barriers and build your business, one smart step at a time.

Part 1: The Foundation – Mindset and Model Selection

Before you spend a single dollar, the right mindset is your most critical investment. A low-investment venture requires a unique blend of creativity, resilience, and a “lean” approach that prioritizes learning and adaptation over perfection. This isn’t about cutting corners; it’s about being strategically frugal and incredibly focused.

The Lean Startup Philosophy: Build, Measure, Learn

Popularized by Eric Ries in his seminal book, The Lean Startup, this methodology is perfect for the bootstrapper. Instead of spending months or years building a “perfect” product in isolation, you create a “minimum viable product” (MVP)—the simplest version of your service or product that delivers core value. You then get it in front of real customers as quickly as possible, gather feedback, and adapt. This iterative process of Build-Measure-Learn minimizes wasted time and money, ensuring you’re building something people actually want and will pay for.

- Real-Life Example: Sarah, a graphic designer, doesn’t spend months and thousands of dollars building a full-scale agency website. Instead, she creates a simple, one-page portfolio on a low-cost platform like Carrd (cost: ~$50/year) showcasing three specific design packages tailored for local coffee shops. She then personally contacts five local shop owners, offers a free brand audit, and presents her initial package ideas for feedback. Based on their input, she discovers that her “Social Media Graphics Package” is in high demand, but her “Packaging Redesign” service is less of a priority. She adapts, pivoting her offerings before officially launching. This validation ensures there’s a real demand for her services and saves her from building a service no one wanted.

Choosing Your Low-Investment Business Model

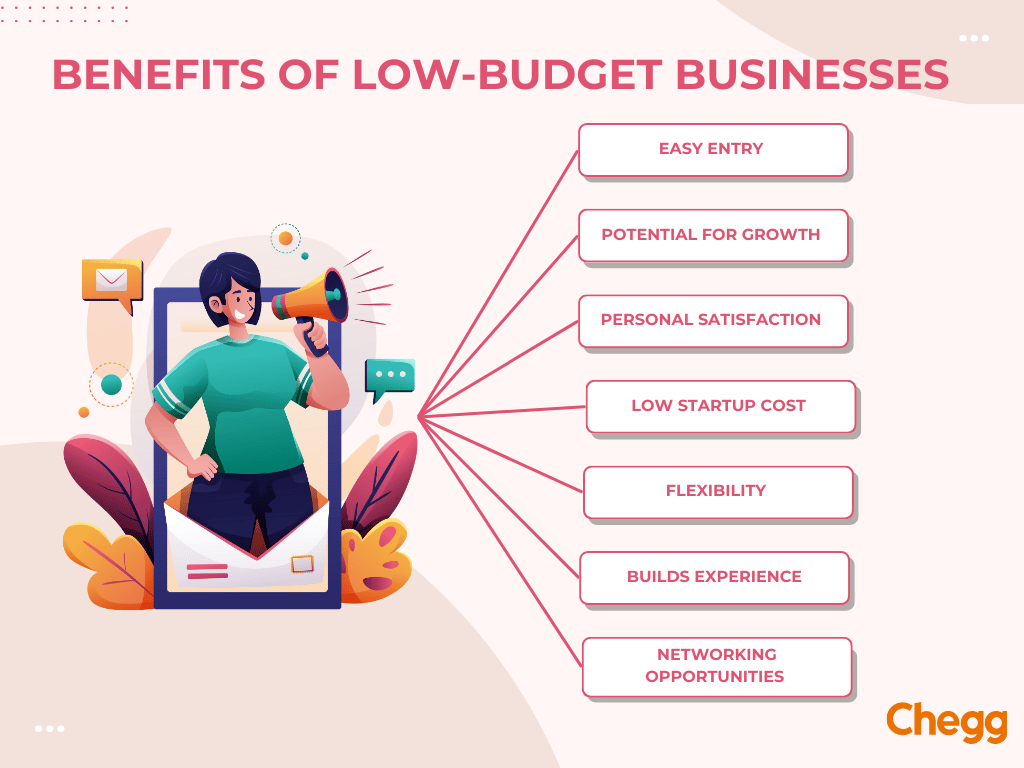

The key to selecting the right business is to focus on models with low fixed costs, minimal to no inventory, and that leverage your existing skills or knowledge. Here are the most accessible and profitable categories for 2024.

