Starting a small business is an exhilarating journey filled with passion, innovation, and the pursuit of the American dream. However, amidst the excitement of product launches and client acquisitions, a less glamorous but critically important aspect demands your attention: your tax obligations. The U.S. tax code is notoriously complex, and missteps can lead to penalties, cash flow problems, and unnecessary stress.

This guide is designed to demystify the process. Think of it as your foundational checklist—a roadmap to help you understand, prepare for, and meet your federal tax responsibilities. By taking a proactive and organized approach, you can transform tax season from a time of anxiety into a routine business process, ensuring you remain compliant while maximizing your financial health.

Part 1: Laying the Groundwork – Business Structure and Initial Set-Up

Before you file a single form, your first and most crucial decision is your business structure. This choice has profound and lasting implications for how you pay taxes.

Choosing Your Business Structure

The most common structures for small businesses are:

- Sole Proprietorship

- What it is: The simplest structure. You and your business are legally the same entity. There’s no formal legal distinction.

- Tax Implications: You report business income and expenses on Schedule C (Form 1040), which you attach to your personal tax return. You are subject to self-employment tax on your net earnings.

- Best for: Low-risk, single-owner businesses just starting out.

- Partnership

- What it is: A business owned by two or more people.

- Tax Implications: The partnership itself does not pay income tax. It files an informational return (Form 1065) to report income, gains, losses, etc. Each partner then receives a Schedule K-1 detailing their share of the profit or loss, which they report on their personal tax returns. Partners pay self-employment tax on their distributive share.

- Best for: Businesses with multiple owners who want to share profits and losses formally.

- Limited Liability Company (LLC)

- What it is: A flexible hybrid structure that provides the liability protection of a corporation with the tax treatment of a partnership or sole proprietorship.

- Tax Implications: This is where it gets flexible.

- Single-Member LLC: By default, taxed as a sole proprietorship (uses Schedule C).

- Multi-Member LLC: By default, taxed as a partnership (uses Form 1065 and K-1s).

- LLC Electing S-Corp or C-Corp Status: An LLC can elect to be taxed as an S-Corporation or C-Corporation by filing forms with the IRS.

- Best for: Business owners seeking personal liability protection without the complexity of a corporation, or those who want future tax flexibility.

- S-Corporation (S-Corp)

- What it is: A corporation that elects to pass corporate income, losses, deductions, and credits through to its shareholders for federal tax purposes.

- Tax Implications: The S-Corp files an informational return (Form 1120-S). Shareholders receive K-1s and report the income on their personal tax returns. The key advantage is the potential to save on self-employment taxes. Shareholders who work for the business must pay themselves a “reasonable salary” (subject to payroll taxes), but remaining profits can be distributed as dividends, which are not subject to self-employment tax.

- Best for: Established, profitable businesses where the owners can justify a reasonable salary and want to minimize self-employment tax liability.

- C-Corporation (C-Corp)

- What it is: A legal entity that is completely separate from its owners.

- Tax Implications: The C-Corp pays corporate income tax on its profits at the corporate level (using Form 1120). If profits are distributed to shareholders as dividends, those dividends are taxed again on the shareholders’ personal returns. This is the infamous “double taxation.”

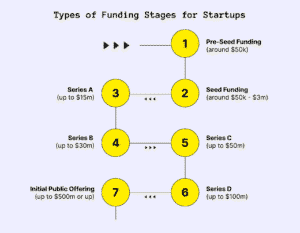

- Best for: Businesses planning to reinvest profits heavily, seek venture capital, or go public.

Expert Insight: The choice between an LLC and an S-Corp is common. While an S-Corp can offer self-employment tax savings, it comes with increased complexity and administrative costs (e.g., payroll processing). For a new business with modest profits, the simplicity of an LLC often outweighs the potential tax benefits of an S-Corp. Consult a tax professional to model both scenarios for your specific numbers.

Obtaining Your Employer Identification Number (EIN)

Think of an EIN as your business’s Social Security Number. It’s a unique nine-digit number assigned by the IRS.

- Why you need it: You need an EIN to open a business bank account, hire employees, and file certain tax returns. Even sole proprietors with no employees can benefit from getting one to keep their business and personal finances separate.

- How to get it: It’s free and relatively quick to apply online on the IRS website.

Setting Up a Separate Business Bank Account

This is non-negotiable for sound financial management.

- Purpose: It separates your personal and business finances, making bookkeeping infinitely easier and providing a clear audit trail.

- Action: Open a dedicated checking account using your EIN and business name. Use this account for all business income and expenses.

Part 2: The Core of Small Business Taxes – Understanding Your Key Obligations

As a small business owner, you wear many hats, and “Chief Tax Officer” is one of them. Here are the primary taxes you need to understand.

1. Income Tax

This is the tax on your business’s annual profit.

- Pass-Through Entities (Sole Props, Partnerships, LLCs, S-Corps): Business profit “passes through” to your personal tax return. You pay tax at your individual income tax rates. You must make Estimated Tax Payments quarterly (using Form 1040-ES) to cover your tax liability throughout the year, as no tax is withheld from your business income.

