1. Earning Power vs. Traditional Accounts

- The national average savings rate is just 0.57% APY

- Meanwhile, top HYSAs offer 4%–5% APY, delivering 7–10× the return

- As Barron’s noted, even in a volatile stock market, cash alternatives like HYSAs offer yields surpassing 4%, making them attractive anchors for safe money .

2. Fed Rate Outlook

- The Fed has paused rate cuts for now, but future cuts could drop HYSA rates Locking in today’s high rates is smart before yields decline.

3. Security & Liquidity

- Most HYSAs are FDIC- or NCUA-insured up to $250K, secure and flexible—ideal for emergency funds, short-term goals, or parking cash safely

📊 Best High-Yield Savings Accounts and Their Rates

Here are the top yield offerings in July 2025:

🔝 5.00% APY – Varo Bank, AdelFi, Fitness Bank

- Varo Bank: 5% APY up to $5K with qualifying direct deposits and account maintenance; standard portion reverts thereafter

- AdelFi, Fitness Bank: Also 5%, with low balance requirements but may include conditions like step counts or initial deposits

🥈 4.66% – Axos Bank

- No minimum deposit required; competitive for those wanting simplicity

🥉 4.60% – Pibank

- Requires online-only setup, with limitations on transfers—suitable for tech-savvy savers .

📈 4.30–4.35% – Newtek, Bread Savings, My Banking Direct, BrioDirect

- Newtek leads at 4.35% with no minimum, followed by several banks around 4.30–4.35%, offering strong returns with minimal access barriers