1. Service-Based Businesses: Trading Skills for Cash

This is the most straightforward and fastest path to profitability. You are selling your time and expertise directly. The startup costs are often just a computer, a phone, and some basic software. According to the U.S. Bureau of Labor Statistics, millions of professionals are choosing freelance and contract work, making this a robust and growing sector.

- Freelance Writing & Copywriting: Businesses of all sizes constantly need blog posts, website copy, email newsletters, and social media content. If you have a knack for words, this is a wide-open field.

- Virtual Assistant (VA): Providing administrative, creative, or technical support to entrepreneurs, executives, and other busy professionals remotely. Tasks can include email management, scheduling, social media, and customer service.

- Social Media Management: Small business owners are often overwhelmed by the demands of social platforms. You can offer to create content calendars, write posts, create graphics in Canva, and engage with their audience.

- Bookkeeping: If you’re detail-oriented and good with numbers, managing finances for other small businesses using software like QuickBooks or Xero is a highly valuable service.

- Tutoring or Coaching: Teaching academic subjects, music, fitness, or business skills online via Zoom has never been easier. You can package your knowledge into one-on-one or group sessions.

- Handyman or Home Organization Services: Leveraging practical skills for local clients. With apps like TaskRabbit, you can find your first customers immediately.

2. Digital Product Businesses: Create Once, Sell Repeatedly

This model requires more upfront work but offers incredible scalability and passive income potential. Once the product is created, the cost of duplicating and delivering it to another customer is nearly zero.

- Online Courses & Workshops: Packaging your specialized knowledge into a structured video course on platforms like Teachable, Kajabi, or Udemy. You teach the material once, but students can enroll for years to come.

- E-books & Digital Guides: Writing and selling in-depth guides on a topic you’ve mastered, from “The Ultimate Guide to Keto Baking” to “A Local’s Hiking Guide to the Colorado Rockies.” Platforms like Amazon Kindle Direct Publishing make distribution simple.

- Stock Photography & Digital Assets: If you have a good camera or design skills, you can sell photos, video templates, presentation slides, or digital planners on marketplaces like Etsy, Creative Market, or Shutterstock.

- Print-on-Demand: Designing t-shirts, mugs, posters, and tote bags that are only printed and shipped when a customer orders them. You handle the design and marketing, while a partner like Printful or Printify handles the production and fulfillment, eliminating all inventory risk.

3. “Curated” or “Dropshipping” E-commerce

While a traditional e-commerce store that holds its own inventory is capital-intensive, these two models are designed for low startup costs.

- Dropshipping: You set up an online store and partner with a supplier who holds all the inventory and ships products directly to your customer. Your profit is the difference between your retail price and the supplier’s wholesale price. The key in 2024 is to move beyond generic items and build a niche brand.

- Curated Collections: Instead of holding vast inventory, you become a tastemaker. For example, you could start a subscription box for unique, locally-made crafts or for a specific hobby like gourmet coffee or calligraphy, sourcing products only after you have secured orders from subscribers.

Part 2: The Step-by-Step Launch Plan (From Idea to First Sale)

With a model in mind, it’s time to move from concept to reality. This phased, systematic approach is designed to ensure you don’t overspend before validating your idea and gaining traction.

Step 1: Validate Your Business Idea (Cost: $0)

An idea is just an idea until the market says otherwise. Validation is the process of confirming that people will actually pay for your solution. The U.S. Small Business Administration (SBA) emphasizes market research as the critical first step for a reason—it de-risks your venture.

- Talk to Potential Customers: Go beyond your friends and family. Find your target customers and ask them about their pain points. Use open-ended questions like, “What’s the biggest challenge you face with [your problem area]?” and “How would you solve it today?” Follow up with, “Would you pay for a service that solved X problem effectively?”

- Run a “Smoke Test”: Create a simple, one-page website using a tool like Carrd or Canva Websites describing your product or service and include a “Buy Now” or “Learn More” button. Drive a small amount of traffic to it (e.g., through a targeted Facebook post or a Reddit community) and see how many people click. The goal is to gauge interest, not to trick people.