- C-Corporations: The corporation itself pays tax on its profits at the corporate tax rate (currently a flat 21%).

2. Self-Employment Tax

This is the equivalent of Social Security and Medicare taxes for employees. It’s a flat tax of 15.3% (12.4% for Social Security on income up to a yearly limit, and 2.9% for Medicare with no limit).

- Who Pays: Sole proprietors, partners, and LLC members (by default) pay self-employment tax on their net business earnings, reported on Schedule SE.

- The Benefit: Paying this tax builds your Social Security and Medicare credits for retirement.

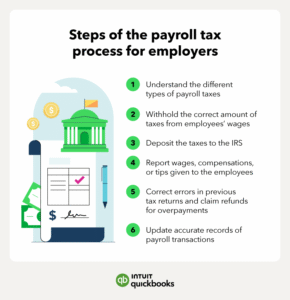

3. Employment Taxes (If You Have Employees)

Hiring your first employee introduces a new layer of tax compliance.

- Withholding: You must withhold federal income tax, Social Security, and Medicare tax from your employees’ wages.

- FUTA (Federal Unemployment Tax): Paid by the employer to fund the unemployment insurance system.

- Reporting: You must deposit these taxes periodically and file quarterly (Form 941) and annual (Form 940) payroll tax returns.

4. Excise Taxes (Less Common)

These apply to specific industries, like manufacturing or selling certain products (e.g., alcohol, tobacco, gasoline), operating certain types of businesses (e.g., tanning salons), or using heavy highway vehicles.

Part 3: The Ultimate Bookkeeping & Recordkeeping System

Accurate records are the backbone of tax compliance. A disorganized shoebox full of receipts is a recipe for disaster.

What to Track Meticulously

- Income: All revenue from sales, services, etc.

- Expenses: Every single business-related cost. Categorize them (e.g., office supplies, travel, utilities, cost of goods sold).

- Assets: Records of equipment, vehicles, or property you purchase for the business.

- Mileage: If you use your personal vehicle for business, track the date, purpose, and miles for each trip. The IRS standard mileage rate is often the easiest method.

- Home Office: If you qualify, track expenses related to the business use of your home (e.g., a percentage of your rent, mortgage interest, utilities, and insurance).

Choosing a Bookkeeping Method

- Cash Basis: You record income when you receive it and expenses when you pay them. This is simpler and more common for small businesses.

- Accrual Basis: You record income when you earn it (e.g., when you invoice) and expenses when you incur them, regardless of when cash changes hands. This gives a more accurate picture of profitability but is more complex.

Tools for Success

- Spreadsheets: A simple start for very small, simple businesses.

- Accounting Software: QuickBooks, Xero, or FreshBooks are industry standards. They automate categorization, connect to bank accounts, generate reports, and make tax preparation much smoother. The investment is well worth it.

Part 4: A Step-by-Step Quarterly and Annual Tax Checklist

Staying on top of deadlines is critical. Here’s a practical timeline.

Quarterly Tasks (The “Estimated Tax” Cycle)

To avoid underpayment penalties, you must pay estimated taxes if you expect to owe at least $1,000 in tax for the year. The payment deadlines are:

- April 15 (for Jan 1 – Mar 31)

- June 15 (for Apr 1 – May 31)

- September 15 (for Jun 1 – Aug 31)

- January 15 of next year (for Sep 1 – Dec 31)

Each Quarter, You Should:

- Reconcile Your Books: Ensure all transactions for the period are recorded and categorized correctly in your accounting software.

- Review Profit & Loss (P&L): Analyze your income and expenses to estimate your quarterly profit.

- Calculate Estimated Payment: Use your P&L and the Form 1040-ES worksheet to determine your payment.

- Make the Payment: Pay online via the IRS Direct Pay system, which is fast, secure, and free.

Annual Tasks (Gearing Up for Tax Filing)

January:

- Gather all your year-end financial statements and reports.

- Ensure your bookkeeping for the prior year is 100% complete and accurate.

- If you had employees or contractors, prepare the necessary forms:

- Form W-2 for employees (due to them by Jan 31).

- Form 1099-NEC for non-employee compensation to contractors (due to them by Jan 31).

February – March:

- Provide all your organized records to your tax professional (if you’re using one). The earlier you do this, the better.

- If filing yourself, ensure you have the correct forms and begin preparing your return.

- Key Deadlines:

- March 15: S-Corporation (Form 1120-S) and Partnership (Form 1065) returns are due.

- April 15:

- C-Corporation (Form 1120) returns are due.

- Sole Proprietorship (Schedule C) and Personal Tax Returns (Form 1040) are due.

- First Quarter Estimated Tax Payment is due.

Read more: How to File Your US Taxes Online for Free (And Get Your Maximum Refund)

Part 5: Beyond Compliance – Strategic Tax Planning for Growth

Tax compliance is about following the rules; tax planning is about using the rules to your advantage.

