In the competitive landscape of American entrepreneurship, a business plan is often viewed as a necessary evil—a lengthy document collecting dust in a drawer. But for the entrepreneurs who secure funding, it’s something entirely different: it’s their strategic weapon, their sales pitch, and their proof of credibility.

The stark reality is that over 50% of small businesses in the USA fail within the first five years, often due to a lack of capital or a flawed model. A well-crafted business plan directly addresses these pitfalls. It’s not just about having an idea; it’s about proving you have a viable, scalable, and profitable business that is a worthwhile risk for an investor or lender.

This guide is not a theoretical exploration. It is a practical, step-by-step blueprint for creating a business plan that does one thing exceptionally well: get funded in the United States. We will move beyond generic templates and delve into the specific elements that American funding sources—from Silicon Valley venture capitalists (VCs) to Main Street bank lenders—actually want to see. We’ll incorporate the principles of EEAT (Experience, Expertise, Authoritativeness, and Trustworthiness) directly into your plan’s structure, making it an undeniable testament to your capability as a founder.

Section 1: The Foundation – Understanding Your Audience

Before you write a single word, you must know who you are writing for. The priorities of a bank loan officer in Ohio are vastly different from those of a tech VC in California.

1.1 The SBA & Traditional Lenders (Banks/Credit Unions)

- What They Fund: Established, low-to-moderate risk businesses with solid collateral and a proven ability to repay debt.

- Their Primary Concern: Cash Flow. They want to see that your business can generate consistent, predictable revenue to cover the loan payments, with a comfortable buffer.

- Key Document Focus: They heavily rely on your Financial Projections, particularly cash flow statements, and your personal and business credit history. They are risk-averse.

1.2 Angel Investors

- What They Fund: Early-stage companies with high growth potential. They often invest in the founder as much as the idea.

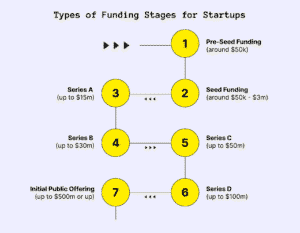

- Their Primary Concern: Potential for a 10x Return. They are taking a high risk for a potentially high reward. They look for a strong management team, a large Total Addressable Market (TAM), and a clear exit strategy.

- Key Document Focus: The Executive Summary and Management Team sections are critical. They want to be captivated by the vision and believe in the people executing it.

1.3 Venture Capital Firms (VCs)

- What They Fund: Businesses with the potential for explosive, hyper-growth and market domination. They invest large sums of money for significant equity.

- Their Primary Concern: Scalability and Defensibility. How big can this get, and how will you protect your market share from competitors? They need to see a “moat.”

- Key Document Focus: The Business Model, Market Analysis, and Financial Projections must tell a compelling story of rapid market capture and immense future valuation.

1.4 Friends & Family

- What They Fund: Your dream, based on their belief in you.

- Their Primary Concern: Trust and Your Commitment. While they may not scrutinize the numbers as deeply, a professional plan demonstrates you are serious, organized, and have done your homework.

- Key Document Focus: A clear Problem & Solution statement and realistic Financials to manage expectations.

Your plan must be tailored. While the core structure remains, the emphasis on certain sections will shift based on your target funder.

Section 2: The Fundable Business Plan Blueprint: A Section-by-Section Guide

Here is the anatomy of a business plan that gets “yeses.” We will infuse each section with elements that build EEAT.

2.1 The Executive Summary: Your 2-Minute Elevator Pitch on Paper

This is the most important section of your plan. Many investors will only read this first. If it doesn’t grab them, the rest won’t matter.

- What to Include:

- The Hook: Start with a powerful, one-sentence problem statement. *”Every year, American homeowners overpay $11 billion on their utility bills due to a lack of transparent, real-time energy monitoring.”*

- Your Solution: Briefly describe your product or service.

- The Market: State your Target Market and the compelling size of the opportunity (TAM, SAM, SOM – defined later).

- The Business Model: How do you make money? Be crystal clear.

- The Team: Briefly highlight the key team members and their “unfair advantage” – why this team is the one to win.

- The Ask: Clearly state how much funding you are seeking and exactly how it will be used (e.g., “$500,000 for product development, marketing, and key hires”).

- Key Financial Snapshot: Provide top-line numbers: projected revenue in Year 3, 5-year EBITDA, or key milestones.

- Building EEAT Here: Demonstrate Expertise by showing a deep, quantified understanding of the problem. Demonstrate Authoritativeness by citing a key industry report or statistic.

Pro Tip: Write the Executive Summary last, after you’ve completed every other section. It’s a summary, after all.

2.2 Company Description: What Are You Building?

This section provides the foundational details of your venture.

- What to Include:

- Company Name & Legal Structure: (e.g., “Innovate Inc., a Delaware C-Corporation”).

- Mission & Vision Statements: Your mission is your purpose; your vision is the future you want to create.