- Analyze the Competition: If competitors exist and are thriving, that’s actually a good sign—it proves a market exists. Your task is not to reinvent the wheel but to find your unique angle. Can you serve a specific niche? Can you offer a better customer experience? Can you bundle services differently?

Step 2: Establish Your Legal and Digital Foundation (Cost: <$150)

It’s tempting to get everything “perfect” legally and digitally from day one. Resist this. Keep it simple and cost-effective at the start. You can always formalize as you grow and generate revenue.

- Business Structure: For 99% of solo entrepreneurs starting out, a Sole Proprietorship is the way to go. It’s the simplest and cheapest structure with no formal registration required in many states if you’re operating under your own name. Once you have significant income (e.g., over $5k-$10k in profit) or liability concerns, you can form an LLC (Limited Liability Company) for personal asset protection.

- Business Name & Bank Account: Choose a unique and memorable name. Open a separate business checking account at your local bank or an online bank like Novo or Bluevine. This is non-negotiable for clean financial tracking and makes tax time infinitely easier.

- The Essential Digital Toolkit:

- Website: Your online home base. Use a free or low-cost website builder like Carrd, Canva Websites, or a basic WordPress plan. Your initial goal is a simple online business card with your services, a bit about you, and a contact form—not a complex e-commerce hub.

- Email Marketing: Start building an email list from day one. It’s your most owned marketing channel. Use a free plan from Mailchimp or MailerLite to create a simple sign-up form for a helpful tips newsletter.

- Productivity: Use free tiers of powerful tools. Google Workspace for professional email and document collaboration, Trello or Asana for project management, and Canva for all your graphic design needs.

Step 3: Craft a One-Page Business Plan (Cost: $0)

Forget the 40-page business plan documents of the past. Your plan should be a living, breathing, one-page guide that you revisit monthly.

- Value Proposition: What specific problem do I solve and for whom? (e.g., “I save time for overworked Etsy sellers by managing their product listings and customer communication.”)

- Target Market: Who is my ideal customer? Be hyper-specific. Instead of “small businesses,” think “female-owned craft businesses on Etsy with 50-500 sales, located in the US.”

- Marketing Strategy: How will I find my first 10 customers? (e.g., “By engaging in 5 Etsy seller Facebook groups daily, offering a free listing audit, and partnering with a popular Etsy coach for a webinar.”)

- Revenue Streams: How will I make money? (e.g., “One-time shop setup fee, monthly retainer for maintenance and customer service.”)

- Cost Structure: What are my fixed and variable costs? (e.g., “Canva Pro ($12.99/mo), Trello Gold ($5/mo), marketing spend ($50/mo).”)

Step 4: Acquire Your First Paying Customers (Cost: Varies)

Your first customers are your most important. They provide the initial cash flow, social proof in the form of testimonials, and invaluable feedback to refine your offering.

- Leverage Your Network: Announce your new business professionally on LinkedIn and personal social media channels. Be specific about who you want to help and how. A post like, “After helping my friend Sarah streamline her Etsy shop, I’m officially launching [Business Name] to help Etsy sellers manage their backend operations. Know anyone who could use a hand?” can work wonders.

- Offer a “Founders’ Discount”: Incentivize early adopters with a special, limited-time price in exchange for their detailed feedback and a testimonial upon successful completion of the project.

- Provide Immense Value for Free: Write insightful posts on LinkedIn about common mistakes in your industry, offer a free 30-minute consultation to diagnose a problem, or create a helpful tutorial video and post it on YouTube. This builds trust and showcases your expertise, turning viewers into clients.

- Partner with Complementary Businesses: A social media manager could partner with a web developer to offer a “Complete Online Presence” package. A bookkeeper could partner with a business coach, referring clients to each other.

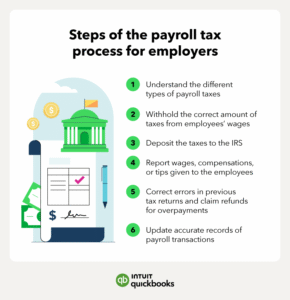

Part 3: Mastering the Money: Financial Management for Low-Cost Startups

Profitability isn’t just about revenue; it’s about meticulously managing what comes in and what goes out. For a low-investment business, financial discipline is your superpower.