Key Deductions You Should Not Overlook

- Home Office Deduction: If you have a dedicated space in your home used regularly and exclusively for business, you can deduct a portion of your home expenses. You can use the simplified method ($5 per square foot, up to 300 sq. ft.) or the regular method (based on actual expenses).

- Vehicle & Mileage: As mentioned, track your business miles diligently.

- Business Meals: Currently, you can deduct 50% of the cost of qualified business meals (e.g., taking a client to lunch).

- Start-Up Costs: You can deduct up to $5,000 of start-up and organizational costs in your first year of business.

- Retirement Contributions: Contributions to a SEP-IRA, Solo 401(k), or similar plan are often tax-deductible, reducing your current-year taxable income while saving for the future.

- Health Insurance Premiums: For self-employed individuals, premiums paid for medical, dental, and long-term care insurance for yourself, your spouse, and dependents are often deductible.

The Power of Retirement Planning

Setting up a small business retirement plan is one of the most powerful tax-saving strategies available. It reduces your taxable income now and allows your investments to grow tax-deferred.

The Indispensable Role of a Tax Professional

While this guide provides a solid foundation, it is not a substitute for personalized advice. A qualified tax professional—such as an Enrolled Agent (EA), Certified Public Accountant (CPA), or tax attorney—provides immense value by:

- Ensuring you are filing correctly and on time.

- Identifying all deductions and credits you’re eligible for.

- Providing strategic advice on business structure, purchases, and long-term planning.

- Representing you in the event of an audit.

The cost of a professional is often far less than the cost of a mistake or a missed opportunity.

Conclusion: Empowerment Through Organization

Navigating US tax obligations is a fundamental part of your entrepreneurial journey. By understanding your responsibilities, implementing robust systems for recordkeeping, staying on top of deadlines, and seeking professional guidance, you can confidently manage this critical area. View your taxes not as a burdensome chore, but as a reflection of your business’s financial story. A well-managed tax strategy ensures you keep more of your hard-earned money, fuels your growth, and provides the peace of mind to focus on what you do best—building your business.

Read more: How to Protect Your Identity and Data Online: Essential Security Tips for 2024

Frequently Asked Questions (FAQ)

Q1: I’m just a sole proprietor with a side hustle making a few thousand a year. Do I really need to worry about taxes?

A: Yes, absolutely. If your net earnings from self-employment are $400 or more, you are required to file a tax return and pay self-employment tax. Even if you don’t owe income tax due to your low income, the self-employment tax obligation still applies. It’s always better to report the income proactively.

Q2: What’s the difference between a tax deduction and a tax credit?

A: This is a crucial distinction. A tax deduction reduces your taxable income. For example, a $1,000 deduction reduces the amount of income you’re taxed on by $1,000. The actual tax savings is $1,000 multiplied by your tax rate (e.g., $220 if you’re in the 22% bracket). A tax credit is a dollar-for-dollar reduction of your tax bill. A $1,000 tax credit reduces your final tax bill by $1,000. Credits are generally more valuable than deductions.

Q3: Can I write off my personal vehicle if I use it for business?

A: You cannot write off the entire cost of a personal vehicle. However, you can deduct the expenses related to the business use of the vehicle. The two main methods are the Standard Mileage Rate (multiplying your business miles by the IRS-set rate) or the Actual Expense Method (tracking all vehicle costs and deducting the business-use percentage). You must choose the method that gives you the largest deduction.

Q4: What happens if I can’t afford to pay my tax bill by the deadline?

A: This is a common and stressful situation. The most important thing is to file your return on time, even if you can’t pay. The penalty for filing late is much harsher than the penalty for paying late. Once you’ve filed, you have options:

- Apply for an Installment Agreement with the IRS, which allows you to pay your debt over time.

- See if you qualify for a temporary delay in collection.

Ignoring the problem will only make it worse due to accumulating penalties and interest.

Q5: How long should I keep my business tax records and receipts?

A: The general rule is to keep records that support an item of income or a deduction on a return for at least three years from the date you filed the return. This is the standard statute of limitations for the IRS to audit a return. However, there are exceptions. Keep records related to property (like equipment or real estate) for at least three years after you dispose of the property. It’s often safest to keep key documents (like incorporation papers, major asset purchases, and tax returns) indefinitely in digital form.

Q6: When does it make sense to switch from a Sole Proprietorship/LLC to an S-Corporation for tax purposes?

A: There’s no one-size-fits-all answer, but a common rule of thumb is to consider the switch when your business’s net profit consistently exceeds what would be considered a “reasonable salary” for the work you perform. For example, if your business nets $80,000 and a reasonable salary for your role is $60,000, the remaining $20,000 could be distributed as profit not subject to self-employment tax. However, the administrative cost and complexity of running an S-Corp (payroll, separate tax return) must be less than the potential tax savings. This is a perfect topic to discuss with a tax professional.