- Core Values: What principles guide your company? (e.g., “Customer Obsession,” “Radical Transparency”).

- Business Stage & Location: Are you in the ideation, startup, or growth stage? Where are you headquartered?

- The Problem You Solve: Go deeper than the Executive Summary. Use data and anecdotes to make the problem feel real and urgent.

- Your Solution: Describe your product/service in clear, benefit-oriented language. What is your “secret sauce”?

- Building EEAT Here: Weave in founder Experience. “Our founder, Jane Doe, spent 15 years in the energy sector and personally witnessed this inefficiency, which led to the inception of our company.”

2.3 Market Analysis: Proving There’s a Gold Rush

This is where you prove you aren’t building a solution in search of a problem. You must demonstrate a deep, data-driven understanding of your industry and customers.

- What to Include:

- Industry Overview & Trends: Is the industry growing, shrinking, or transforming? Cite authoritative sources like IBISWorld, Statista, or Gartner.

- Total Addressable Market (TAM): The total revenue opportunity if you achieved 100% market share.

- Serviceable Addressable Market (SAM): The segment of the TAM you can realistically target.

- Serviceable Obtainable Market (SOM): The portion of the SAM you can capture in the first 3-5 years. This shows you are realistic.

- Target Customer Profile: Create a detailed persona. Who are they? What are their demographics, psychographics, and pain points?

- Competitive Analysis: Create a competitor matrix. List 3-5 main competitors and analyze their strengths, weaknesses, pricing, and market position. Be honest and objective.

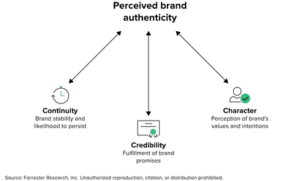

- Your Competitive Advantage (Your “Moat”): What makes you different and better? Is it proprietary technology, exclusive partnerships, a unique brand, or lower costs? Be specific.

- Building EEAT Here: Using high-quality, cited data builds Trustworthiness and Authoritativeness. Showing a nuanced understanding of the competition demonstrates Expertise.

2.4 Organization & Management: Betting on the Jockey

Investors often say they “bet on the jockey, not the horse.” This section is all about the team.

- What to Include:

- Organizational Chart: A visual of your company’s structure.

- Founder(s) & Key Management Bios: For each key person, include:

- Relevant professional experience and past successes.

- Educational background.

- Specific responsibilities within the company.

- Why they are the right person for this role.

- Advisory Board: If you have well-respected industry experts on your advisory board, list them. This adds immense credibility.

- Gaps & Hiring Plan: Acknowledging team gaps shows self-awareness. Outline your plan to fill these roles with the new funding.

- Building EEAT Here: This section is your Experience and Expertise. Highlighting past exits, successful product launches, or deep industry tenure is crucial. An esteemed advisory board adds Authoritativeness.

2.5 Products or Services: What You’re Selling

Move from the abstract to the concrete.

- What to Include:

- Detailed Description: What is it? How does it work? Use photos, diagrams, or screenshots if possible.

- Technology & Development Roadmap: If applicable, describe the technology stack and your plan for future development (e.g., “Q4 2024: Launch Mobile App”).

- Intellectual Property: Detail any patents, trademarks, or copyrights you have secured or have pending. This is a huge value driver.

- Sourcing & Fulfillment: How do you create/deliver your product? Explain your supply chain or operational process.

- Building EEAT Here: Detailing your IP and development process showcases deep Expertise and builds a Trustworthy case for your technical capability.

2.6 Marketing & Sales Strategy: Your Path to Customers

How will you find customers and turn them into paying users? A great product is useless if no one knows about it.

- What to Include:

- Market Positioning: How will you position your brand in the minds of consumers relative to competitors?

- Pricing Strategy: Explain your pricing model and justify it based on value provided and competitor pricing.

- Promotion Strategy: Be specific. Will you use content marketing, paid social ads (on which platforms?), SEO, PR, or trade shows?

- Sales Process & Channels: Map the customer journey from awareness to purchase. Is it a self-service e-commerce site, a inside sales team, or a retail partnership?

- Customer Retention: How will you keep customers and encourage repeat business?

- Building EEAT Here: A specific, multi-channel strategy shows you have real-world Experience in customer acquisition, not just theoretical knowledge.

Read more: How to Sell on Facebook Marketplace: The Ultimate Guide to Making Money and Avoiding Scams

2.7 Financial Plan & Projections: The Bottom Line

This is the section where your story gets translated into the universal language of business: dollars and cents. It must be realistic, detailed, and defensible.

- What to Include:

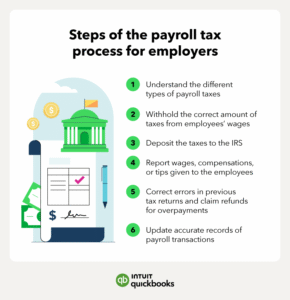

- Funding Request & Use of Funds: A table clearly showing how much you need and a itemized breakdown of how every dollar will be spent.