Bootstrapping: The Art of Frugal Growth

Bootstrapping means building your business using your own finances and the revenue it generates, avoiding debt and outside investors. This forces you to be customer-funded and highly resourceful.

- Core Principle: Reinvest every dollar of profit back into the business to fuel growth.

- Practical Tactic: Use free software trials extensively, barter services (e.g., design a logo for a lawyer in exchange for setting up your LLC), and avoid unnecessary expenses like a fancy office or premium subscriptions you don’t yet need.

Pricing Your Services Correctly

Undervaluing your work is one of the most common pitfalls for new entrepreneurs. You are not just selling hours; you are selling outcomes and expertise.

- Cost-Plus Pricing: Calculate all your costs (software, taxes, etc.) and the value of your time, then add a profit margin. This is a good starting point.

- Value-Based Pricing: This is the gold standard. Price based on the perceived value to the client. For example, if your bookkeeping service saves a client $5,000 in tax liabilities by identifying missed deductions, charging $1,000 is a bargain for them, regardless of whether it took you 5 hours or 10 hours.

- Competitive Analysis: See what others in your field are charging, but don’t automatically compete on being the cheapest. Compete on the quality of your results, your customer service, and your specialized niche.

Key Financial Metrics to Track From Day One

You cannot manage or grow what you don’t measure. From your very first transaction, keep a close eye on these numbers.

- Monthly Revenue: Your total income before any expenses.

- Monthly Expenses: Your total costs. Categorize them (Software, Marketing, etc.).

- Profit: Revenue – Expenses. This is the number that truly matters.

- Customer Acquisition Cost (CAC): How much it costs, on average, to gain a new customer. (Total Marketing Spend / Number of New Customers). If you spend $100 on Facebook ads and get 2 clients, your CAC is $50.

- Lifetime Value (LTV): The total revenue you expect from a single customer over the entire time they do business with you. A healthy, sustainable business has an LTV that is at least 3x its CAC.

Part 4: Scaling on a Shoestring: From First Sale to Sustainable Business

Once you have a proven model, a handful of happy customers, and consistent cash flow, the focus shifts from mere survival to sustainable growth. This is where you work on your business, not just in it.

Marketing That Doesn’t Break the Bank

Forget expensive, broad-reach ad campaigns for now. At this stage, your time, creativity, and consistency are your most effective marketing tools.

- Content Marketing: This is a long-game strategy that builds immense authority. Create blog posts, videos, or podcasts that answer your target audience’s most pressing questions. For example, a virtual assistant for coaches could write a post titled “5 Time-Saving Automation Tools Every Life Coach Needs.” This content attracts organic search traffic and builds trust.

- Social Media Engagement: Don’t just broadcast your services. Engage authentically. Join conversations in relevant Facebook Groups and LinkedIn communities. Answer questions, provide value, and become a known and helpful member. People buy from those they know, like, and trust.

- Email Marketing Nurturing: Your email list is gold. Send consistent, valuable content to your subscribers. Share tips, industry news, and case studies. When they need a service you offer, you will be the first person they think of.

- Networking (Online & Offline): Attend local chamber of commerce events or industry-specific webinars. Be genuine, ask people about their businesses, and look for ways to help them without an immediate expectation of return.

Systems and Automation: Working On Your Business

To avoid becoming trapped in a job you created for yourself, you must systemize repetitive tasks. This frees you up to focus on high-value activities like strategy and business development.

- Create Standard Operating Procedures (SOPs): Document the step-by-step process for every recurring task in your business—from how you onboard a new client to how you create an invoice and send it. This makes delegation easy in the future.

- Automate Where Possible: Use tools like Calendly for scheduling calls to avoid back-and-forth emails. Use Zapier to connect your apps; for example, when a new lead fills out your contact form (Google Forms), it can automatically create a card in your project management tool (Trello).

- Outsource Strategically: When your revenue consistently allows, hire a virtual assistant from a platform like Upwork or Fiverr for $10-$20/hour to handle administrative tasks like email management or social media scheduling. This investment of $100-$200 a month can free up 5-10 hours for you to focus on client work or strategy, effectively paying for itself.

