The world of investing can seem like an exclusive club with a steep entry fee. Headlines shout about soaring stock prices and billionaire investors, leaving many to wonder, “Can I even start with the little I have?” The answer is a resounding yes.

Starting with just $100 is not only possible; it’s one of the most powerful financial decisions you can make. Why? Because you’re not just investing money; you’re investing in the most valuable asset of all—your financial education. The habits you build, the lessons you learn, and the power of compounding you set in motion with that first $100 can pave the way to a secure financial future.

This guide is designed for the absolute beginner. We will demystify the stock market, walk you through the exact steps to get started, and provide a clear, actionable roadmap for your $100 investment. We will prioritize safety, education, and long-term strategy over get-rich-quick schemes, adhering to the principles of Expertise, Authoritativeness, and Trustworthiness (EEAT).

Part 1: The Mindset Before the Money

Before you open an app or buy a single share, it’s crucial to lay the right foundation. Your mindset is the bedrock upon which all successful investing is built.

1.1. The Power of “Starting Small” and Compounding

Your $100 is a seed. On its own, it doesn’t look like much. But when planted in fertile soil and given time, it can grow into a mighty tree. This growth is due to compounding, often called the eighth wonder of the world.

Compounding is the process where your investment earnings generate their own earnings. Here’s a simple example:

- You invest $100 and earn a 7% return in a year. You now have $107.

- In year two, you earn 7% on the full $107, not just your original $100. You now have $114.49.

- In year three, you earn 7% on $114.49, and so on.

Over 20 years, that single $100 investment, without you adding another dime, could grow to nearly $387, assuming a 7% average annual return. Now imagine if you added just $25 or $50 every month. The growth becomes exponential. The single most important ingredient in this recipe is time. Starting with $100 today is infinitely more valuable than starting with $1,000 in ten years.

1.2. Defining Your Goals and Risk Tolerance

Why are you investing? Your answer will shape your strategy.

- Long-Term Goals (5+ years): Saving for retirement, a child’s education, or a down payment on a home far in the future. With a long time horizon, you can generally afford to take on more risk (volatility) for the potential of higher returns.

- Medium-Term Goals (1-5 years): Saving for a car, a wedding, or a vacation. You may want to take a more conservative approach to protect your principal.

- Short-Term Goals (Less than 1 year): For money you need soon, the stock market is not the right place. The risk of a short-term downturn is too high. A high-yield savings account is a better fit.

Risk Tolerance is your emotional and financial ability to withstand swings in your investment’s value. If a 20% drop in your $100 investment (to $80) would cause you to panic and sell, your risk tolerance is low. If you can see it as a potential buying opportunity and stay the course, your tolerance is higher. Be honest with yourself.

1.3. The Golden Rule: Invest, Don’t Speculate

With $100, it can be tempting to try and find the “next big thing” and turn your money into $1,000 overnight. This is not investing; it’s speculating, or gambling.

- Investing is the process of allocating capital to assets with the expectation of generating a return over the long term. It’s based on research, patience, and a belief in the fundamental growth of the economy and companies.

- Speculating is betting on short-term price movements, often based on hype, fear, or a “hot tip.” It’s extremely high-risk and how most beginners lose their initial capital.

Your goal with this $100 is to become an investor, not a speculator.

Part 2: Getting Your Financial House in Order

Before you commit your $100 to the market, you must ensure your personal finances are on solid ground. Investing should not come at the expense of financial security.

2.1. The Essential Prerequisites

- High-Interest Debt: If you have credit card debt or a personal loan with a high interest rate (e.g., 15-25%), your top priority should be paying this down. The guaranteed “return” you get from saving on interest charges is almost always higher and safer than any expected return from the stock market.

- Emergency Fund: Do you have a cushion for unexpected expenses like car repairs or medical bills? Before investing, aim to build a starter emergency fund of $500-$1,000 in a separate, easily accessible savings account. This prevents you from having to sell your investments at a loss to cover an emergency.

Once these two pillars are in place, you can invest with confidence, knowing your $100 is truly “risk capital”—money you can afford to lose without derailing your life.

Part 3: Where to Invest Your $100: Brokerage Accounts Explained

You can’t buy stocks directly from the New York Stock Exchange. You need a intermediary: a brokerage account. For a beginner with $100, the best options are discount online brokers and robo-advisors.

3.1. Discount Online Brokers

These platforms allow you to buy and sell investments yourself. They have eliminated commissions for most trades and have low or no account minimums, making them perfect for you.