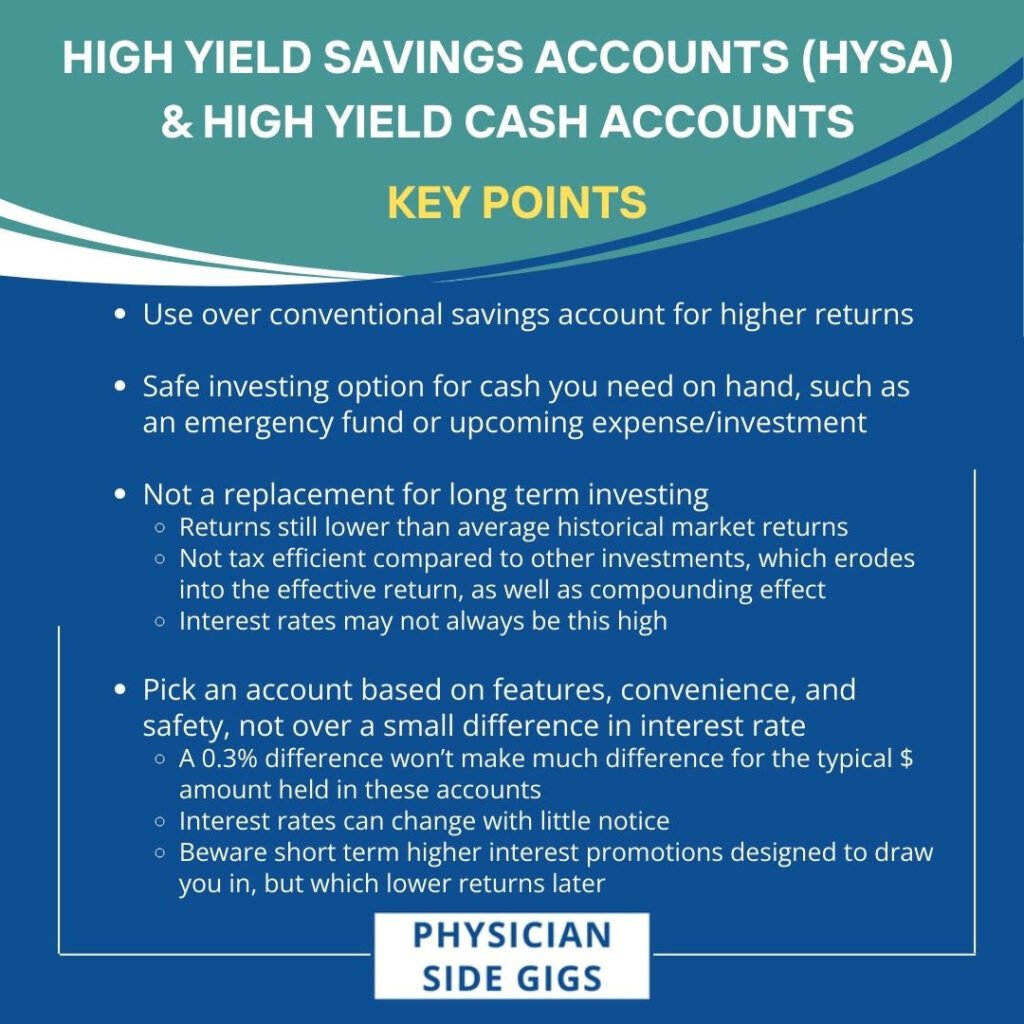

🧭 How to Choose the Right HYSA

✅ Key Considerations

- APY & Rate Tiering

- Look at both top-tier rates and how much of your balance they cover.

- Requirements & Fees

- Note minimum deposits, direct deposit rules, or balance thresholds.

- Access & Transfers

- Online banks offer easy ACH; some restrict credit/debit usage or transfers.

- Stability & Insurance

- Ensure FDIC/NCUA coverage and check institution reputation.

📌 Additional Tips

- Avoid chasing minor APR gains if it means managing multiple accounts frequently—rotate no more than once or twice a year

- Use your primary checking account for daily needs and a HYSA for backup funds.

- Watch announcements—HYSA rates can shift quickly with economic changes.

📈 Maximizing Income: Sample Earnings

Let’s illustrate with $50,000:

| APY | Yield in 1 Year |

|---|---|

| 5.00% | $2,500 |

| 4.35% | $2,175 |

| 0.57% (avg) | $285 |

Choosing a 4–5% HYSA generates $2,000+ annually—$1,700–2,200 more than average savings.

🏦 Recommended HYSAs in 2025

**

**

Leading Options:

- Varo Bank: Best-in-class rate (5%) for accessible balances.

- AdelFi & Fitness Bank: Also 5%, subject to conditions.

- Axos Bank: 4.66% with no deposit minimum at any balance.

- Newtek Bank: 4.35%, zero minimum, straightforward setup.

- Bread Savings / My Banking Direct / BrioDirect: 4.30%, easy access.

🗂️ HYSA vs. Alternative Cash Options

📉 Traditional Savings / Checking

- Offer near-zero APY (~0.01%), which loses to inflation—move surplus funds out

🔐 CDs & Money Market Accounts

- No-penalty CDs offer fixed rates (~4.5%), good if rates fall. Money Markets are similar to HYSAs in yield

💵 Treasury Bills

- Yields: ~4.3% (3-mo), 4.08% (1-yr). Comparable to HYSA but less liquid .

⚠️ Risks & Limitations of HYSAs

- Variable APYs may decrease if rates fall.

- Balance caps on top-tier rates—e.g., Varo’s 5% only applies to first $5K.

- Withdrawal limits (up to six monthly under Reg D), though rarely enforced now .

- Transfer delays: ACH transfers may take 1–3 business days.

🧠 Smart HYSA Strategy for 2025

- Park emergency and short-term funds in a HYSA with top-tier APY.

- Monitor rates and prepare to switch once or twice yearly if yields drop by ≥0.5%.

- Keep $1–2k in your checking account for convenience, but funnel remaining cash into HYSA.

- Optimize with laddering: use HYSA for short-term needs; consider CDs or T-bills for fixed longer-term returns.

✅ Final Take: Should You Use a HYSA?

Definitely—especially in 2025, when rates are high and Fed cuts may be pending. HYSAs combine:

- Better returns (4–5% APY vs. 0.5% avg)

- Security via federal insurance

- Flexibility with no lock-in