- Key Assumptions: This is critical. List the assumptions behind your projections (e.g., “We assume a 2% monthly customer conversion rate,” “We assume a 10% monthly churn rate”). This shows your numbers aren’t just pulled from thin air.

- 12-Month Monthly Projections: Provide a detailed, month-by-month forecast.

- 3-5 Year Annual Projections: Provide a higher-level, annual forecast.

- Core Financial Statements:

- Profit & Loss (P&L) Statement: Shows revenue, costs, and profitability.

- Cash Flow Statement: Shows the movement of cash in and out of the business. This is king for lenders.

- Balance Sheet: A snapshot of your company’s financial position at a point in time.

- Break-Even Analysis: When will the business become self-sustaining?

- Key Performance Indicators (KPIs): What metrics will you track? (e.g., Customer Acquisition Cost, Lifetime Value, Monthly Recurring Revenue).

- Building EEAT Here: Realistic, assumption-backed projections are the cornerstone of Trustworthiness. Using standard accounting formats and, if possible, having the numbers reviewed by a CPA, adds immense Authoritativeness.

2.8 Appendix: The Supporting Evidence

This is where you place all the supplemental materials that would clutter the main body of the plan.

- What to Include:

- Founder and key team member resumes.

- Full credit reports.

- Product brochures or detailed schematics.

- Letters of intent from potential customers or partners.

- Press clippings.

- Detailed market research data.

- Legal documents (e.g., patents, articles of incorporation).

Section 3: Common Pitfalls That Kill Funding Deals

Avoid these fatal errors at all costs:

- Unrealistic Financials: Projecting $10 million in revenue in Year 1 with no marketing budget. It screams inexperience.

- Ignoring the Competition: Stating “we have no competition” is naive. It shows you haven’t done your homework.

- Being Vague: Using phrases like “some people,” “the industry standard,” or “we will use social media.” Be specific and data-driven.

- Over-Hyping and Under-Substantiating: Making grand claims without the team, technology, or data to back them up.

- Typos and Grammatical Errors: Sloppy presentation suggests sloppy execution.

Section 4: Final Steps Before You Submit

- Get a Second (and Third) Opinion: Have mentors, industry experts, and a financially literate friend review it.

- Run it by a CPA: A certified public accountant can review your financials for realism and proper formatting.

- Practice Your Pitch: Your business plan sets the stage for your in-person pitch. Be prepared to defend every assertion you’ve made on paper.

Conclusion: Your Plan is a Living Document

A fundable business plan is not a one-time task. It is a living document that should evolve as your business grows, the market shifts, and you gain new insights. It is your strategic roadmap, your communication tool, and your most powerful asset in the quest for capital.

By following this blueprint, you are not just writing a document. You are building a compelling, evidence-based case for why your business deserves a chance to succeed. You are demonstrating the Experience, Expertise, Authoritativeness, and Trustworthiness that separates a dreamer from a fundable entrepreneur.

Now, go get that yes.

Read more:How to Protect Your Online Privacy: Essential Security Settings for Every American

Frequently Asked Questions (FAQ)

Q1: How long should my business plan be?

A: For most early-stage startups and small businesses, 15-25 pages is the sweet spot, plus the appendix. The key is to be comprehensive yet concise. The Executive Summary must be one to two pages maximum.

Q2: What’s the difference between a business plan and a pitch deck?

A: A business plan is a detailed, written document used for deep due diligence. A pitch deck is a short (10-15 slide) presentation used for initial meetings to pique interest. Your business plan provides the deep backup for the claims in your pitch deck.

Q3: Do I really need a business plan if I’m bootstrapping?

A: Absolutely. While you may not need the polished version for investors, the process of writing one forces you to confront potential challenges, validate your model, and create a operational roadmap. It is an invaluable internal management tool.

Q4: How detailed do my financial projections need to be?

A: Very detailed for the first 12-24 months (monthly is best), and then annually for the following 3 years. The most important thing is that you can explain and defend the assumptions behind every line item.

Q5: Is it worth paying a consultant to write my business plan?

A: It can be, but with a major caveat. No one knows your business like you do. If you hire a consultant, you must be deeply involved in the process. The plan must reflect your vision and knowledge. The consultant’s role is to structure, polish, and provide industry-specific financial modeling expertise. The final document must sound like it came from you.

Q6: What is the most common mistake you see in business plans?

A: A lack of specificity. Vague statements about “huge markets” and “revolutionary products” without the data, team, or plan to back them up. Funders invest in specifics, not generalities.

Q7: Should I include an exit strategy for investors?

A: Yes, especially for angel investors and VCs. They need to know how they will eventually realize a return on their investment. Common exit strategies include an acquisition by a larger company or an Initial Public Offering (IPO). For a small business seeking a bank loan, this is less critical, as the loan is repaid with interest, not through an equity event.