Top Picks for Beginners:

- Fidelity Investments: A top-tier, full-service broker with a stellar reputation. They offer $0 account minimums, $0 commission trades on US stocks and ETFs, and even allow you to buy fractional shares of stocks and ETFs (more on this later). Their research and educational tools are exceptional.

- Charles Schwab: Another industry giant known for its excellent customer service and robust platform. Like Fidelity, it has $0 minimums and $0 commissions, and offers fractional shares through their “Stock Slices” program.

- E*TRADE (a Morgan Stanley Company): A powerful platform with a user-friendly interface, $0 minimums, and $0 commissions.

- TD Ameritrade (now part of Charles Schwab): While being merged into Schwab, its thinkorswim platform is highly regarded. New accounts are typically directed to Schwab.

Why these are great for a $100 start: You can open an account, transfer your $100, and start investing immediately without fees eating into your capital.

3.2. Robo-Advisors

A robo-advisor is a digital platform that provides automated, algorithm-driven financial planning services with little human supervision. You answer questions about your goals and risk tolerance, and the robo-advisor builds and manages a diversified portfolio for you.

Top Picks for Beginners:

- Betterment: A pioneer in the space, known for its user-friendly interface and goal-based investing approach. There is no account minimum to get started.

- Wealthfront: Similar to Betterment, it offers automated portfolio management and tax-efficient strategies. The minimum to invest is $500, so it’s not suitable for a single $100 investment, but it’s good to know for when your portfolio grows.

- M1 Finance: A unique hybrid between a broker and a robo-advisor. You can build a custom “Pie” of stocks and ETFs (or use one of their expert pies), and M1 automatically invests your money into the slices. It supports fractional shares and has no account minimum. This is an excellent, flexible choice.

Robo-Advisor vs. Broker: Which is Right for You?

| Feature | Discount Online Broker | Robo-Advisor |

|---|---|---|

| Control | High. You choose every investment. | Low. The algorithm manages everything. |

| Effort | High. Requires research and decisions. | Low. “Set it and forget it.” |

| Cost | $0 trades; you pay the ETF expense ratios. | $0 trades + a small annual advisory fee (e.g., 0.25%). |

| Best For | Beginners who want to learn and be hands-on. | Beginners who want a completely hands-off approach. |

For your first $100, if you want to learn, a discount broker like Fidelity or Schwab is a fantastic choice. If you want the simplest, most hands-off experience, a robo-advisor like Betterment or M1 Finance is ideal.

Part 4: What to Invest In with $100: Your First Investments

This is the core of your journey. With $100, your key to building a diversified portfolio lies in Exchange-Traded Funds (ETFs) and Fractional Shares.

4.1. The King of Small-Stakes Investing: ETFs

An ETF is a basket of securities (like stocks, bonds, or commodities) that you can buy or sell on a stock exchange through a brokerage, just like a regular stock.

Think of an ETF as a ready-made investment basket. Instead of trying to buy 500 different companies individually, you can buy one share of an ETF that holds all 500.

Why ETFs are perfect for a $100 investment:

- Instant Diversification: This is the number one benefit. With one purchase, you can own a small piece of hundreds or even thousands of companies. This dramatically reduces your risk compared to owning just one or two individual stocks.

- Low Cost: ETFs typically have low expense ratios (the annual fee you pay to the fund manager). Many broad-market ETFs have fees below 0.10%.

- Accessibility: Many popular ETFs trade for well under $100 per share, and with fractional shares, you can invest any dollar amount.

4.2. The Game-Changer: Fractional Shares

A fractional share is, as the name implies, a fraction of a single share of a company or ETF. If a company like Amazon (AMZN) trades for over $3,000 per share, it was once out of reach for a beginner. Now, with fractional shares, you can invest $25, $50, or your entire $100 into a slice of Amazon or any other high-priced stock or ETF.

This technology has completely democratized investing. Your $100 can now buy you a piece of the most valuable companies and funds in the world.

4.3. Recommended Starter Portfolio for $100

Given your small initial capital, your primary goal should be diversification and low cost. Here are a few simple, effective strategies for deploying your $100.

Option A: The Single, All-in-One ETF

This is the simplest approach. You find one ETF that does everything for you.

- Vanguard Total World Stock ETF (VT): This single ETF holds over 9,000 stocks from companies located in the United States and nearly every other developed and emerging market country around the world. With one purchase of VT, you literally own a small piece of the entire global stock market. It’s the ultimate “one and done” diversification.