Frequently Asked Questions (FAQ)

1. What is the most profitable business to start with low investment?

Service-based businesses like freelance writing, virtual assistance, and social media management often have the fastest path to profitability as they generate cash flow immediately from the first client. Digital product businesses, like online courses or e-books, have higher passive income potential but may take 3-6 months to develop and gain traction before becoming profitable.

2. Can I really start a business with $100?

Absolutely. Many service-based businesses can be launched for the cost of a website domain ($15), a few months of a basic website builder ($50), and a business checking account ($0). The primary investment is your time, effort, and dedication to learning and executing, not significant financial capital.

3. How do I find my first client with no experience or portfolio?

You create your own experience. This is a classic bootstrapping technique. Offer your service at a heavily discounted rate (or even for free) to 1-2 initial, ideal clients in exchange for a detailed testimonial and the right to showcase the work in your portfolio. Be upfront: “I’m launching my business and am looking for my first 2 clients to build my portfolio. In exchange for this discounted rate, I would appreciate your feedback and a testimonial upon completion.” This is how almost every successful freelancer begins.

4. What are the biggest mistakes to avoid when starting a low-cost business?

- Spending too much too soon on logos, legal fees, and expensive software before validating the business.

- Trying to be a perfectionist instead of getting a “good enough” minimum viable product to market to start learning.

- Undervaluing your services and getting stuck in a cycle of low-paying work that leads to burnout.

- Ignoring the numbers and not tracking income and expenses from day one, leading to tax and cash flow problems.

5. Do I need a business license to start?

For most sole proprietors operating under their own legal name, you can often start without a formal business license. However, requirements vary by city, county, and state. It is crucial to check with your local municipal office. If you form an LLC or use a “Doing Business As” (DBA) name, you will almost certainly need to register with your state.

6. How can I market my business for free?

Leverage “owned” channels: your personal and professional network, organic social media posts, and content creation (like a blog or YouTube channel). Engaging authentically and helpfully in online communities (like Reddit or niche forums) and implementing a formal referral program asking happy customers for referrals are also powerful and free strategies.

7. What is the difference between a sole proprietorship and an LLC?

A sole proprietorship is you and your business as one legal entity. It’s simple and cheap but offers no personal asset protection; if your business is sued, your personal assets (home, car, savings) are at risk. An LLC (Limited Liability Company) is a separate legal entity that creates a corporate veil, shielding your personal assets from business debts and lawsuits. It is highly recommended once your business generates significant income or carries any liability risk.

8. How long does it take to become profitable?

This varies dramatically by business model and execution. A service business like freelance writing could be profitable within its first month. A product-based business like print-on-demand might take 3-6 months to build a audience and see consistent sales. The key factor is the speed at which you can validate your idea, build a minimal presence, and acquire your first paying customers.

9. Should I use dropshipping in 2024?

Dropshipping can still be profitable, but the “get rich quick with generic products” model is largely over. Success in 2024 comes from building a real, trusted brand, finding unique or niche products, providing exceptional customer service, and using sustainable marketing methods like content creation, rather than just relying on fleeting Facebook ads for cheap items from AliExpress.

10. How do I balance a startup with a full-time job?

It requires intense discipline and time management. Dedicate specific, consistent blocks of time to work on your business. This is often called the “5-9” (working after your 9-5) or the “5 AM Club.” For example, commit to 6-8 AM on weekdays and a 4-hour block on Saturday. Protect this time fiercely. Use your lunch breaks or commute for less-intensive tasks like responding to emails, engaging on social media, or listening to business podcasts.

Conclusion: Your Journey Begins Now

Starting a profitable business with low investment is not a fantasy; it’s a modern reality built on a foundation of strategy, execution, and resilience. The path is clear: identify a pressing need that aligns with your unique skills, validate it with real people, build a minimal but professional presence, and acquire your first customers through sheer force of will and undeniable value. Remember, the biggest barrier is rarely money—it’s inertia. The most expensive mistake you can make is to do nothing at all, waiting for the “perfect” moment that never comes. Choose one idea from this guide that resonated with you. Take the first step today, whether it’s brainstorming three potential business names, having a conversation with a potential customer, or simply setting up your one-page website. Your future as a business owner is not a distant dream; it’s a project waiting to be built, and the first brick is in your hands.