- iShares Core S&P 500 ETF (IVV) or SPDR S&P 500 ETF Trust (SPY): These track the S&P 500 index, which is 500 of the largest companies in the United States (e.g., Apple, Microsoft, Amazon, Google). While it’s only US companies, it’s a fantastic core holding for any portfolio.

How to execute this: In your brokerage account, search for the ticker symbol “VT.” Use the trade function to buy $100 worth of VT. Because of fractional shares, you will own a piece of it.

Option B: The Two-Fund “Starter” Portfolio

If you want a bit more control, you can split your $100 between two ETFs.

- 80% ($80) in a US Total Stock Market ETF: Like Vanguard Total Stock Market ETF (VTI). This holds virtually every publicly traded US stock, from giants to small companies.

- 20% ($20) in an International Stock Market ETF: Like Vanguard Total International Stock ETF (VXUS). This gives you exposure to companies outside the US.

This simple split gives you a globally diversified portfolio for under $100.

Option C: The Robo-Advisor Portfolio

If you chose a robo-advisor, the process is even simpler. You’ll answer the questionnaire, and the platform will automatically invest your $100 into a diversified portfolio of ETFs tailored to your risk profile. You don’t have to pick anything.

4.4. What About Individual Stocks?

While the strategies above are recommended, you might be curious about buying a specific company. If you are, apply these principles:

- Invest in What You Know and Believe In: Do you love a company’s products, its business model, and its leadership? Do you believe it will be bigger and more profitable in 10 years? This is a better approach than chasing trends.

- Start Small: Use a fractional share to put $10 or $20 into a single company you believe in, and use the rest of your $100 to buy a diversified ETF like VT or VTI. This lets you “scratch the itch” of stock picking while keeping the vast majority of your money in a safer, diversified investment.

Read more: How to Get an EIN for Your New US Business (A Step-by-Step Guide)

Part 5: The Step-by-Step Action Plan

Let’s turn theory into practice. Here is your exact roadmap for investing your $100.

Step 1: Choose Your Brokerage

Based on the information above, select either a discount broker (Fidelity, Schwab) or a robo-advisor (Betterment, M1 Finance). For the sake of this walkthrough, we’ll use Fidelity.

Step 2: Open Your Account

Go to Fidelity.com and click “Open an Account.” You’ll likely want to open an individual brokerage account (also called a taxable investment account). The process takes about 10 minutes. You’ll need your Social Security Number, driver’s license, and employment information.

Step 3: Fund Your Account

Link your checking or savings account to your new Fidelity account. Initiate a transfer of $100. This can take 1-3 business days to clear.

Step 4: Place Your First Trade

Once your $100 is settled in your account:

- Go to the “Trade” platform.

- In the “Symbol” field, type VT (or VTI, or another chosen ETF).

- Select “Buy.”

- Under “Trade Type,” select “Dollars” (this is the fractional share option).

- In the “Amount” field, type $100.

- Select “Good ‘Til Canceled” and review the order.

- Click “Place Order.”

Congratulations! You are now an investor in the global stock market.

Step 5: Set Up a Plan for the Future

The real magic begins with consistent investing. Log into your account and set up automatic recurring investments. Even $25 or $50 transferred from your bank account every month and automatically invested into your chosen ETF will harness the full power of dollar-cost averaging and compounding. This is how you build wealth.

Part 6: What to Do After You’ve Invested

Your work isn’t over once the trade is executed. The most successful investors are patient and disciplined.

6.1. The Art of Doing Nothing

The biggest mistake new investors make is constantly checking their portfolio and reacting to daily market noise. The market will go up and down. Your $100 might be $90 next month or $110. This is normal. Volatility is the price of admission for long-term returns. Trust your strategy, ignore the short-term fluctuations, and focus on the long-term horizon.

6.2. Continue Your Financial Education

Use this as a starting point for learning. Read books like The Little Book of Common Sense Investing by John C. Bogle or The Simple Path to Wealth by JL Collins. Follow reputable financial news sources. The more you learn, the more confident you will become.

6.3. The Path Forward: Increasing Contributions

As your income grows, prioritize increasing your investment contributions. The journey from $100 to $1,000 is a milestone. Then to $10,000. The principles remain the same: diversify, keep costs low, and invest consistently.

Conclusion: Your Journey Begins Now

Starting with $100 is a profound act of optimism in your own future. You have broken down the psychological and financial barriers to entry. You’ve learned that the key to building wealth isn’t about having a large sum of money to start; it’s about starting, period.

By choosing a reputable brokerage, investing in low-cost, diversified ETFs, and committing to a long-term strategy of consistent investing, you have positioned yourself for success. You are no longer on the sidelines. You are an investor.

Take that first step today. Open an account, invest your $100, and begin one of the most rewarding journeys of your life.

Read more: LLC vs. S-Corp: A Beginner’s Guide to Choosing Your US Business Structure

Frequently Asked Questions (FAQ)

Q1: Is it really worth it to invest only $100?

Absolutely. The primary value of your first $100 is not the monetary return, but the educational return and the establishment of a crucial habit. You are learning the process, experiencing market dynamics firsthand, and, most importantly, activating the power of compounding. The $100 you invest today is more valuable than the $1,000 you might invest in a decade.

Q2: How much money can I actually make from a $100 investment?

Assuming a historical average annual return of around 7% for the stock market:

- In 10 years, your $100 could grow to about $197.

- In 20 years, it could grow to about $387.

- In 30 years, it could grow to about $761.

This is without adding any more money. If you add even small amounts monthly, the growth becomes significantly larger.

Q3: What are the risks of losing all my money?

If you follow the guidance in this article and invest in a broadly diversified ETF like VT or VTI, the risk of losing all of your money is virtually zero. These funds hold thousands of companies; for it to go to zero, every single one of those companies would have to fail simultaneously, which would imply a global collapse far beyond financial markets. The real risk is short-term volatility—the value of your investment fluctuating down 10%, 20%, or even more during a market downturn. This is why a long-term perspective is essential.

Q4: Are there any hidden fees I should be aware of?

With the recommended brokers (Fidelity, Schwab) and ETFs, fees are very transparent.

- Trading Commissions: $0 for online stock and ETF trades.

- Account Fees: $0 for maintenance of a standard brokerage account.

- ETF Expense Ratios: This is the main fee. It is automatically deducted from the fund’s assets, so you don’t see a bill. For VT, it’s 0.07% per year. On a $100 investment, that’s 7 cents annually.

Always check a fund’s prospectus for its expense ratio before investing.

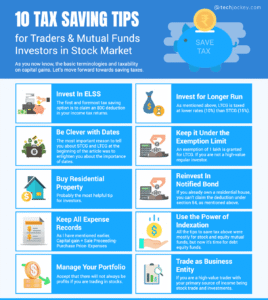

Q5: How do I pay taxes on my investment earnings?

In a standard taxable brokerage account, you are responsible for taxes in two scenarios:

- Dividends: When the ETFs or stocks you own pay out dividends (a share of company profits), these are taxable income in the year you receive them.

- Capital Gains: When you sell an investment for a profit, you owe taxes on the “capital gain.” If you held the investment for over a year, it’s taxed at a lower long-term capital gains rate. If you held it for less than a year, it’s taxed at your ordinary income tax rate.

Key Tip: As a long-term investor, you can minimize taxes by not frequently buying and selling.

Q6: Should I use a Robinhood-style app to start?

Apps like Robinhood are user-friendly and popular. However, for a true beginner, a more established broker like Fidelity or Schwab is often a better choice. The established brokers offer superior customer service, extensive educational resources, and access to a wider range of investments (like mutual funds and bonds later on). They also have a long, proven track record of security and reliability, which enhances trustworthiness.

Q7: When should I sell my investments?

You should sell for one of three reasons:

- You need the money for the goal you were originally investing for (e.g., retirement).

- Your investment strategy or goal changes.

- There is a fundamental breakdown in the investment itself (e.g., the ETF changes its strategy in a way you disagree with). This is rare for broad-market index funds.

You should not sell simply because the market is down or because a stock had a bad week. Selling based on emotion is the most common way investors harm their returns.

Q8: What’s the difference between a Brokerage Account and a Retirement (IRA) Account?

A standard brokerage account is flexible—you can put in and take out money anytime without tax penalties. You pay taxes on dividends and capital gains as they occur.

An IRA (Individual Retirement Account) is a tax-advantaged account designed specifically for retirement. Your money grows tax-free (or tax-deferred), but you generally cannot withdraw it before age 59½ without paying a penalty.

For your very first $100, a standard brokerage account is a great, flexible starting point. As you begin saving for retirement seriously, opening and funding an IRA should be a top priority.